KUWAIT ENERGY plc GROUP

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

For the year ended 31 December 2011

F-148

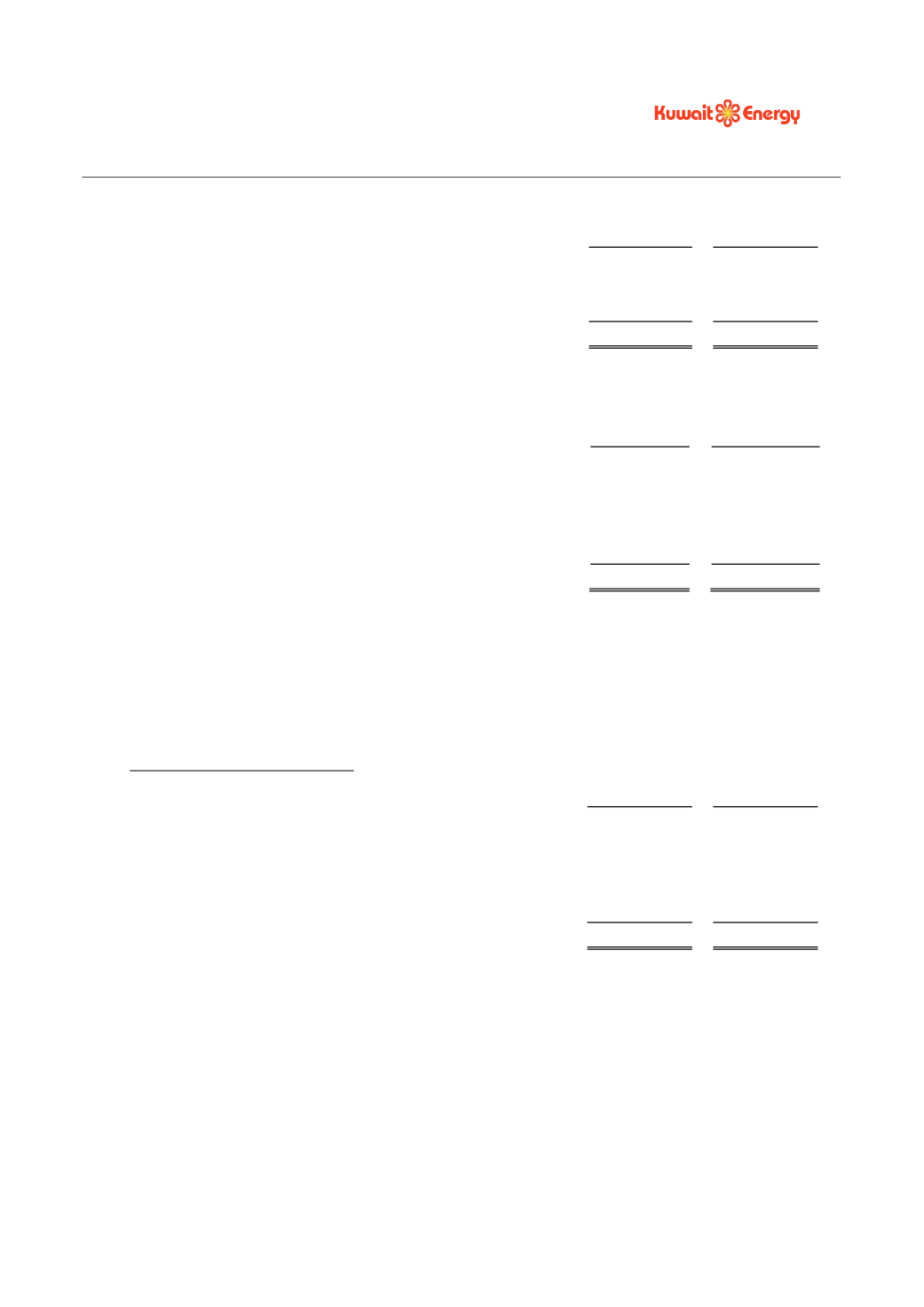

45.

INVENTORIES

2011

2010

USD 000’s

USD 000’s

Crude oil

2,688

3,162

Spare parts, materials and supplies

13,552

14,700

16,240

17,862

Spare parts, materials and supplies are used in operations and are not held for re-sale.

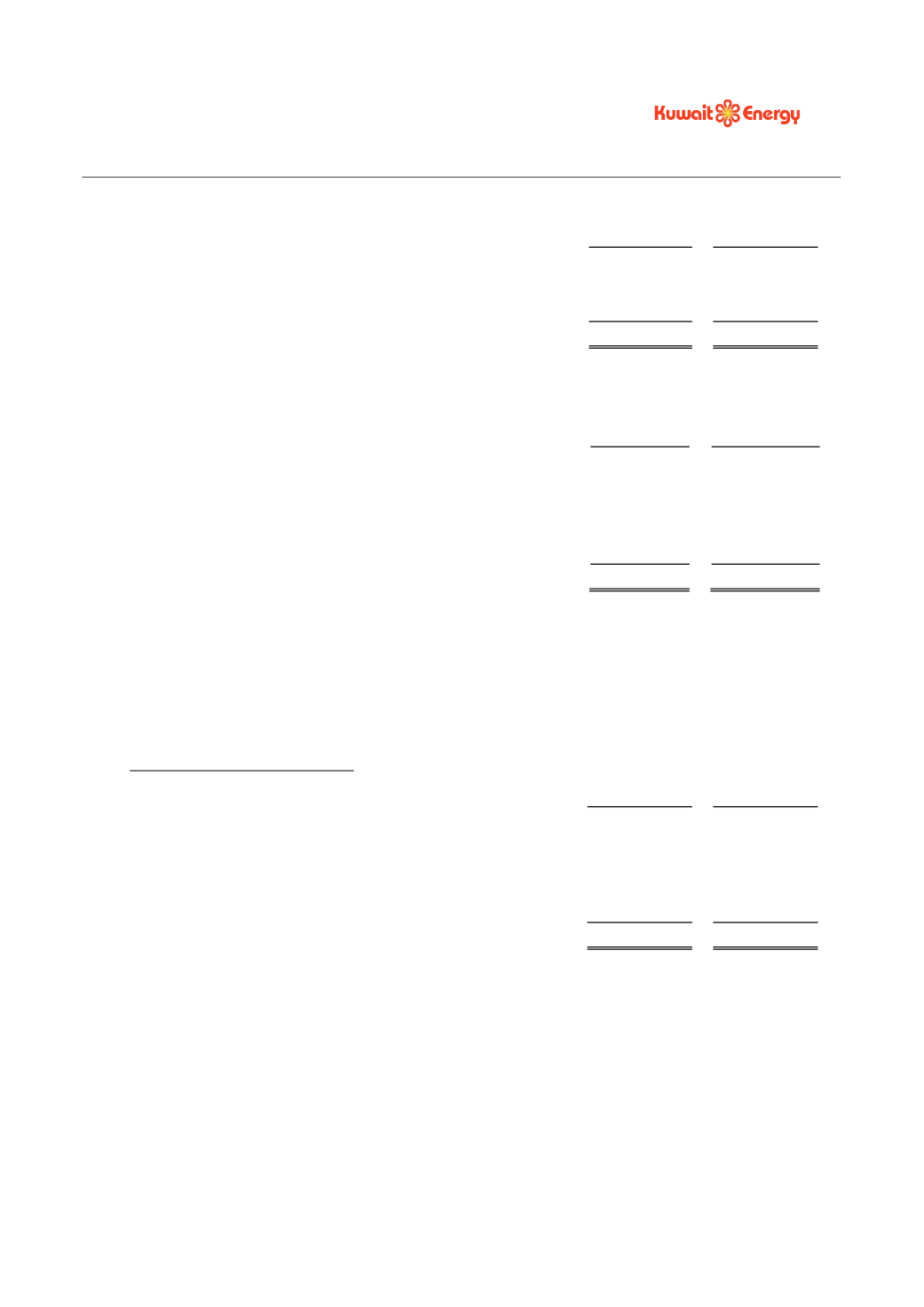

46.

TRADE AND OTHER RECEIVABLES

2011

2010

USD 000’s

USD 000’s

Trade receivables

133,256

65,201

Prepayments, deposits and advances

6,141

18,379

Receivable on farm out of working interests (See note 13)

-

19,464

Other receivables

36,658

32,155

176,055

135,199

Other receivables include amounts to be received in connection with the arbitration claim (See note 30(a)),

amounts owed by joint venture partners and VAT.

The average credit period on sales is 60 days. No interest is charged on the overdue trade receivables.

Included in the Group’s trade receivables balance are debtors with a carrying amount of USD 97,664

thousand (2010: USD 39,577 thousand) which are past due at the reporting date for which the Group has not

provided against as there has not been a significant change in credit quality and the amounts are still

considered recoverable (See “Debtor recoverability” in note 4 for further details).

Ageing of past due but not impaired

2011

2010

USD 000’s

USD 000’s

61 – 90 days

9,225

14,403

91 – 120 days

20,236

5,504

121 – 180 days

24,412

14,016

> 180 days

43,791

5,654

Total

97,664

39,577

During the year, the Group has written off impaired trade receivables of USD Nil (2010: USD 1,329

thousand).

In determining the recoverability of a trade receivable, the Group considers any change in the credit quality

of the trade receivable from the date credit was initially granted up to the reporting date. Management

believes that there is no credit provision required as all the trade receivables are fully collectible.

The maximum exposure to credit risk at the reporting date is the carrying amount of each class of receivable

mentioned above. The directors consider that the carrying amount of trade and other receivables is

approximately equal to their fair value.