Kuwait Energy

EL-12-211107

12

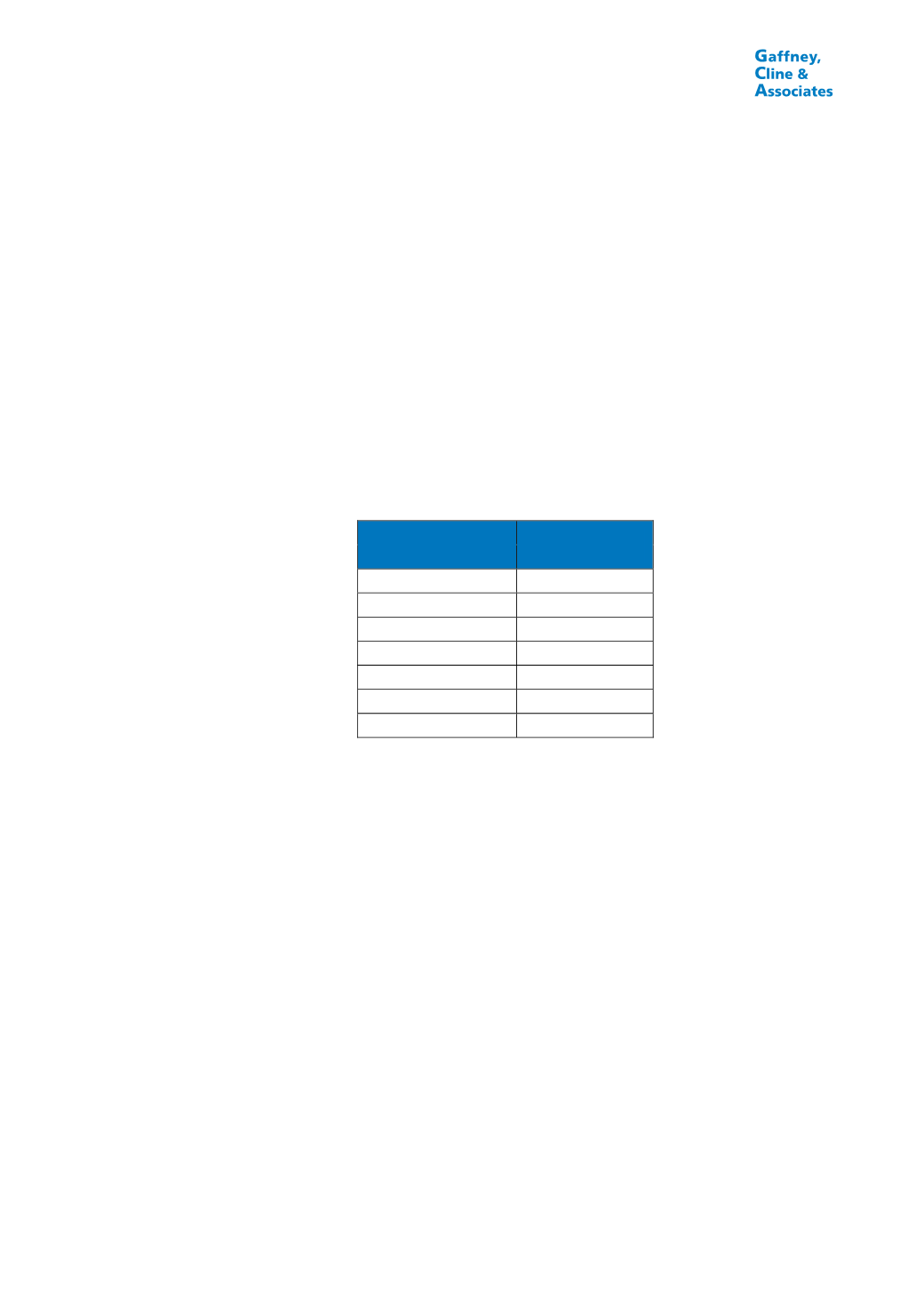

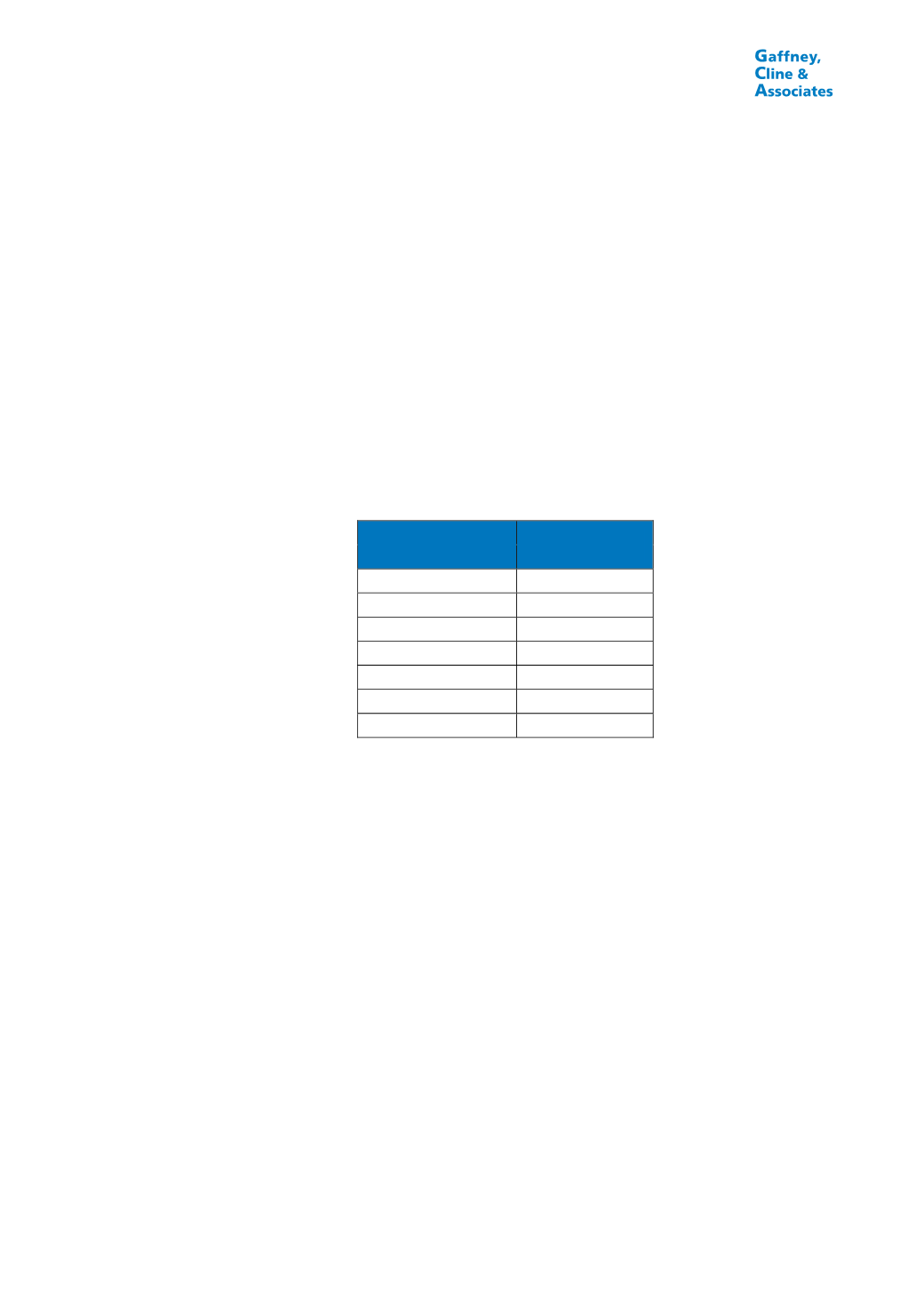

Net Present Value Summary

Reference Post-Tax NPVs have been attributed to the Proved, the Proved plus Probable

and the Proved plus Probable plus Possible Reserves cases, at a discount rate of 10%

(Table 0.7). Discounting has been done on a mid-year basis to 31

st

May, 2014. NPV

estimates have also been made for the KSF Service Agreement for each oil production

case (Table 0.8).

These assessments have been based upon GCA’s understanding of the fiscal and

contractual terms governing the assets. All NPVs quoted are those exclusively

attributable to KE’s net economic entitlement in the properties under review.

GCA’s Brent Crude oil price scenario for 2Q14, shown in Table 0.6, has been employed

as the reference oil price. These prices were adjusted for location and quality for each

field in KE’s portfolio, based on historic sales prices and contractual terms advised by KE.

TABLE 0.6

BRENT CRUDE OIL PRICE SCENARIO

Year

Price

(US$/Bbl)

2014 (Remainder)

106.55

2015

102.38

2016

98.24

2017

95.48

2018

96.45

2019

99.37

2020+

+2% p.a.

Estimates of future capital and operating expenditures on a 2014 cost basis have been

provided by KE in the form of budgets, development plans, historical costs and forecasts.

GCA has audited these estimates and found them to be reasonable. For economic

modelling purposes costs have been assumed to escalate at 2% p.a. from 2015 onwards

(except that for Area A in Egypt, the GPC Facility Tariff and the Baseline Production

OPEX Reimbursement are held constant, and for Abu Sennan, the handling and

processing fees for production above 2,000 bopd are escalated at 10% p.a. from 2015

onwards, based on the contract with GPC).