92

According to the BP Statistical Review, as at 31 December 2013, Egypt had approximately 1.8 Tcm of proven gas

reserves, a decrease from 2012 estimates of 2.0 Tcm and 47% of which has yet to be contracted. Egypt has the third

largest gas reserves in Africa, behind Nigeria and Algeria. New discoveries offshore in the Nile Delta and the Western

Desert have led to the increase in proven reserves. Over 80% of Egypt’s natural gas reserves and 70% of its production is

located in the Mediterranean and Nile Delta. Egypt’s natural gas sector has expanded rapidly over the last decade as

production has more than doubled from 27.3 Bcm in 2002 to 56.1 Bcm in 2013, according to the BP Statistical Review.

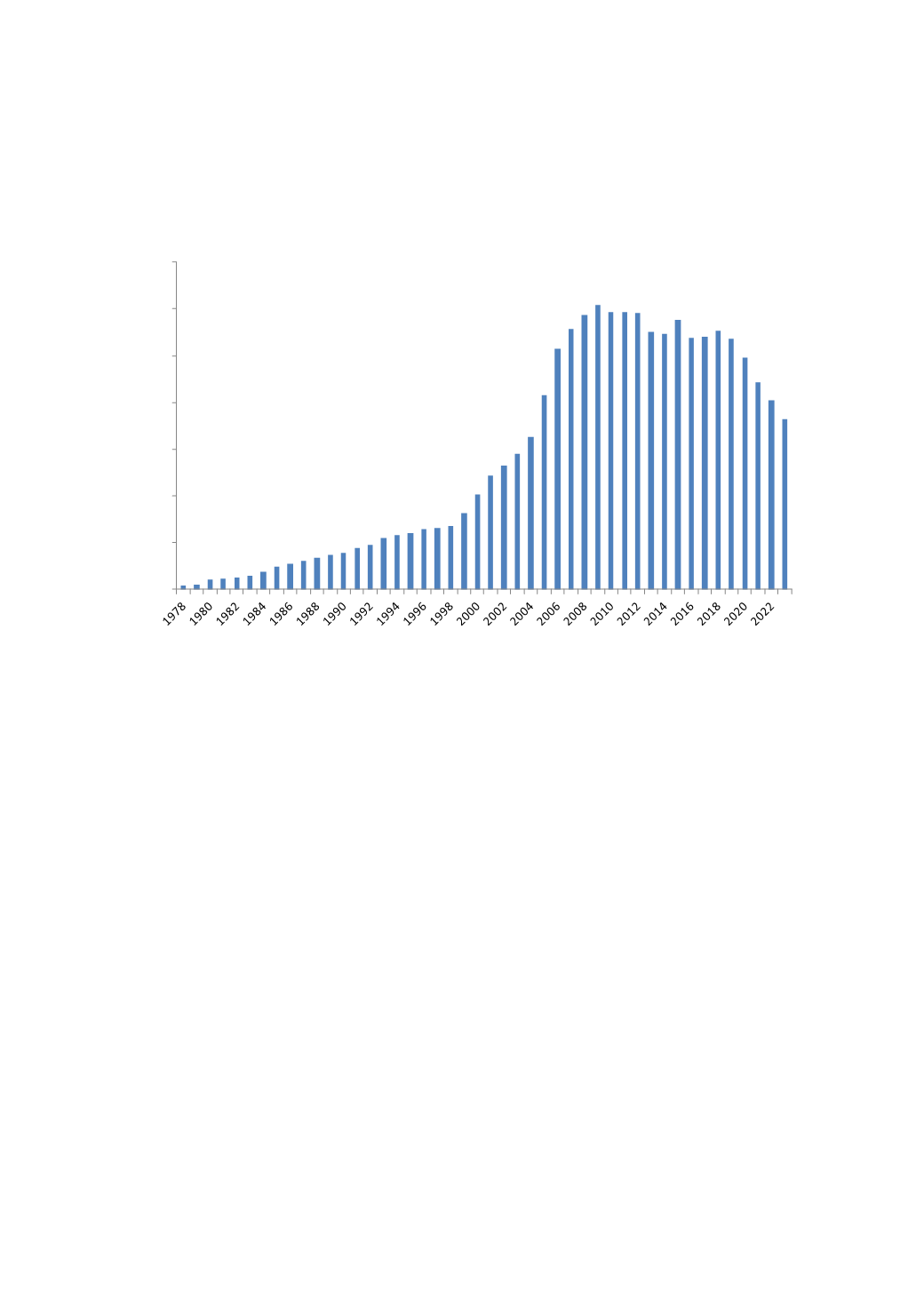

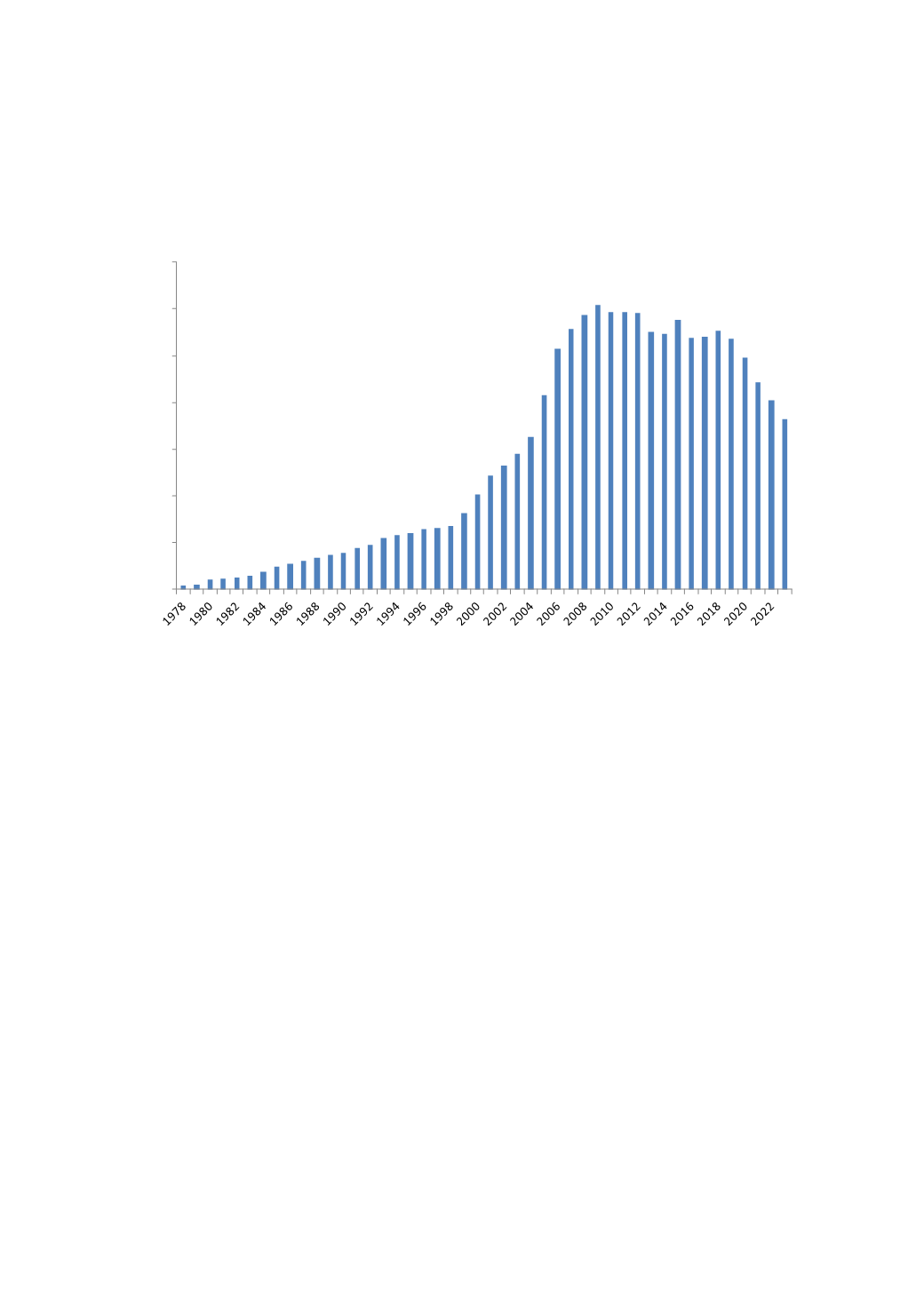

Egypt Gas Production 1978-2023

0

1,000

2,000

3,000

4,000

5,000

6,000

7,000

mmcfd

Source: Wood Mackenzie (January 2014), BP Statistical Review of World Energy (June 2014).

As is the case with the oil sector, the EGPC is the state entity charged with managing upstream gas activities including

infrastructure, licensing and production. GASCO is charged with promoting the sector, establishing a development

strategy and distributing tenders. Foreign companies operating in Egypt’s gas sector must direct all or a portion of its

current production to the domestic market, while new discoveries are earmarked for the domestic market. Major foreign

players in the gas sector in Egypt include: Eni, BG Group, BP and Apache Corporation. Key gas projects currently under

development include BP’s North Alexandria.

Due to increasing domestic demand, Egypt plans to start importing gas using a Floating Storage and Regasification Unit

(FSRU). Currently, Egypt exports gas as LNG via 7.2 mmtpa BG-operated ELNG plant at Idku. Exports gas is directed

to Jordan, but there are no longer exports to Israel, Lebanon or Syria due to strong domestic demand and pipeline

sabotage. New gas developments are highly dependent on domestic gas price and fiscal negotiations.

Iraq

Iraq has more than 100 billion barrels of proven and probable (2P) oil reserves and yet remains one of the least explored

of the world's major producing countries. Some 80 or so oil and gas fields have been discovered. Less than 30 have been

developed. The country's most important field is Rumaila field in southern Iraq as it has been the bedrock of the

country's oil and gas industry for the past half-century. The Mesopotamian Basin in Iraq has huge yet-to-find potential.

The largely unexplored Western Desert is also highly prospective but gas prone. Significant new oil and gas discoveries

have recently been made in Kurdistan in northern Iraq, which has emerged as one of the Middle East's most active

exploration provinces. Continued activity in these areas is expected to lead to reserves growth, even as oil production

increases.

There has been a rapid widening of Iraq's petroleum sector to foreign participation in the last four years. More than 60

international oil companies now have a licence interest in Iraq. Around two-thirds of these are in Kurdistan. The Federal

Oil Ministry held two, largely successful, petroleum licence rounds in 2009, which led to the award of technical service

contracts for some of the country's biggest producing and undeveloped assets. These include Rumaila (BP/CNPC), West

Qurna One (ExxonMobil/Shell) and Zubair (Eni/Occidental/KOGAS) from the first licence round; and West Qurna Two

(LUKOIL/Statoil), Majnoon (Shell/PETRONAS), Halfaya (PetroChina/PETRONAS/TOTAL) and Gharraf

(PETRONAS/JAPEX) in the second round. Development of these fields will drive the country's production growth. A