Kuwait Energy

EL-12-211107

13

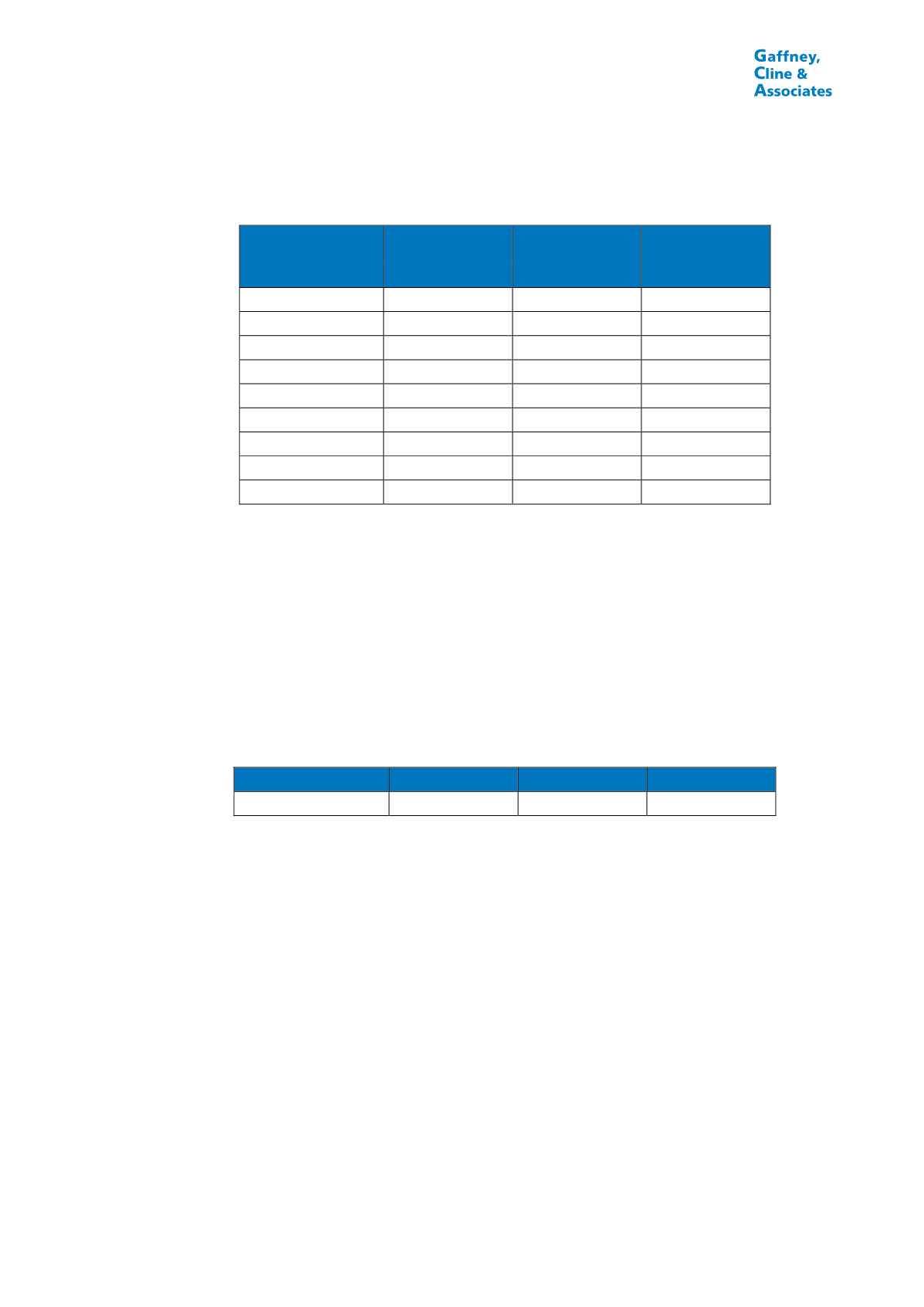

TABLE 0.7

SUMMARY OF POST-TAX NPV (US$ MM) AT 10% DISCOUNT RATE OF

FUTURE REVENUE FROM RESERVES, NET TO KE, AS AT 31

st

MAY, 2014

Field

Proved

Proved +

Probable

Proved +

Probable +

Possible

Block 5

82.6

104.1

123.6

Nabrajah

1.0

1.3

1.8

Burg El Arab

25.5

87.2

128.3

Abu Sennan

3.3

40.8

108.7

East Ras Qattara

126.8

188.7

277.7

Area A

45.1

107.0

220.4

Siba

74.2

115.1

127.2

Mansuriya

16.2

54.1

62.6

Total

374.7

698.4

1,050.3

Notes:

1.

The NPVs are calculated from discounted cash flows incorporating the fiscal terms governing the

assets.

2.

All cash flows are discounted on a mid-year basis to 31

st

May, 2014.

3.

The NPVs shown here are for the Developed plus Undeveloped Reserves.

4.

The reference NPVs reported here do not represent an opinion as to the market value of a property

nor any interest therein.

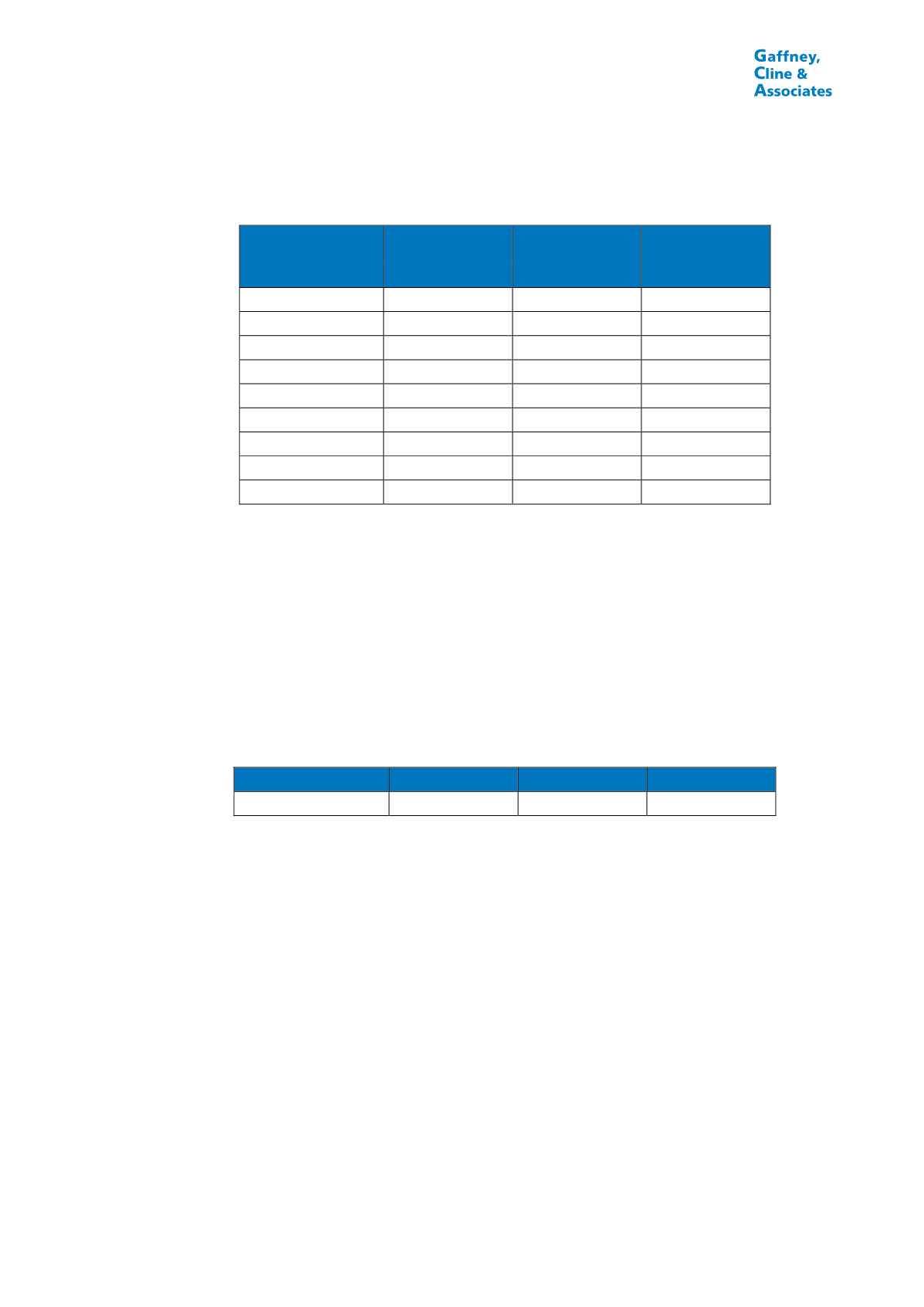

TABLE 0.8

SUMMARY OF POST-TAX NPV (US$ MM) AT 10% DISCOUNT RATE OF

FUTURE REVENUE, NET TO KE, AS AT 31

st

MAY, 2014

Field

Low Case

Best Case

High Case

Karim Small Fields

3.9

4.3

4.6

Notes:

1.

The NPVs are calculated from discounted cash flows incorporating the fiscal terms governing the

assets.

2.

All cash flows are discounted on a mid-year basis to 31

st

May, 2014.

3.

The NPVs shown here are for the Developed plus Undeveloped cases.

4.

KSF is shown separately from KE’s other assets since, under the terms of the Service Agreement for

KSF, no Reserves are attributable to Medco LLC in KSF, and thus none are attributable to KE.

5.

The reference NPVs reported here do not represent an opinion as to the market value of a property

or any interest in it.