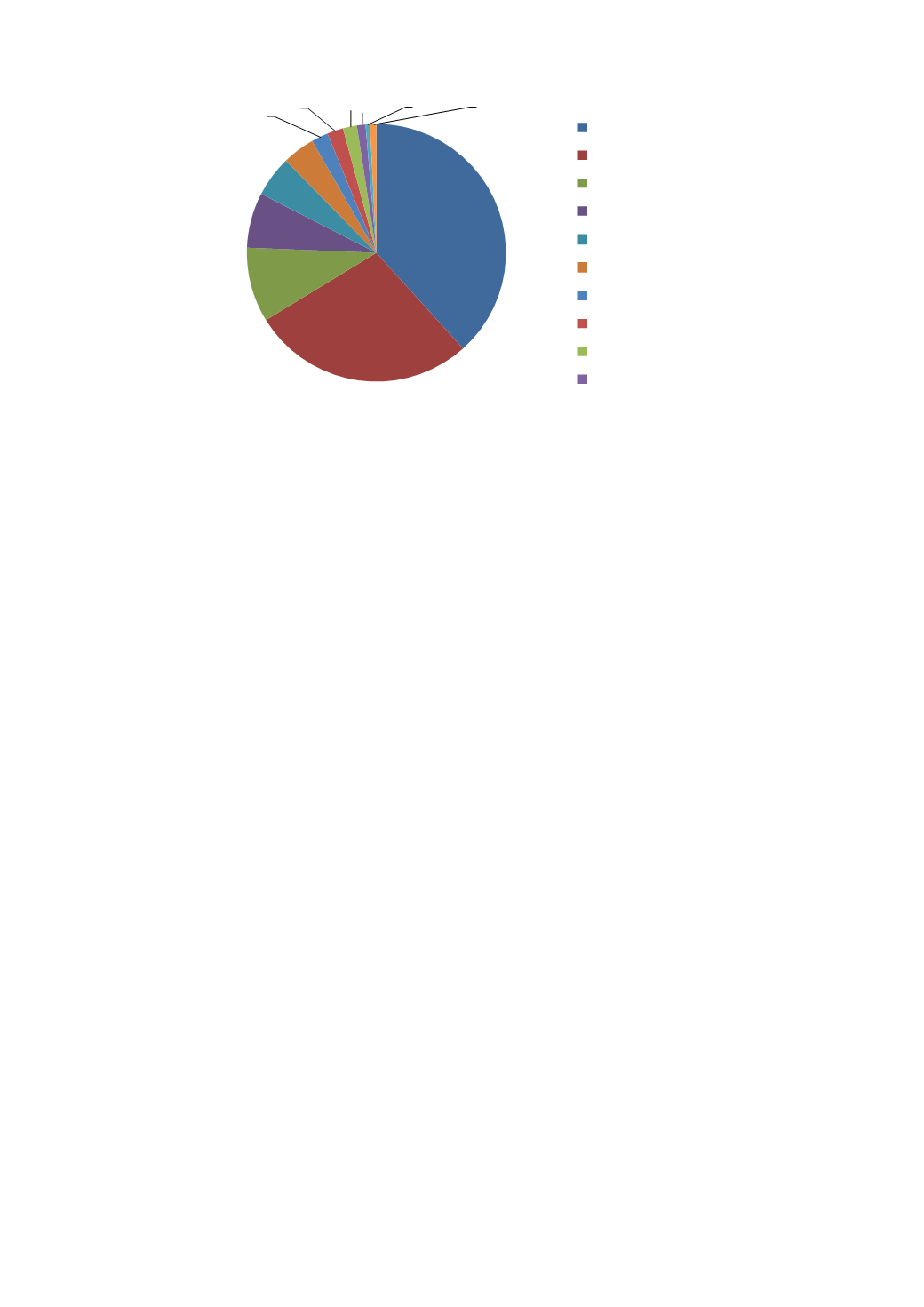

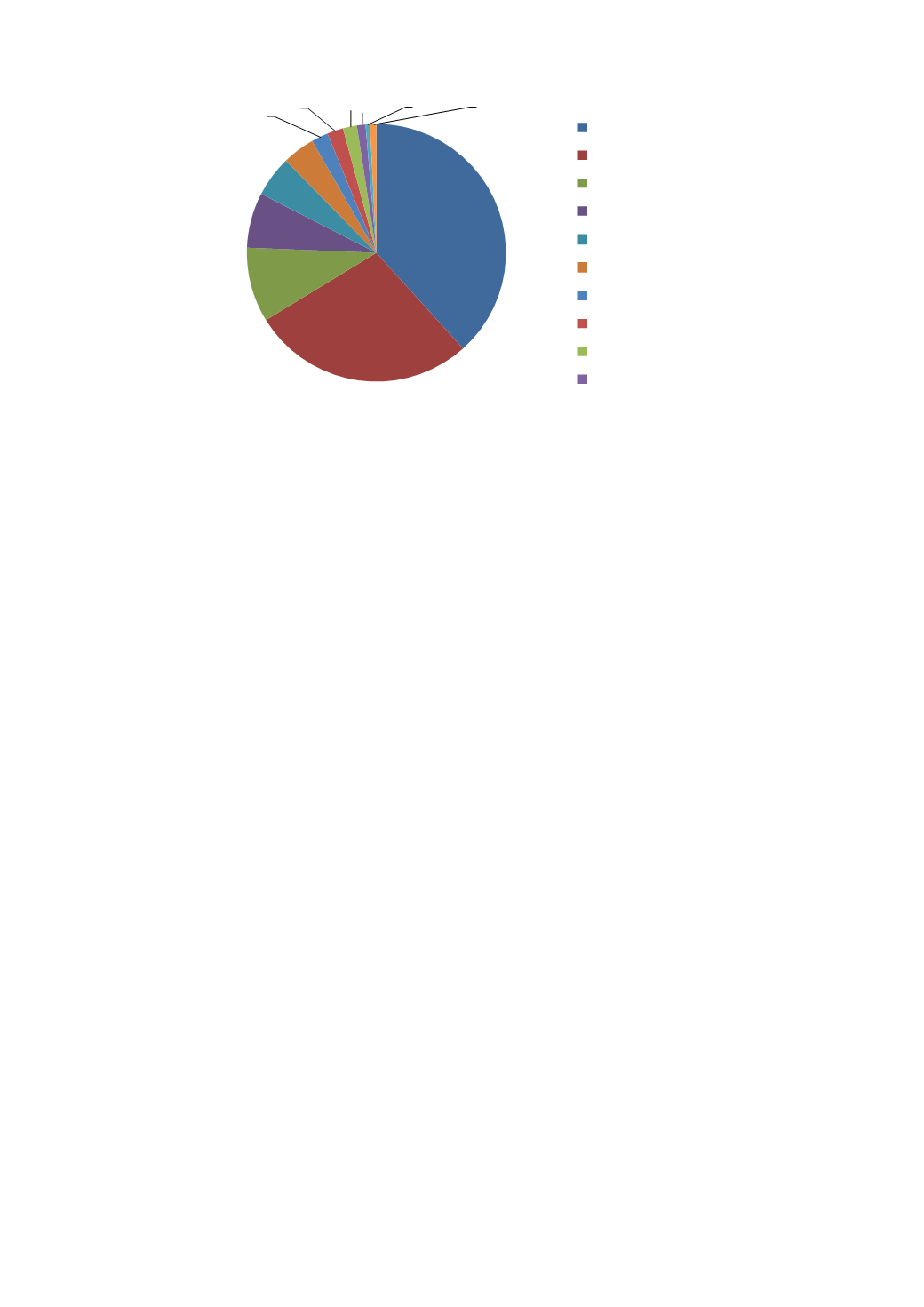

90

38.3%

28.0%

9.3%

6.9%

5.1%

4.1%

2.1%

2.0% 1.8% 1.1% 0.5% 0.8%

Iran

Qatar

Saudi Arabia

United Arab Emirates

Algeria

Iraq

Egypt

Kuwait

Libya

Oman

Source: BP Statistical Review of World Energy (June 2014).

In terms of production, oil production from the MENA region in 2013 averaged 31.7 million bopd, representing 36.5%

of the world’s total average daily oil production. The MENA region also produced 21.1% of the world’s total daily gas

production in 2013. The BP Statistical Review estimates that, on average, less than one-third of the oil produced in the

MENA region daily is consumed locally, with most of the region’s oil being sold for export.

According to the IEA, investments in upstream oil and gas assets within the MENA region are expected to total

approximately $2.7 trillion in the period to 2035. In the medium term, such investments may be delayed due to economic

conditions, political or social instability in key producer economies, market price fluctuations, or other reasons.

Impact of recent events

The International Energy Agency anticipates that, due to the delayed impact of the political upheaval that swept across

north Africa in 2011, oil production from Africa’s OPEC members Algeria, Angola, Libya and Nigeria will remain

steady over the next five years at approximately 7.1 million barrels a day, posting negligible growth from 2012 to 2018.

The attack on the In Amenas gasfield in the Illizi province of Algeria in January 2013 has, in particular, prompted

international oil companies to review how they operate in Northern Africa. Recent violence in Libya, targeting the oil

industry, has further raised the alarm in the industry. Within OPEC, flat production from its African members could

provide room for increased production from Iraq.

According to the EIA, the recent political unrest in Egypt has not significantly affected foreign investor presence in

Egypt or hydrocarbon production, principally due to the fact that the main production areas in the Western desert and the

offshore Nile Delta are remote from the areas affected by political unrest. Although Egypt’s energy transport

infrastructure has been subject to vandalism and sabotage in the past, the recent political unrest has not significantly

affected the country’s three LNG trains.

In Iran, US and EU sanctions have prohibited large-scale investment in Iran’s oil and gas sector and European insurance

of Iranian oil carriers, and have prevented Iran’s access to US and EU financial markets. This has led to cancellations of

export-oriented upstream projects and reduced imports of refined products.

Egypt

Oil

Egypt is a mature oil province which has been actively explored since 1860. The first oil discovery (Gemsa) was made

around 140 years ago and the country has been producing oil since 1910.

According to the BP Statistical Review, Egypt had total proven oil reserves of approximately 3.9 billion barrels as at 31

December 2013, decreased from 4.2 billion barrels as at 31 December 2012. Egypt is the largest oil producer in Africa

that is not a member of OPEC. According to the BP Statistical Review, in 2013, Egypt’s total oil production averaged

approximately 714,000 bbl/d. Egyptian oil production primarily comes from five areas: the Gulf of Suez, the Nile Delta,

the Western Desert, the Eastern Desert and the Mediterranean Sea. The Gulf of Suez fields have underpinned oil