KUWAIT ENERGY plc GROUP

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

For the year ended 31 December 2011

F-159

29.

FINANCIAL INSTRUMENTS (CONTINUED)

Credit risk management (Continued)

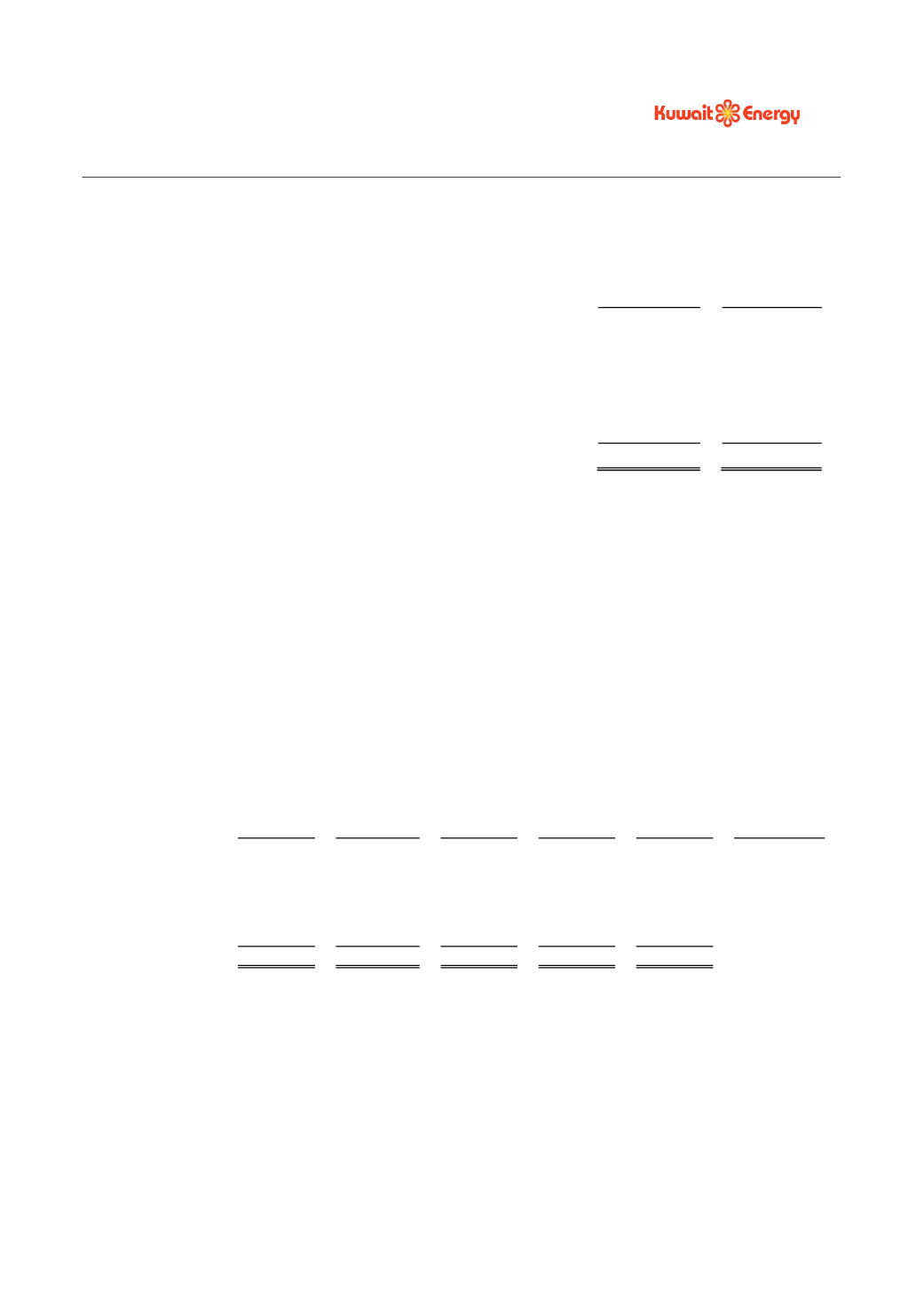

The maximum exposure to credit risk for trade receivables at the reporting date by geographic region was:

2011

2010

USD 000’s

USD 000’s

Egypt

131,039

57,376

Yemen

1,134

1,381

Ukraine

36

4,500

Oman

977

1,503

Russia

70

441

133,256

65,201

Liquidity risk management

Liquidity risk is the risk that the Group will not be able to meet its financial obligations as they fall due. The

Group’s approach to managing liquidity is to ensure, as far as possible, that it will always have sufficient

liquidity to meet its liabilities when due, under both normal and stressed conditions, without incurring

unacceptable losses or risking damage to the Group’s reputation.

Ultimate responsibility for liquidity risk management rests with the management, which has built an

appropriate liquidity risk management framework for the management of the Group’s short, medium and

long-term funding and liquidity management requirements. The Group manages liquidity risk by maintaining

adequate reserves and banking facilities, by continuously monitoring forecast and actual cash flows and

matching the maturity profiles of financial assets and liabilities.

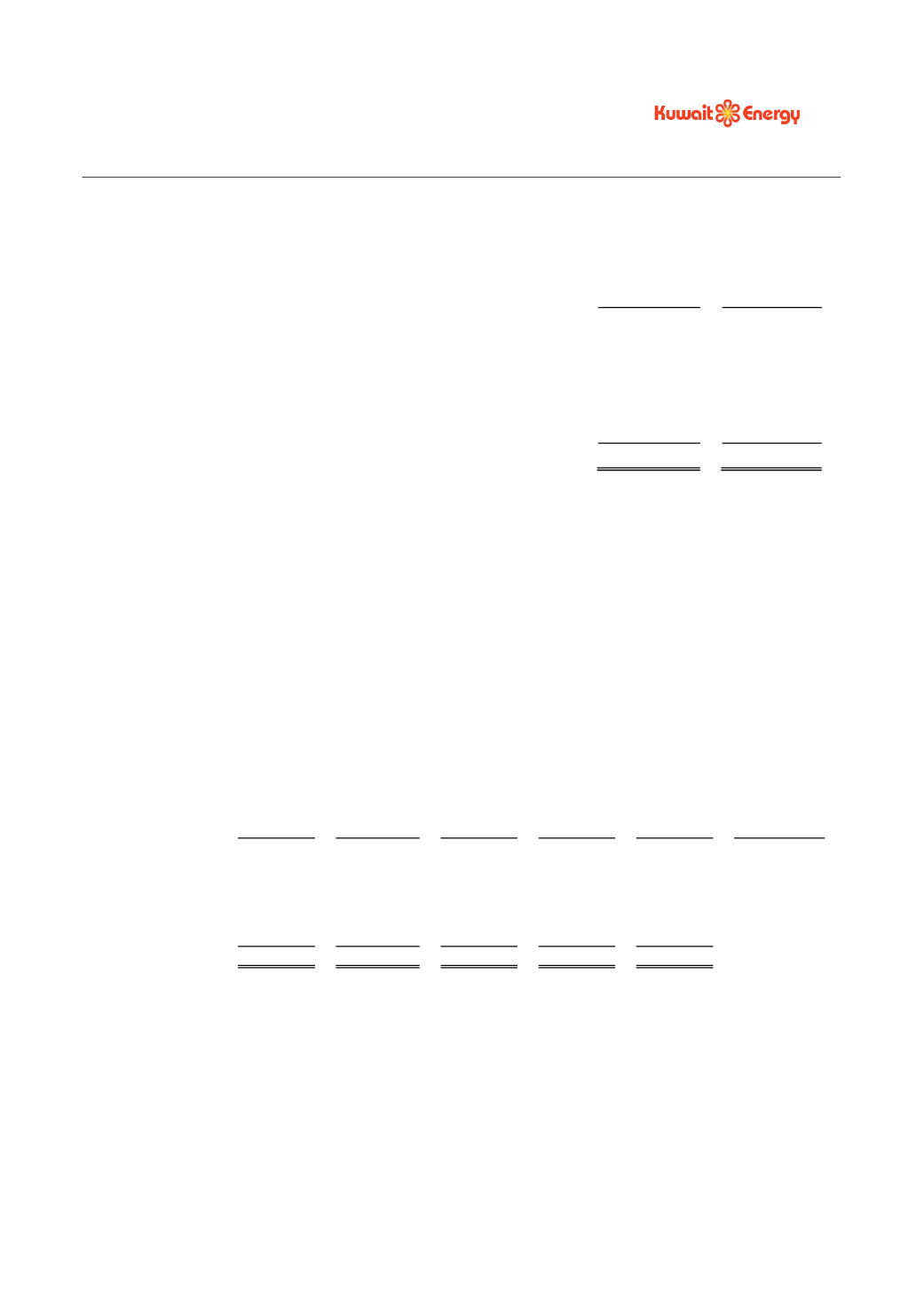

The following tables detail the Group’s remaining contractual maturity for its financial liabilities. The tables

have been drawn up based on the undiscounted cash flows of financial liabilities.

At 31 December 2011

Financial

liabilities

Less than

1 year

Between

1 and 3

years

Between

3 and 5

years

More

than 5

years

Total

Weighted

average

effective

interest rate

USD

000’s

USD

000’s

USD

000’s

USD

000’s

USD

000’s

%

Long-term

loans

8,000

40,667

7,721

-

56,388

10.11%

Trade and other

payables

52,964

-

-

-

52,964

56,964

44,667

7,721

-

109,352