KUWAIT ENERGY plc GROUP

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

For the year ended 31 December 2011

F-154

55.

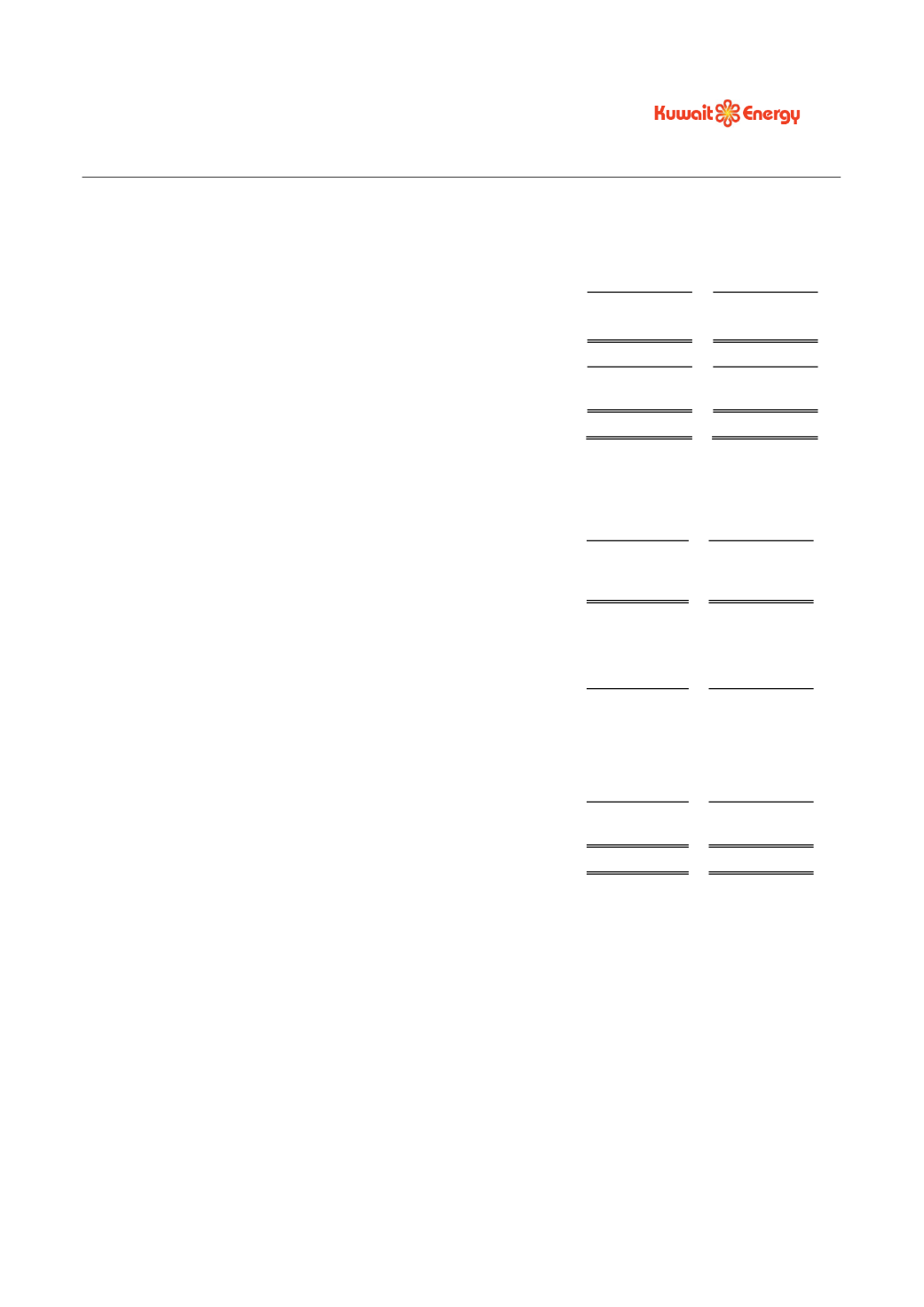

EARNINGS PER SHARE

a) Basic earnings per share

The earnings and weighted average number of shares used in the calculation of basic earnings per share are

as follows:

2011

2010

USD 000’s

USD 000’s

Profit for the year

34,763

21,902

Shares

Shares

Weighted average number of shares for the purposes of basic earnings

per share (thousand)

312,340

263,923

Basic earnings per share (cents)

11.1

8.5

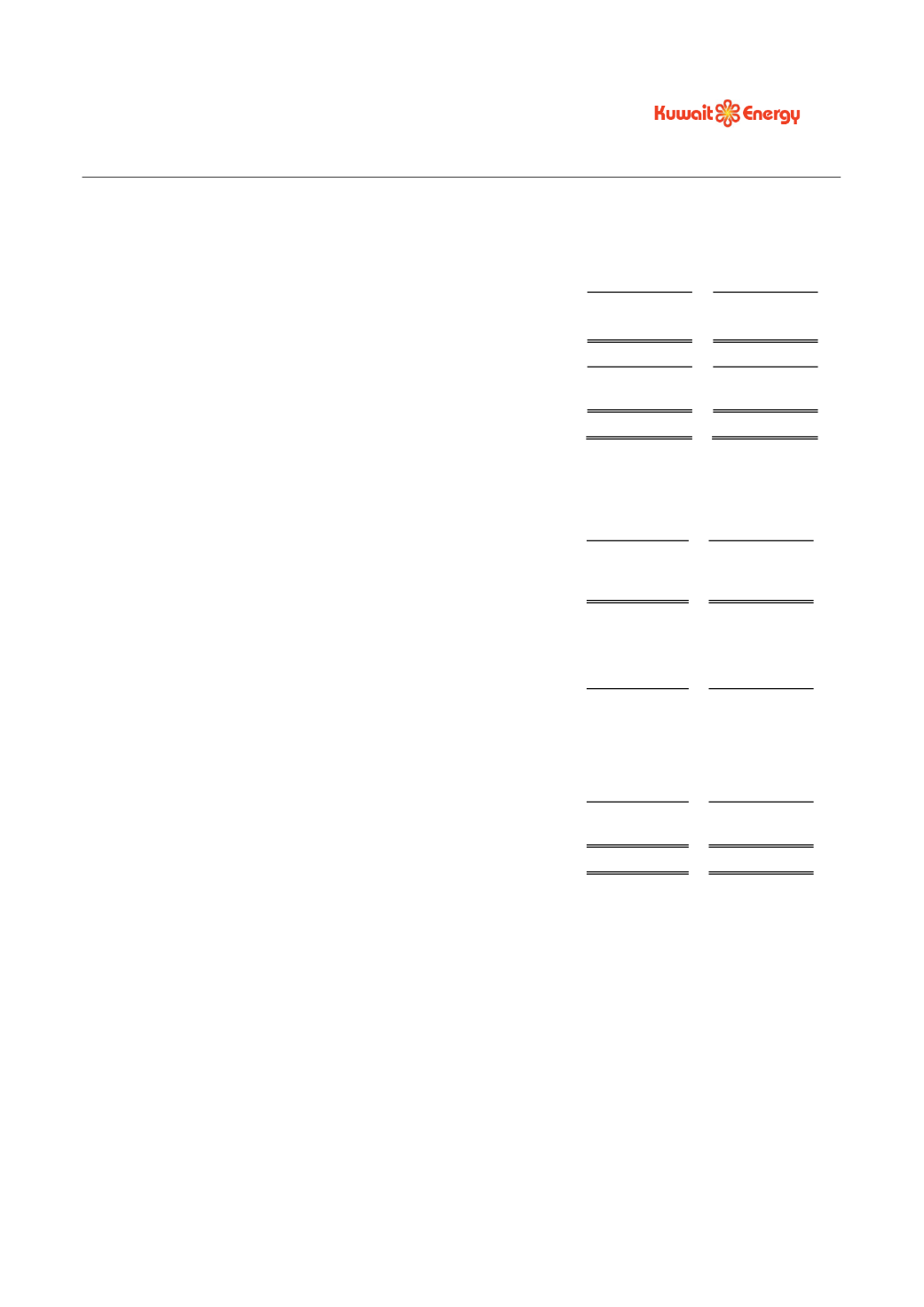

b)

Diluted earnings per share

The earnings used in the calculation of diluted earnings per share are as follows:

2011

2010

USD 000’s

USD

000’s

Earnings used in the calculation of diluted earnings per share

34,763

21,902

The weighted average number of ordinary shares for the purposes of diluted earnings per share reconciles to

the weighted average number of ordinary shares used in the calculation of basic earnings per share as

follows:

Shares

Shares

Weighted average number of ordinary shares used in the calculation of

basic earnings per share (thousand)

312,340

263,923

Shares deemed to be issued for no consideration in respect of:

Employee awards (thousand)

858

618

Business combinations (thousand)

-

247

Weighted average number of ordinary shares used in the calculation of

diluted earnings per share (thousand)

313,198

264,788

Diluted earnings per share (cents)

11.1

8.5

56.

RELATED PARTY TRANSACTIONS

Related parties comprise major shareholders, directors and executive officers of the Group, their families

and companies of which they are the principal owners. All related party transactions are conducted on an

arm’s length basis and are approved by the board of directors

.

Balances and transactions between the

Company and its subsidiaries, which are related parties, have been eliminated on consolidation and are not

disclosed in this note.

Note 1 contains information on the restructuring of the Group and the basis of preparation of the financial

statements. No transactions between the Company and Kuwait Energy K.S.S.C. prior to the completion of

the restructuring are disclosed in this note due to the merger accounting approach followed.

Kuwait Energy KSSC, the parent company prior to the restructuring has continued to provide staff to the

Group at cost plus a mark-up, representing an arm’s length transaction, whilst the contracts for those staff

are transferred to subsidiaries of the group. The charge to the Group after completion of the restructuring in

this regard was USD 569 thousand and USD 569 thousand was owed to Kuwait Energy KSSC in this regard

at 31 December 2011 (2010: USD nil)