91

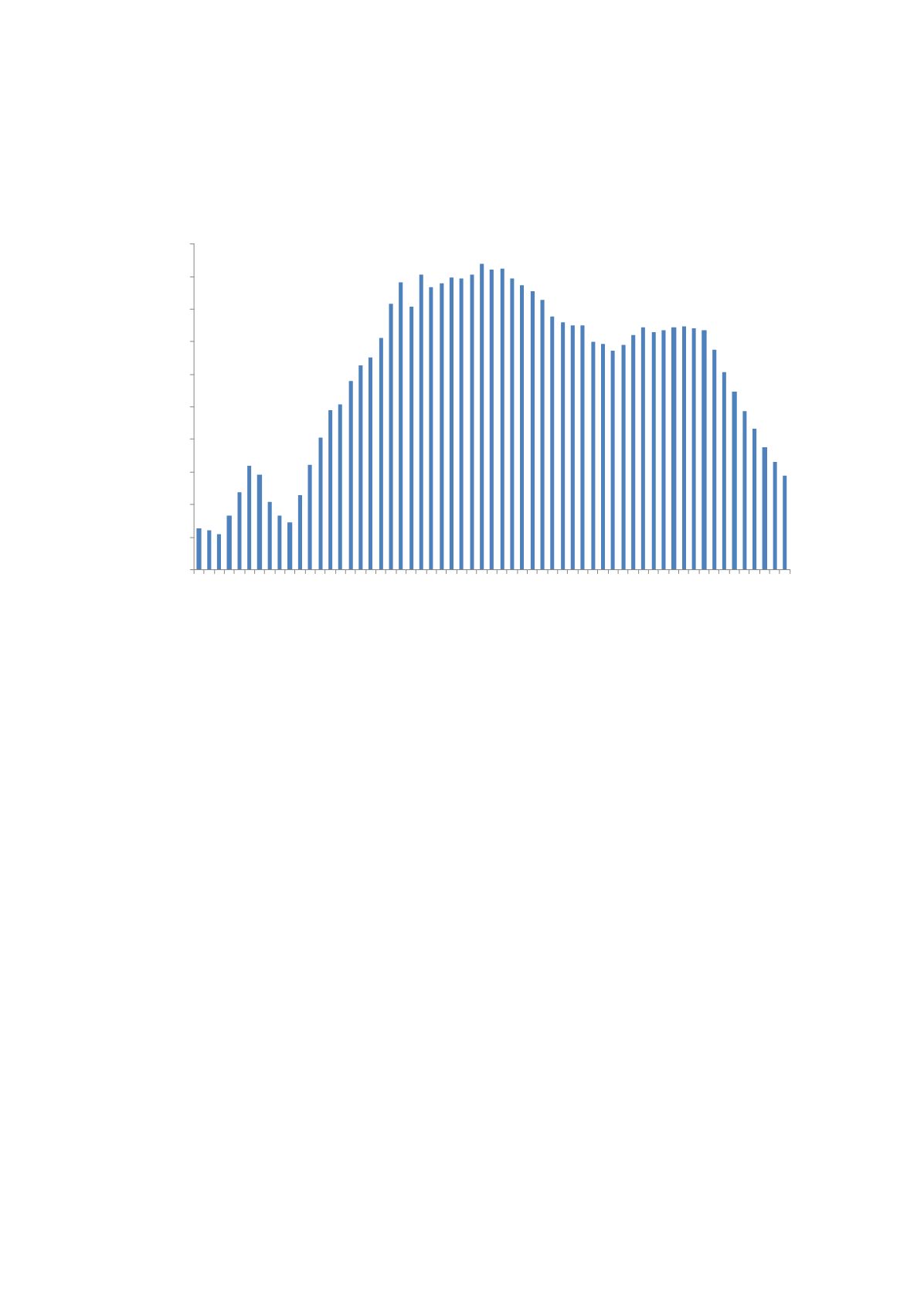

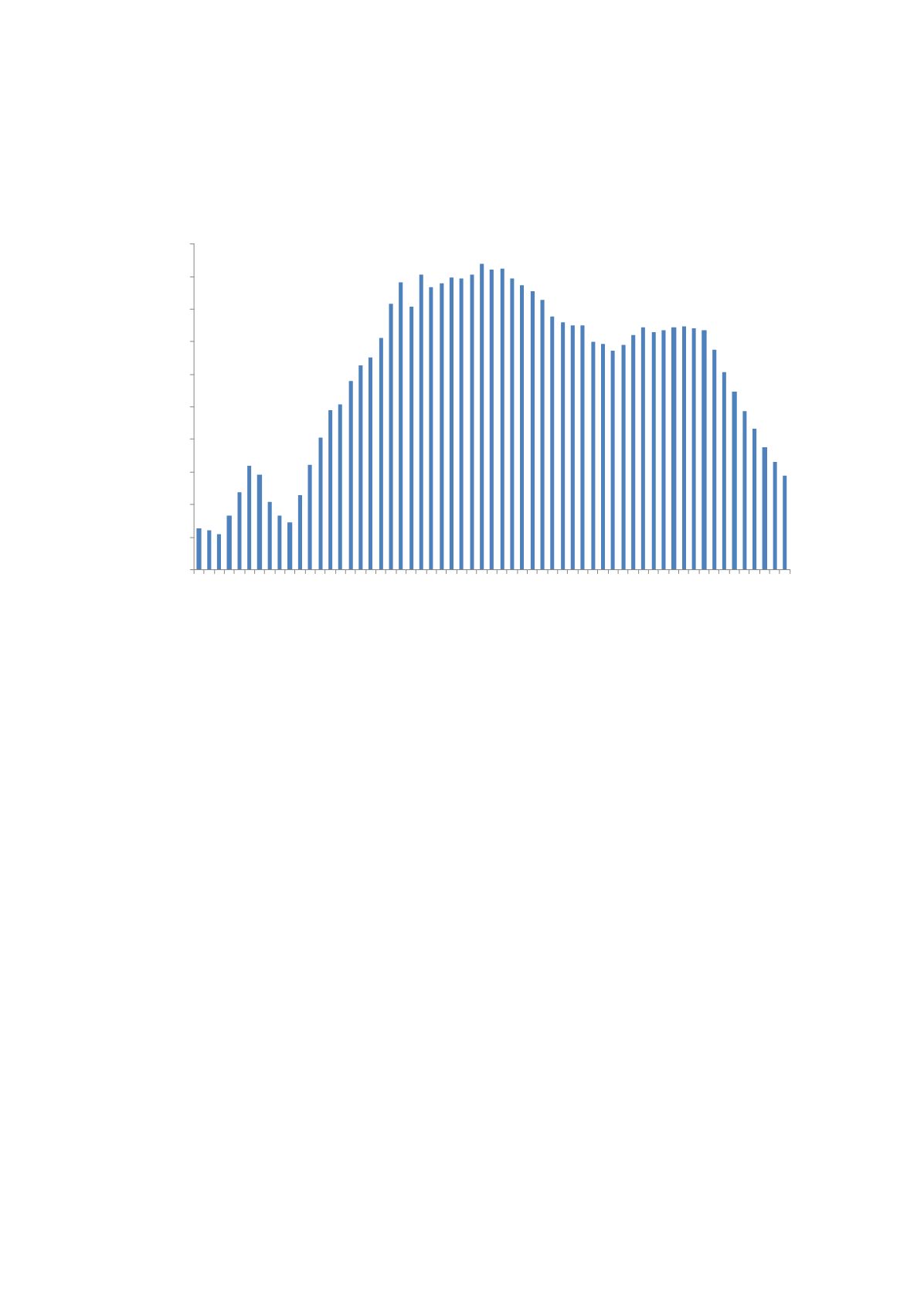

production in Egypt since the 1960s but are now mature and production has been declining since reaching a peak of

912,000 b/d in 1993. The emergence of the Western Desert as a key oil producing region since 2000 has managed to

offset a large part of the decline from the Gulf of Suez. Key oil producers in the Western Desert are the Khalda Area and

East Bahariya, both operated by Apache. New finds in the Mediterranean deepwater offshore and in mature productive

areas in the Gulf of Suez and Nile Delta may offer Egypt sustained oil resources in the future.

Egypt Liquids Production by Region 1965-2023

0

100

200

300

400

500

600

700

800

900

1000

1965

1967

1969

1971

1973

1975

1977

1979

1981

1983

1985

1987

1989

1991

1993

1995

1997

1999

2001

2003

2005

2007

2009

2011

2013

2015

2017

2019

2021

2023

'000 b/d

Source: Wood Mackenzie (January 2014), BP Statistical Review of World Energy (June 2014).

EGPC owns and operates much of the country’s refining capacity and is also the state entity charged with managing

upstream activities including infrastructure, licensing and production. In addition to the EGPC and the Egyptian Mineral

Resource Authority (“

EMRA

”), the energy sector is divided among three holding companies: the Egyptian Natural Gas

Holding Company (“

EGAS

”), the Egyptian Petrochemicals Holding Company (“

ECHEM

”) and Ganoub El Wadi

Petroleum Holding Company (“

GANOPE

”). EGAS is responsible for promoting the gas sector, establishing a

development strategy and distributing tenders. ECHEM is responsible for the implementation of the National

Petrochemicals Master Plan and for developing a competitive portfolio of successful petrochemical businesses.

GANOPE is responsible for managing and supervising petroleum activities and supports international oil companies by

providing technical expertise and data. International and foreign national oil companies, including Apache, British

Petroleum and Shell E&P, play a significant role in Egypt’s upstream sector, and generally operate on the basis of

production sharing contracts (“

PSCs

”) entered into with EGPC. See “

The Group’s business—The Group’s operations—

Egypt—fiscal regimes.

”

In its effort to combat falling liquids production, Egypt has held a significant number of exploration bid rounds in recent

years. In addition to the more familiar Western Desert, Gulf of Suez and Nile Delta areas, blocks have also been offered

in lesser known frontier regions like the Red Sea and Upper Egypt. Bid rounds in Egypt are usually well received by

IOCs, although the response to Red Sea and Upper Egypt rounds has been low key so far, with interest limited to some

smaller companies. Ratification of awards is often subject to lengthy delays since awards are approved by the Egyptian

parliament and become Acts of Egyptian law. During this interim period (between award and ratification) no work can

be undertaken on the acreage. The Egyptian authorities point to the contract stability offered by the process and

compares it with other areas of North Africa where contract sanctity has been less well respected.

In the face of a weakening economy and political upheaval (see “

Risk factors—Risks relating to the jurisdictions in

which the Group operates—The Group’s operations in Egypt may be disrupted by political and economic

developments

”), one of Egypt’s energy challenges is to satisfy increasing domestic demand for oil in the midst of falling

domestic production. Domestic oil consumption has grown by almost 40% over the last decade, from 550,000 bbl/d in

2000 to 757,000 bbl/d in 2013. A small volume of refined petroleum product imports are used to meet domestic demand.

Domestic consumption exceeds production, making Egypt a net oil importer.

Gas