Kuwait Energy

EL-12-211107

96

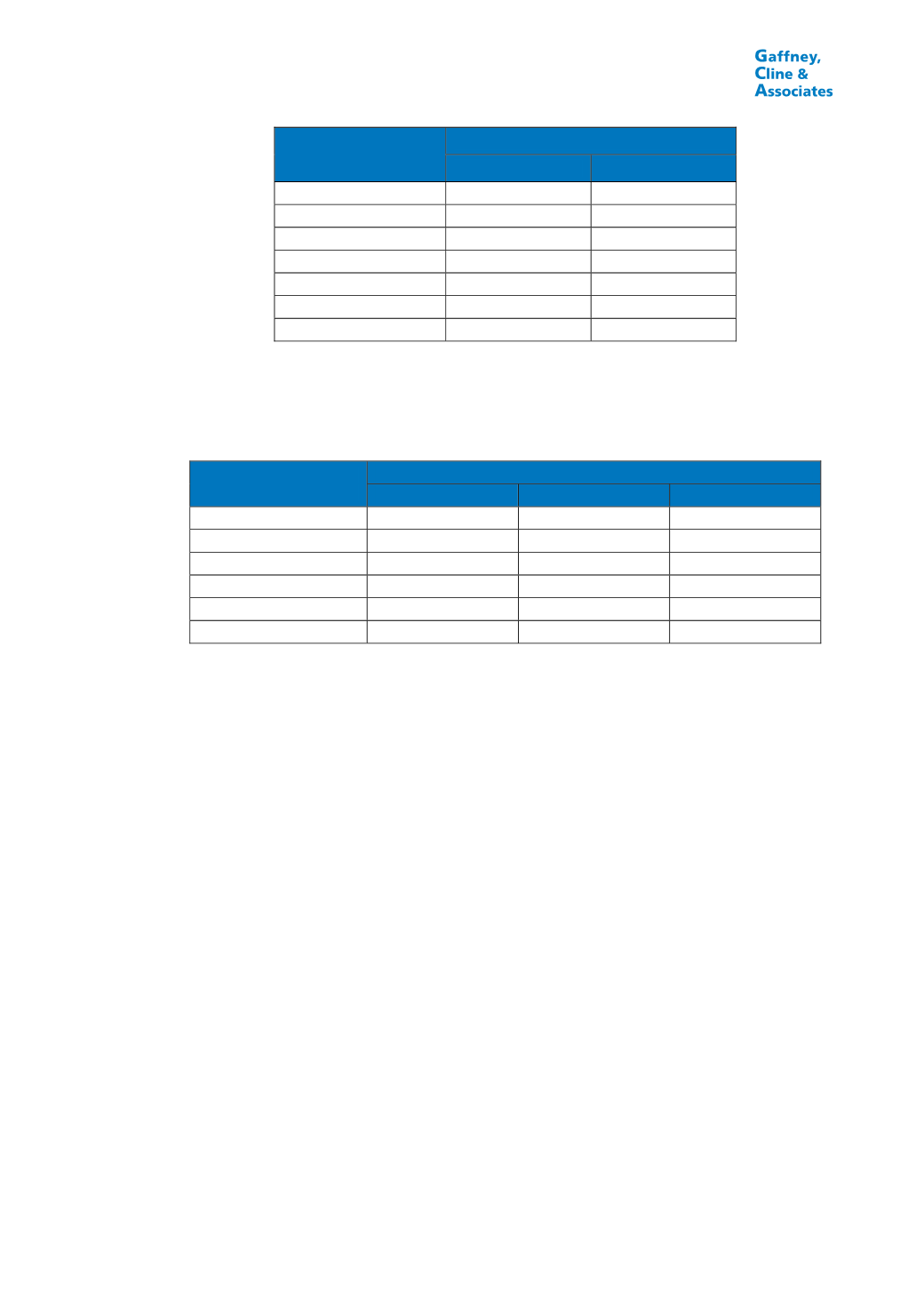

Production Rate

(Mbopd)

Contractor Group Share (%)

Shukheir NW

Other Fields

< 0.5

0.0

0.0

0.5 – 1

57.0

51.5

1 – 2

55.0

51.0

2 – 3

53.5

50.5

3 – 4

52.0

50.0

4 – 5

50.5

49.5

≥ 5

49.0

49.0

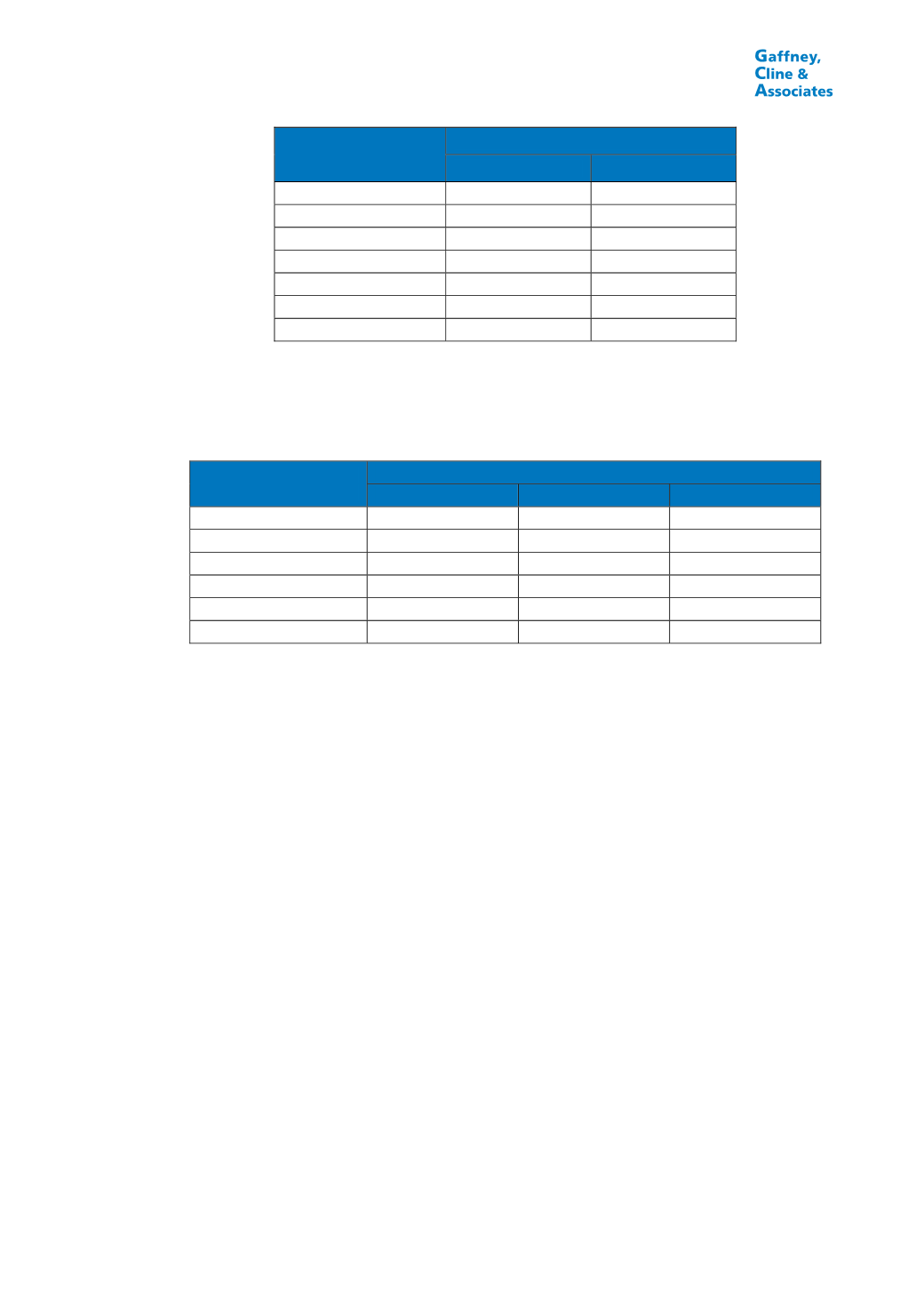

Production Bonuses (not applicable to Area A): when reaching certain rates

of production, the following amounts (which are not cost recoverable) are

payable (none have yet been paid for BEA or Abu Sennan but the first two

have been paid for ERQ):

Production Rate

(Mbopd)

Bonus (US$ MM)

BEA

Abu Sennan

ERQ

3

-

0.5

-

5

-

1.0

0.2

10

-

1.5

0.3

25

1.0

2.0

0.4

50

1.5

-

0.5

100

2.0

-

0.6

Baseline Production OPEX Reimbursement (only applicable to Area A):

US$0.61 for each barrel of Baseline Production achieved.

GPC Facility Tariff (only applicable to Area A): US$1.20/Bbl

Training fee: for Abu Sennan only, US$50,000 p.a. for the duration of the

exploration phase (i.e. until 2016).

Corporate tax: applicable only to Area A where a 25% corporate tax rate

applies. As advised by KE, depreciation is taken into account on a unit of

production basis, with a depreciation balance of US$23.72 MM as at

31

st

May, 2014.

7.3.2 Yemen

The relevant elements of the Yemen fiscal regime for petroleum operations as

they currently stand, together with the applicable PSC terms pertaining to Blocks 5

and 43, are summarised below and are assumed to remain constant going

forward.