KUWAIT ENERGY plc GROUP

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

For the year ended 31 December 2011

F-150

50.

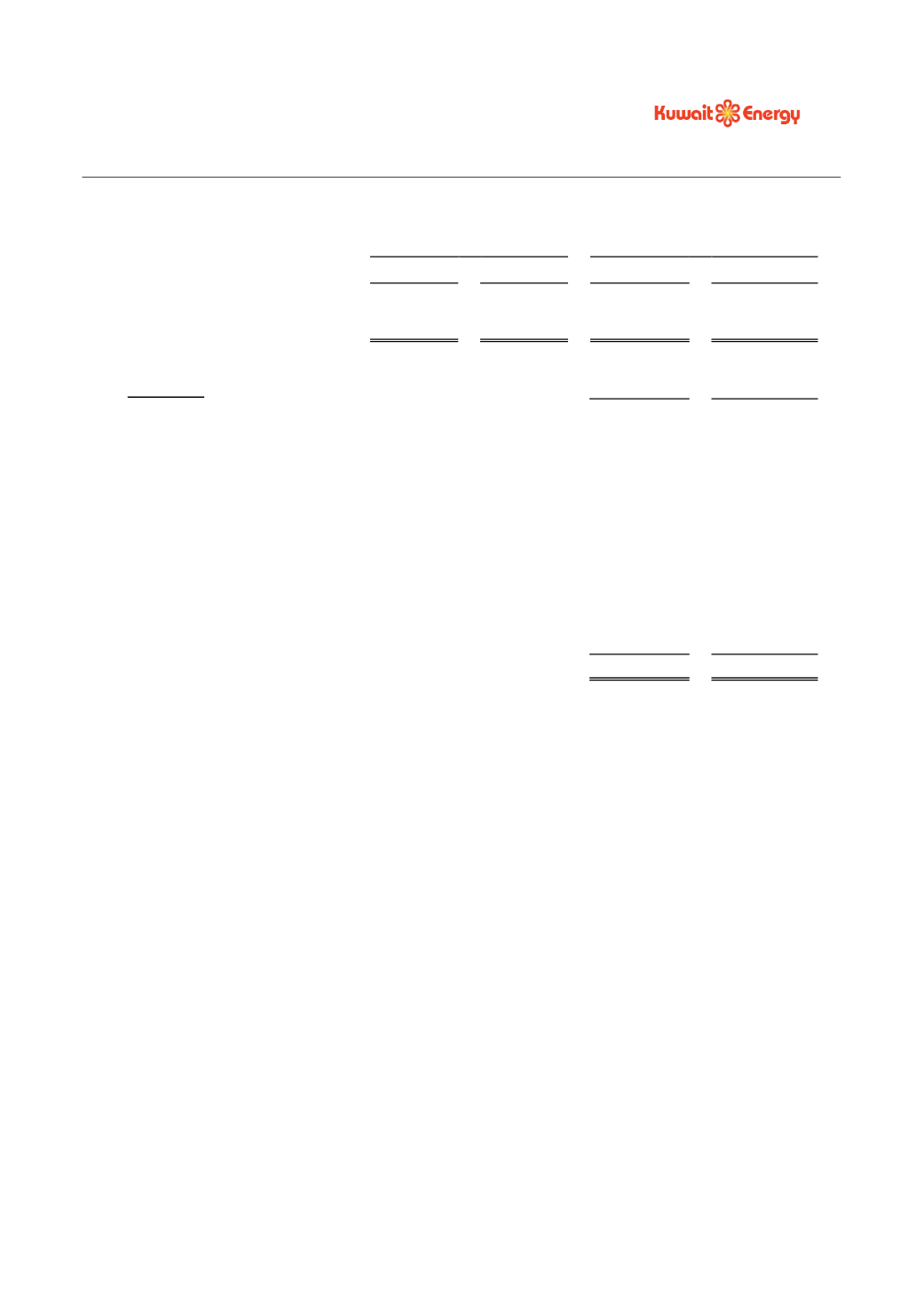

LONG-TERM LOANS

Current

Non-current

2011

2010

2011

2010

USD 000’s

USD 000’s

USD 000’s

USD 000’s

Due to foreign banks

8,000

-

45,000

53,000

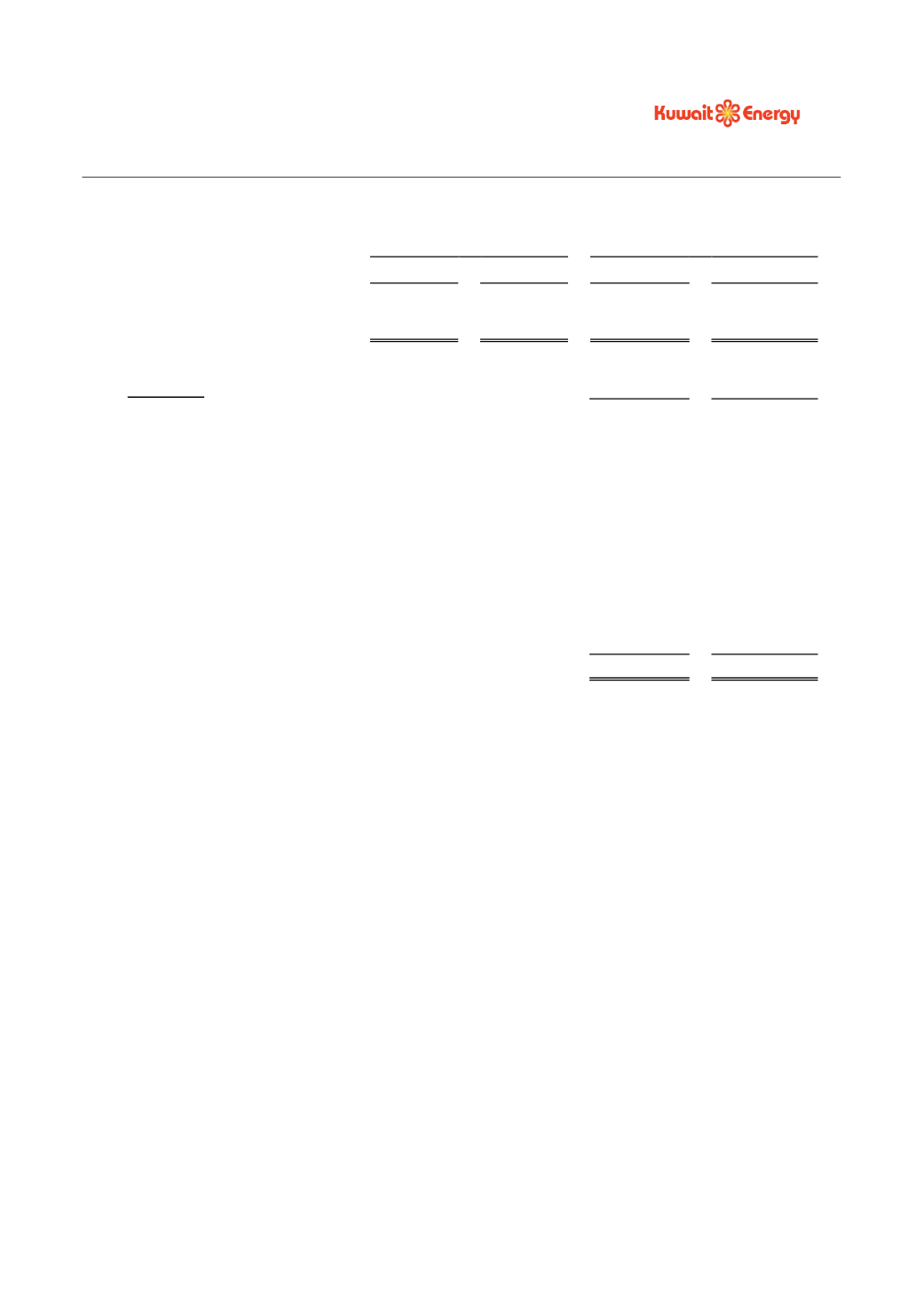

The details of long-term loans are as follows:

Description

2011

2010

USD 000’s

USD 000’s

(i) USD 35 million facility from International Finance

Corporation (“IFC”) that bears an interest rate of LIBOR plus 3.64%

to 4.01% per annum. (a)

30,000

30,000

(ii) USD 15 million facility financing from IFC that bears an

interest rate of 1.176% per annum plus 5% earnings before interest,

depreciation and amortisation arising on the secured assets. (b)

15,000

15,000

(iii) The Loan from European Bank for Reconstruction and Development

(“EBRD”) bears an interest rate of LIBOR plus 6.5% per annum.

The

repayment is in quarterly instalments commencing 27 January 2012

and ending 27 October 2013. (c)

8,000

8,000

53,000

53,000

(a)

The facility is secured by pledges on the assets of the subsidiaries Kuwait Energy Egypt Ltd and Kuwait

Energy Yemen Ltd (See note 14). The loan is to be repaid on 15 June 2014.

(b) The facility is secured by pledges on the assets of the subsidiaries Kuwait Energy Egypt Ltd and Kuwait

Energy Yemen Ltd (See note 14). The facility is to be repaid in two annual instalments of USD 7,500

thousand each on 30 June 2014 and 30 June 2015.

(c)

The debt is secured by pledges on the assets of the subsidiary of Pechora Energy Company Limited (See

note 14).

As at 31 December 2011, the Group has undrawn loan facilities amounting to USD 5,000 thousand (2010:

USD 5,000 thousand).

The facilities shown above include certain financial covenants. One of these covenants on the EBRD facility was

in breach as at 31 December 2011 and accordingly the full amount has been disclosed as falling due within one

year.