Kuwait Energy

EL-12-211107

11

Karim Small Fields, Oman

Under the terms of the Service Agreement for the Karim Small Fields (KSF), Medco LLC

and KE have no direct rights to any volumes of oil, either in situ or produced and are

prohibited from making any public disclosure related to the Reserves in KSF.

Nonetheless, the Service Agreement can be considered as a Risked Service Contract

(RSC) as defined by PRMS, which would normally give the Contractor the right to claim

Reserves. For the purpose of this report, KE’s estimated net pre-tax revenues from KSF,

expressed in terms of equivalent barrels of oil, are shown in Table 0.5.

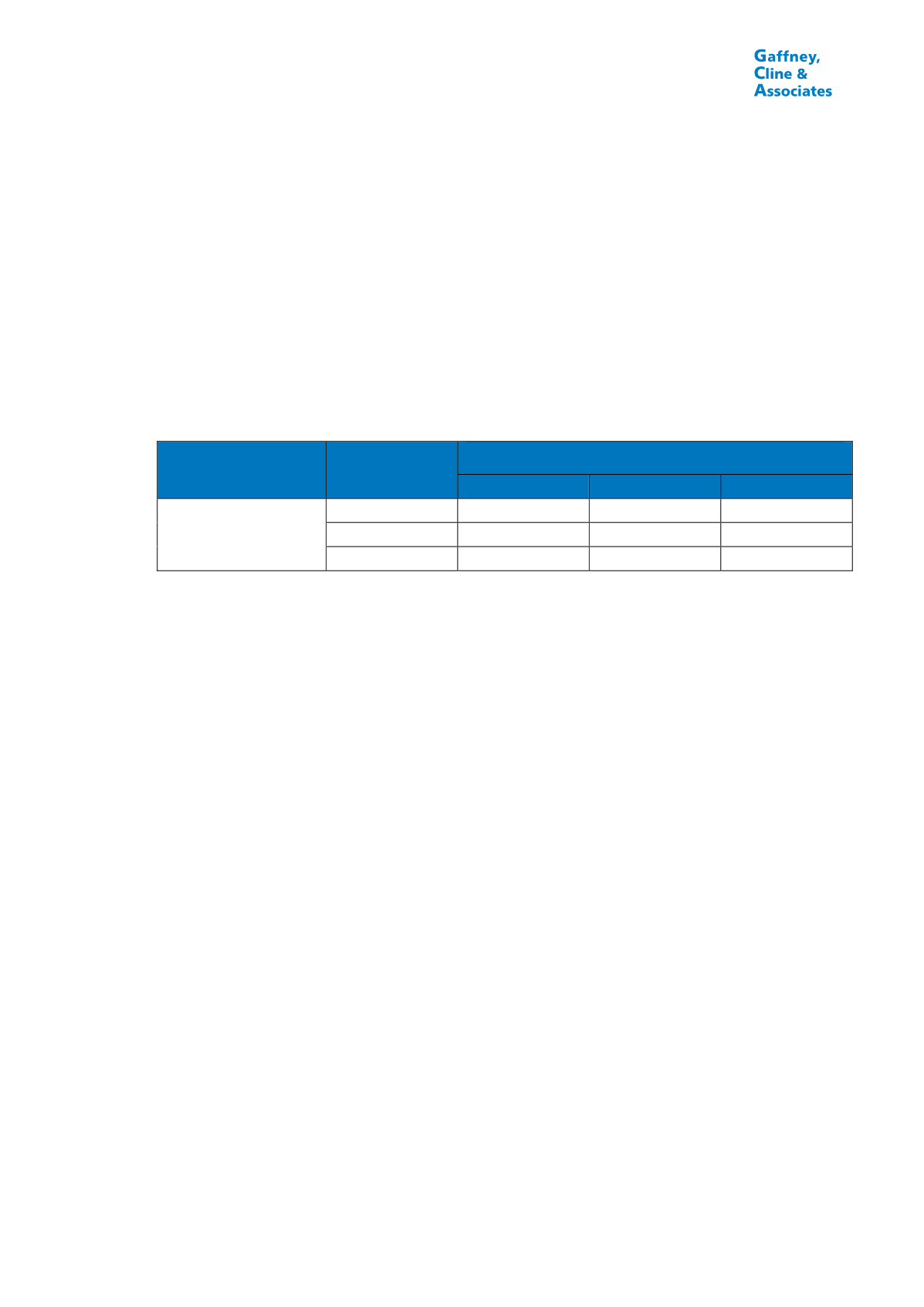

TABLE 0.5

SUMMARY OF KE NET FUTURE PRE-TAX REVENUES

EXPRESSED IN TERMS OF EQUIVALENT BARRELS OF OIL

AS AT 31

st

MAY, 2014

Field or Block

Status

KE Net Revenues

(MBbl equivalent)

Low Case

Best Case

High Case

Karim Small Fields

(Oman)

Dev

138

143

145

Undev

63

64

64

Total

201

206

209

Notes:

1.

The above volumes are displayed for illustrative purposes only as the terms of the Service

Agreement do not allow the Contractor any direct right to lift volumes.

2.

KE net revenues comprise its share of the cost recovery and profit share fees, based on its 20%

equity in Medco LLC, which holds a 75% interest in the Service Agreement.

3.

Under the terms of the Service Agreement, no Reserves are attributable to Medco LLC in KSF, and

thus none are attributable to KE.