KUWAIT ENERGY plc GROUP

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

For the year ended 31 December 2011

F-160

29.

FINANCIAL INSTRUMENTS (CONTINUED)

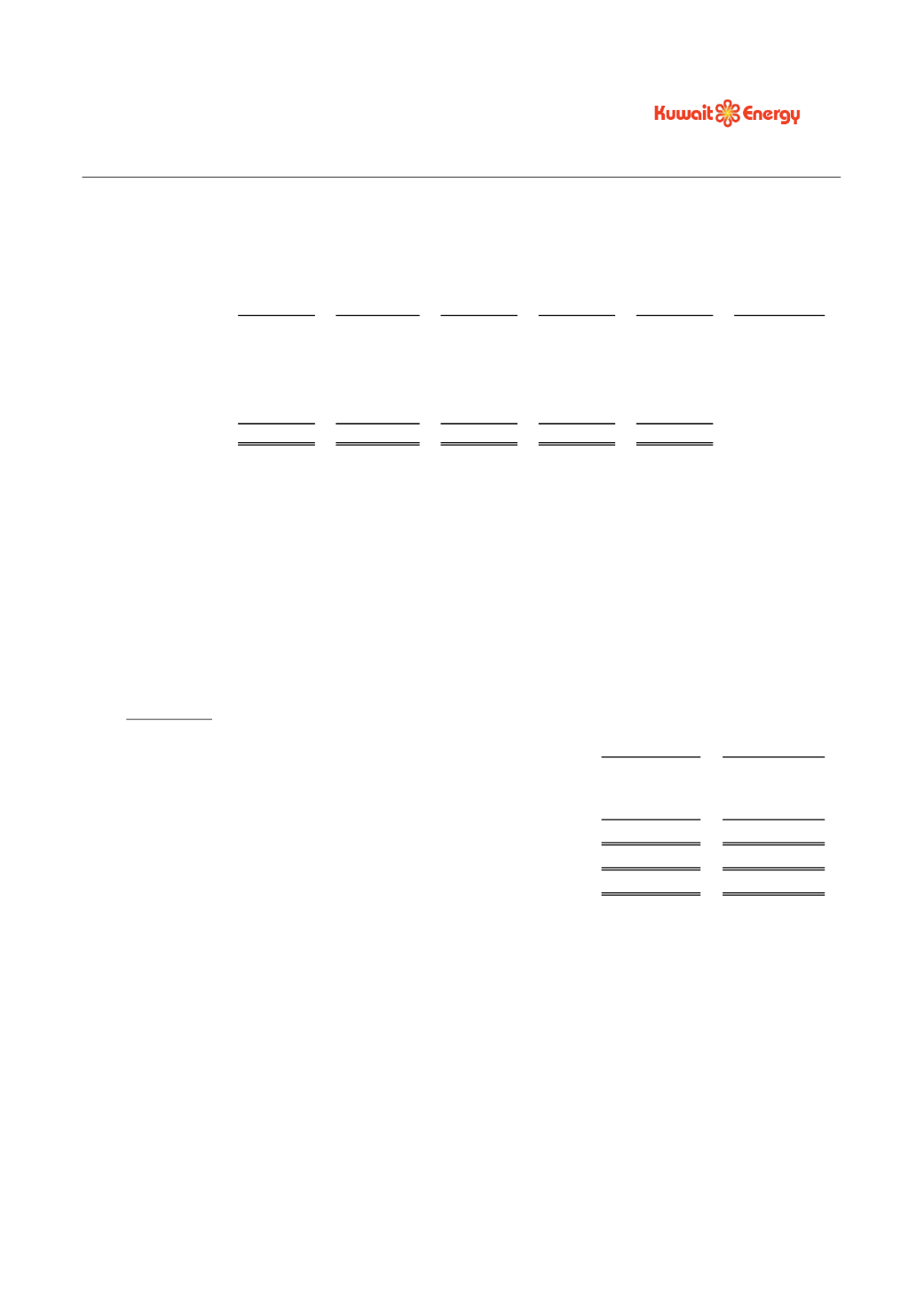

At 31 December 2010

Financial

liabilities

Less than

1 year

Between

1 and 3

years

Between

3 and 5

years

More

than 5

years

Total

Weighted

average

effective

interest rate

USD

000’s

USD

000’s

USD

000’s

USD

000’s

USD

000’s

%

Long-term

loans

-

9,090

50,208

-

59,298

5.3

Trade and other

payables

46,407

-

-

-

46,407

46,407

9,090

50,208

-

105,705

Fair value of financial instruments

Management believes that the fair value of all of the Group’s financial assets and financial liabilities is not

significantly different from their respective carrying values.

Capital risk management

The Group manages its capital to ensure that it will be able to continue as a going concern while maximising

the return to the shareholders through the optimisation of debt and equity balance. The Group’s overall

strategy remains unchanged from 2010.

The capital structure of the Group consists of equity comprising issued share capital, share premium and

merger reserve (see note 18), other reserves (see note 19) and retained earnings.

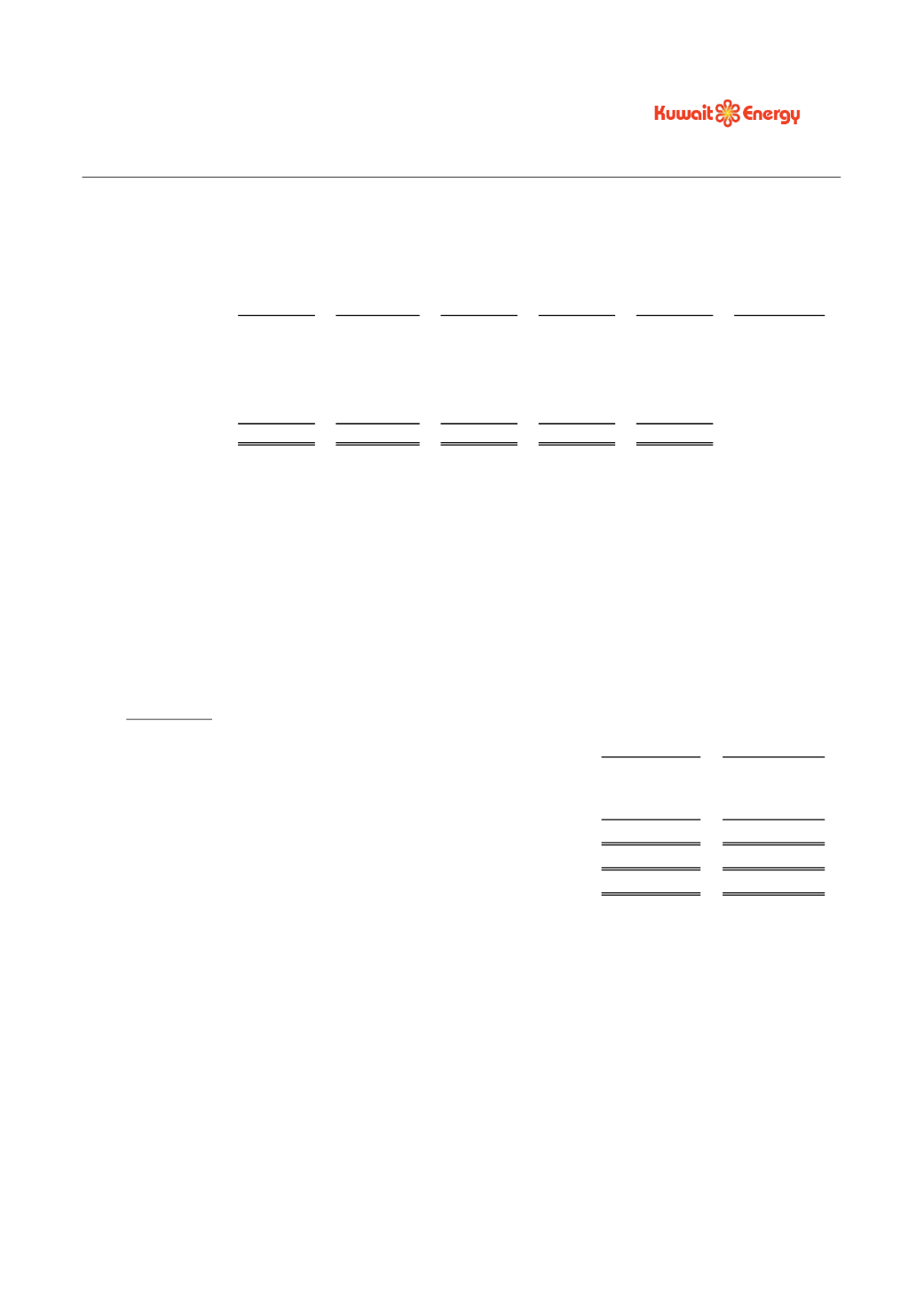

Gearing ratio

The gearing ratio at year end was as follows:

2011

2010

USD 000’s

USD 000’s

Debt (i)

53,000

53,000

Less: Cash and bank balances and liquid investments

(40,477)

(58,092)

Net debt

12,523

(5,092)

Equity

734,292

631,302

Net debt to equity ratio (%)

1.7

-

(i) Debt is defined as long-term loans as detailed in note 20.