Kuwait Energy

EL-12-211107

93

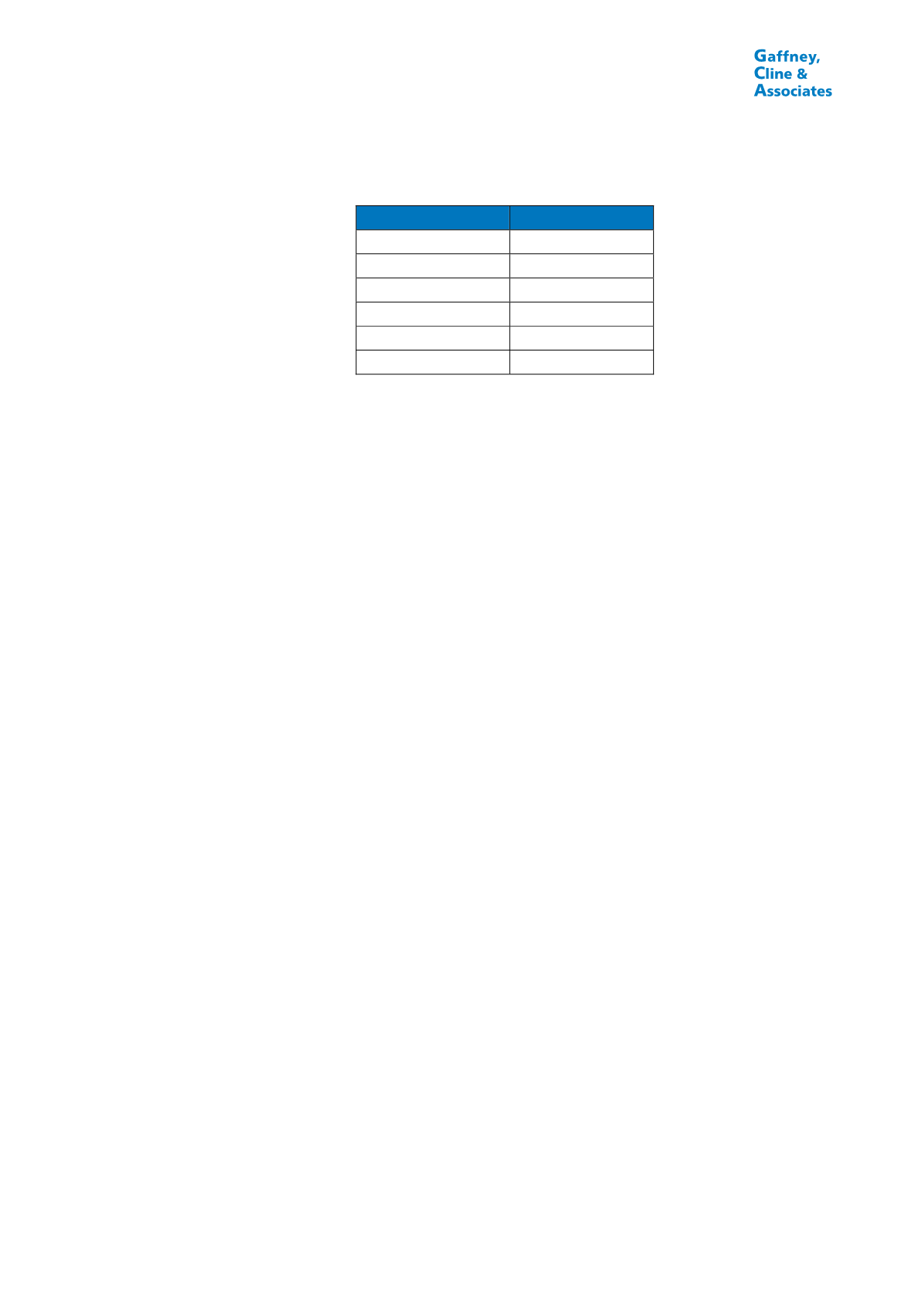

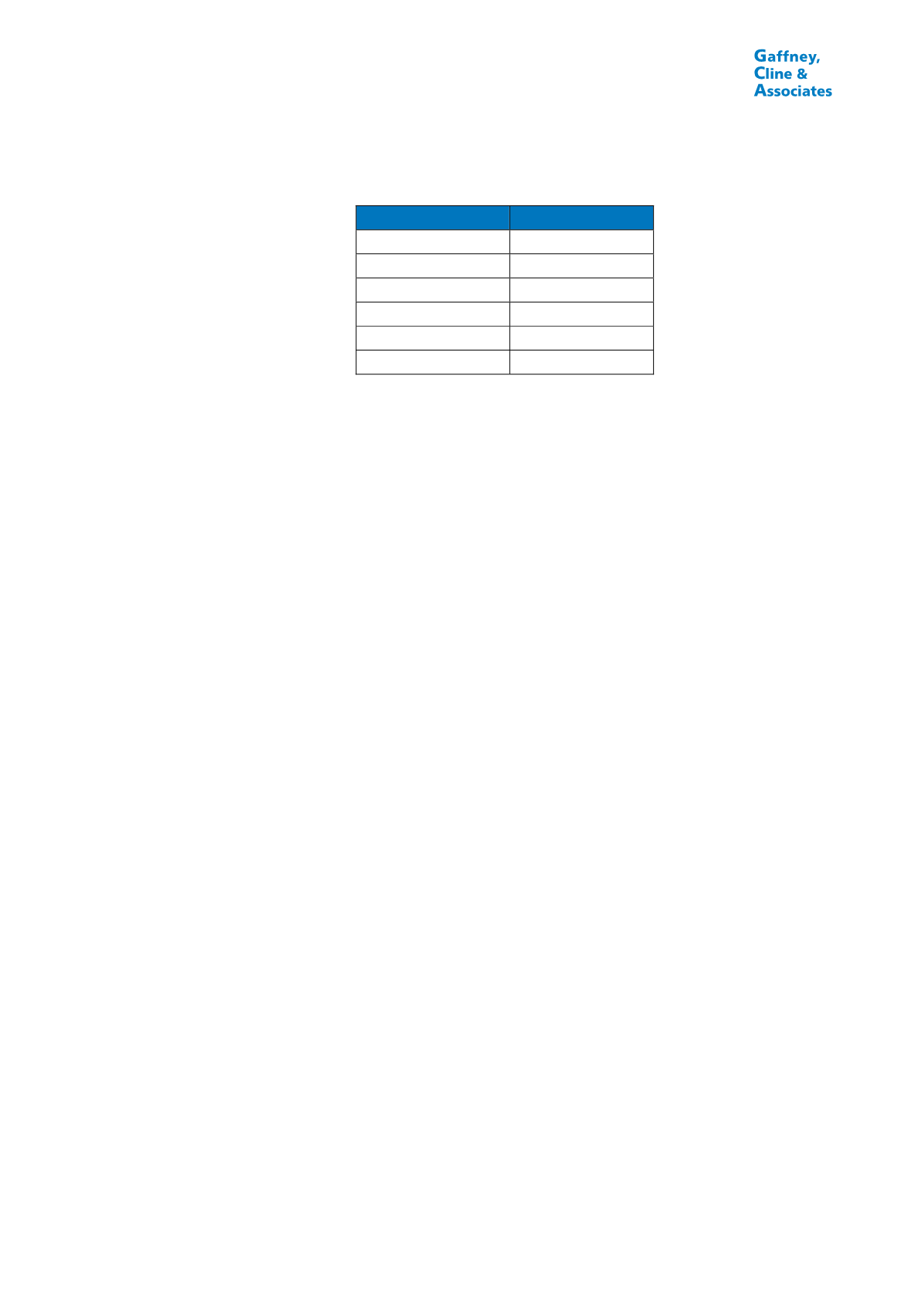

TABLE 7.2

ADJUSTMENTS TO REFERENCE OIL PRICE BY FIELD

Field

Adjustment

Block 5 (Yemen)

-2.0%

Nabrajah

0%

Burg El Arab

-2.0%

Abu Sennan

-4.0%

ERQ

-2.0%

Area A

-9.0%

Notes:

1.

For KSF (Oman) and fields in Iraq, see Sections 7.1.1 and 7.1.2 respectively.

7.1.1 KSF (Oman)

In Oman, contractor revenue at KSF is based on the “Effective Revenue”, which is

equal to the KSF oil production (in barrels) times the Oman Ministry of Oil and Gas

(MOG) published selling price per barrel for Oman Blend crude oil. Over the past

year, there has been only a narrow differential between the MOG published price

and Brent prices, so equality between the two has been assumed from 2014

onwards.

7.1.2 Fields in Iraq

For the Siba and Mansuriya gas fields, the starting point for calculating the

Contractor’s revenue is a “Deemed Revenue” (see Section 7.3.4). This is

calculated by converting the produced gas and condensate volumes into oil

equivalent volumes (using conversation factors of 6.0 Mscf/boe and 1.0 Bbl/boe

respectively) and multiplying by a price per boe defined by the Service Contracts.

This price is related to the Oil Sales Prices (OSPs) published by the State Oil

Marketing Organization of Iraq (SOMO). To arrive at a SOMO OSP scenario, a

5.5% discount to Brent has been applied (Table 7.3). This effectively prices the

gas and condensate as shown in the right-hand columns of Table 7.3. It may be

noted that the deemed gas price specified in the GDPSCs is significantly higher

than prevailing gas prices in the Middle East region.

For Block 9, “Deemed Revenue” is calculated in the same way, except that the

gas price used is only half of the SOMO OSP on a per boe basis.