Kuwait Energy

EL-12-211107

14

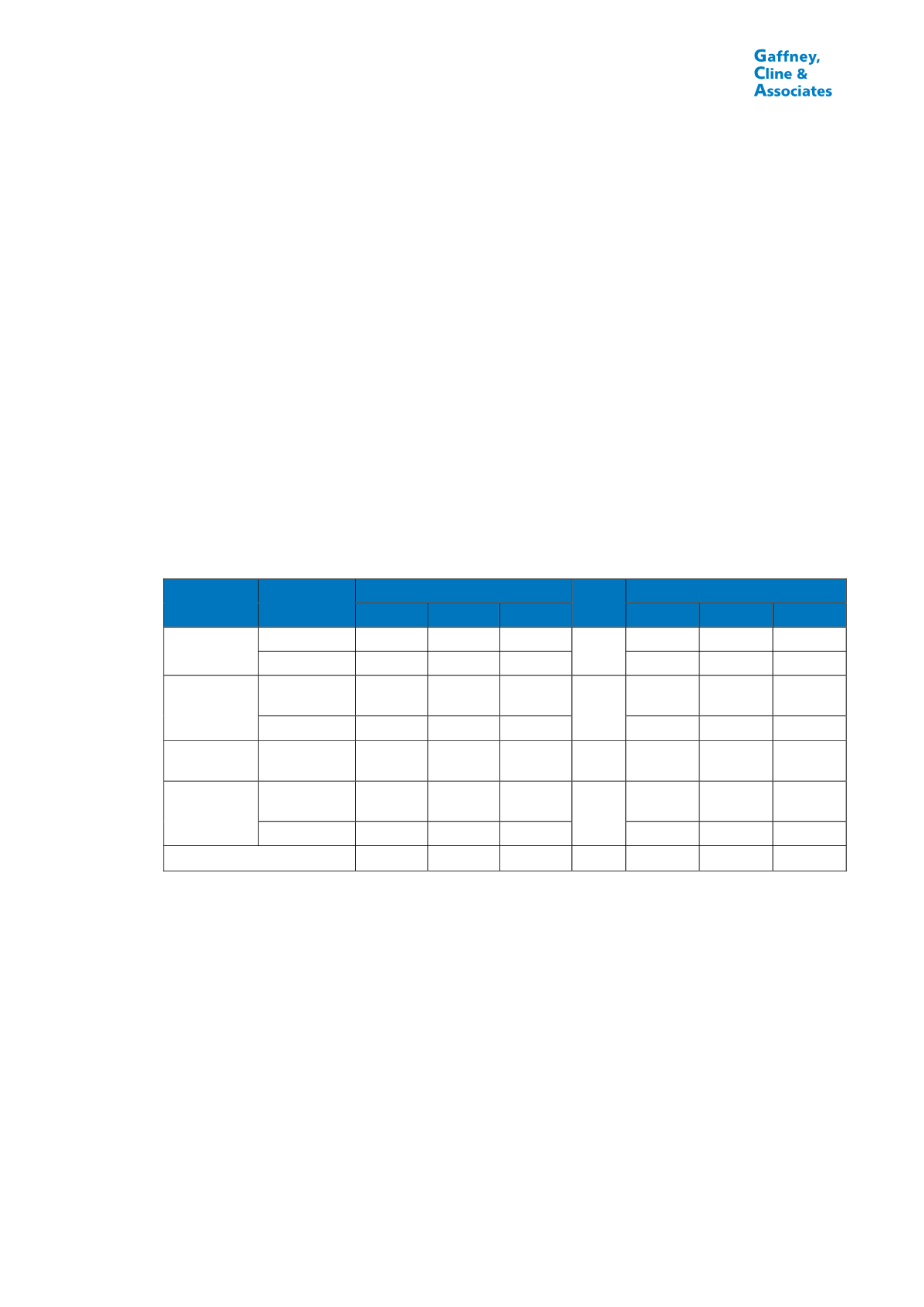

Contingent Resources Summary

The oil, condensate and gas Contingent Resources in the fields in which KE holds an

interest are shown in Tables 0.9, 0.10 and 0.11 respectively.

Contingent Resources are shown both as gross field volumes and net to KE on a Working

Interest (WI) basis. In Pakistan, where the fiscal regime is tax/royalty, KE’s Net

Entitlement Contingent Resources are equal to the WI basis volumes shown herein. In

Egypt, Yemen and Iraq, the WI basis volumes are KE’s WI fraction of the Gross Field

Contingent Resources. They represent KE’s proportion prior to application of the state

share under the PSC/PSAs or Service Contracts that govern the fields. They do not

represent KE’s actual Net Entitlement under the terms of the PSC/PSAs or Service

Contracts, which will be less than the quoted volumes.

Volumes are quoted here on a WI basis because the Contingent Resources are in

general too immature to justify creation of the conceptual development plan needed to

estimate Net Entitlement.

TABLE 0.9

SUMMARY OF OIL CONTINGENT RESOURCES

AS AT 31

st

MAY, 2014

Field or

Block

Project or

Field

Gross Field (MBbl)

KE WI

(%)

KE Net (WI Basis) (MBbl)

1C

2C

3C

1C

2C

3C

Block 9 (Iraq)

B9NE

357,075 916,000 2,164,000

70.0

249,953 641,200 1,514,800

B9W

0 85,073 141,363

0

59,551 98,954

Burg El Arab

(Egypt)

Water

Injection

3,023 13,451 31,132

75.0

2,267

10,089 23,349

Marina

193

475 1,009

145

356

756

Block 5

(Yemen)

Contract

Extension

27,951 47,565 75,985 15.0

4,193

7,135 11,398

Block 49

(Yemen)

Balharak

South

385 2,512 7,124

64.0

246

1,608 4,559

West Ghobata

8,700 15,500 24,600

5,568

9,920 15,744

Total

397,327 1,080,576 2,445,212 n/a

262,372 729,858 1,669,560

Notes:

1.

Gross Field Contingent Resources are 100% of the volumes estimated to be recoverable from the

field or project in the event that development goes ahead.

2.

KE Net Contingent Resources in this table are KEs Working Interest fraction of the Gross Field

Resources; they do not represent KE’s actual Net Entitlement under the terms of the PSC/PSA or

Service Contract that governs each asset, which would be lower.

3.

The volumes reported here are “unrisked” in the sense that no adjustment has been made for the

risk that the project may not go ahead in the form envisaged or may not go ahead at all (i.e. no

“Chance of Development” factor, as defined under PRMS, has been applied).

4.

Contingent Resources should not be aggregated with Reserves because of the different levels of risk

involved and the different basis on which the volumes are determined.

5.

Totals may not exactly equal the sum of the individual entries due to rounding.