Kuwait Energy

EL-12-211107

99

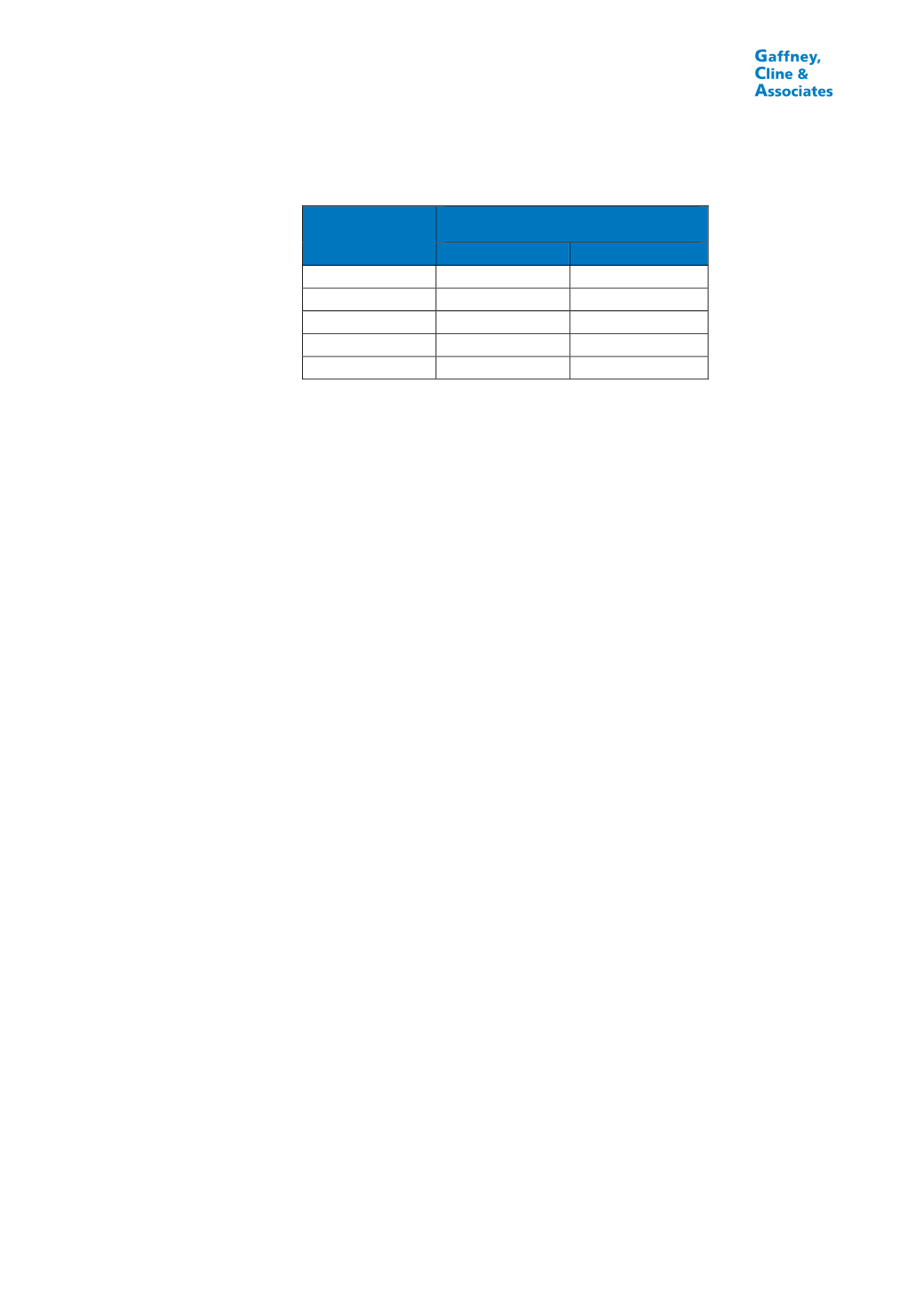

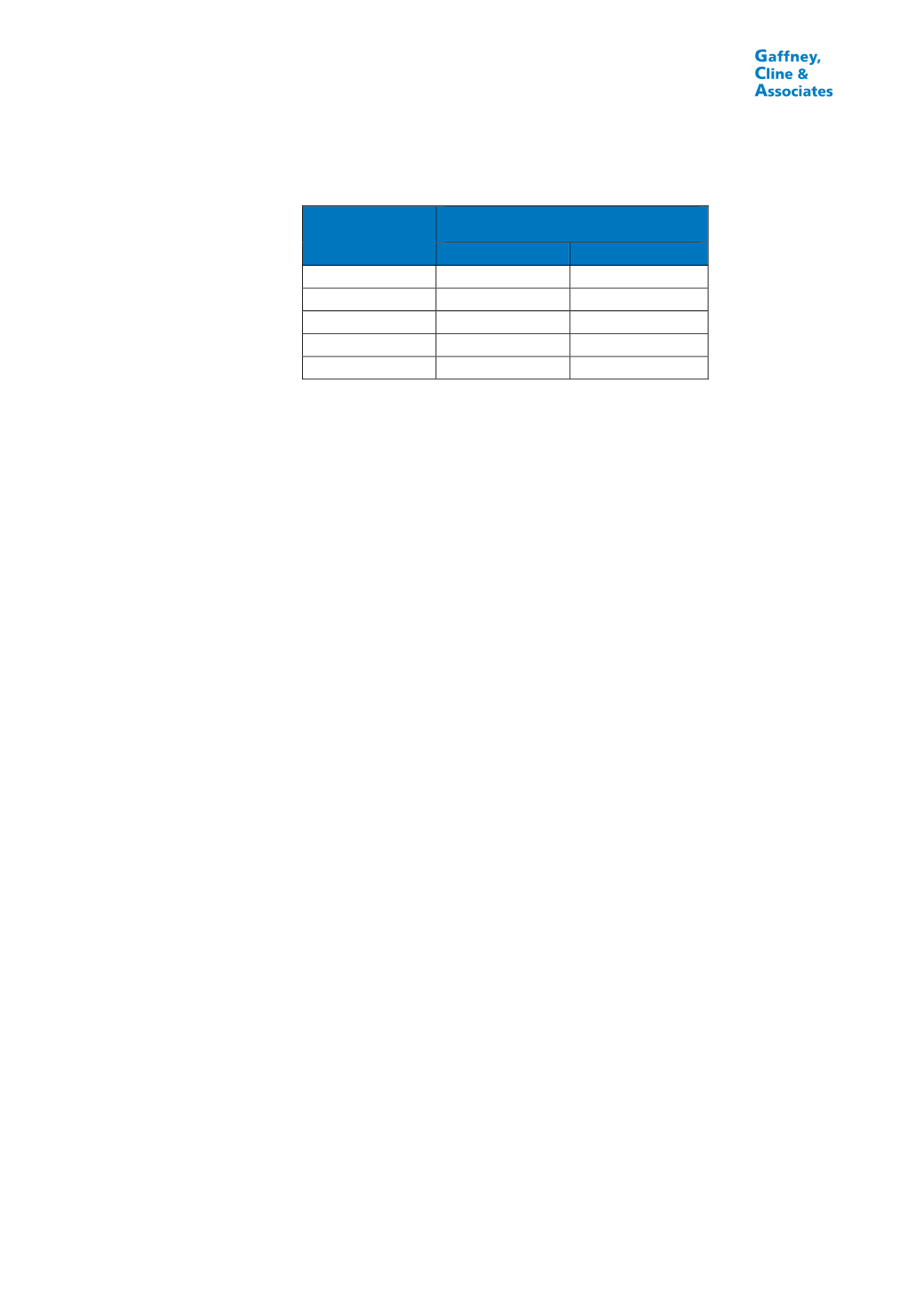

TABLE 7.4

REMUNERATION FEE, SIBA AND MANSURIYA FIELDS, IRAQ

R-Factor

Remuneration Fee

(US$/boe)

Siba

Mansuriya

Below 1.0

7.50

7.00

1.0 - 1.25

6.00

5.60

1.25 - 1.5

4.50

4.20

1.5 - 2.0

3.75

3.50

2.0 and above

2.25

2.10

A state partner holds a 25% participating interest in the Contractor Group for both

fields. The state partner is carried on both CAPEX and OPEX by the other

Contractor parties, who are entitled to a proportionate share of the Cost Recovery

that would otherwise have gone to the state partner. The state partner receives its

participating share of the Remuneration Fees.

Training fund: the Contractor group is required to contribute a non-recoverable

amount of US$1 MM annually for training purposes.

Iraqi corporate income tax is payable at 35% on the Remuneration Fees when

paid.

KE’s Net Entitlement is made up of KE’s share of the Cost Recovery and

Remuneration Fees. These are cash payments (although the Ministry has the

option to pay with oil). However, GCA considers that KE will be entitled to claim

Reserves and/or Contingent Resources because of its exposure to capital at risk

(the GDPSCs are “Risked Service Contracts” (RSCs) as defined by the SPE

PRMS).

Volumes are estimated here by converting KE’s Net Entitlement from US$ into oil

equivalent volumes (boe), using the prevailing SOMO OSP. Since the produced

fluids are gas and condensate, these oil equivalent volumes are reported in

proportion to the prevailing CGR.

7.3.5 Iraq: Block 9

The applicable fiscal regime for Block 9 is defined in the EDPSC. The

Contractor’s revenue is made up of recovery of Petroleum Costs and

Remuneration.

The Petroleum Costs are recoverable quarterly within 50% of the “Deemed

Revenue”, which is calculated as the net oil production (including any NGLs) times

the SOMO OSP (see Section 7.1.2) plus the net dry gas production in boe times

half the SOMO OSP. Unrecovered costs, including all exploration, appraisal and

development costs prior to the start of production, are carried forward to the next

quarter.

Remuneration is limited to 30% of the difference between the Deemed Revenue

and the Petroleum Costs recovered, and is paid for each boe of oil, NGL or dry

gas produced above those used for cost recovery, according to the sliding scale