KUWAIT ENERGY plc GROUP

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

For the year ended 31 December 2013

F-59

(2012: USD 125,227 thousand) arising in Egypt which are past due at the reporting date for which the Group has

not provided against as there has not been a significant change in credit quality and the amounts are still

considered recoverable. In making the judgement about recoverability, factors considered include EGPC’s strong

track record of ultimate settlement, the receipt of USD 241 million in 2013. This is a key source of estimation

uncertainty and is discussed in further detail in the “Debtor recoverability” section of note 4.

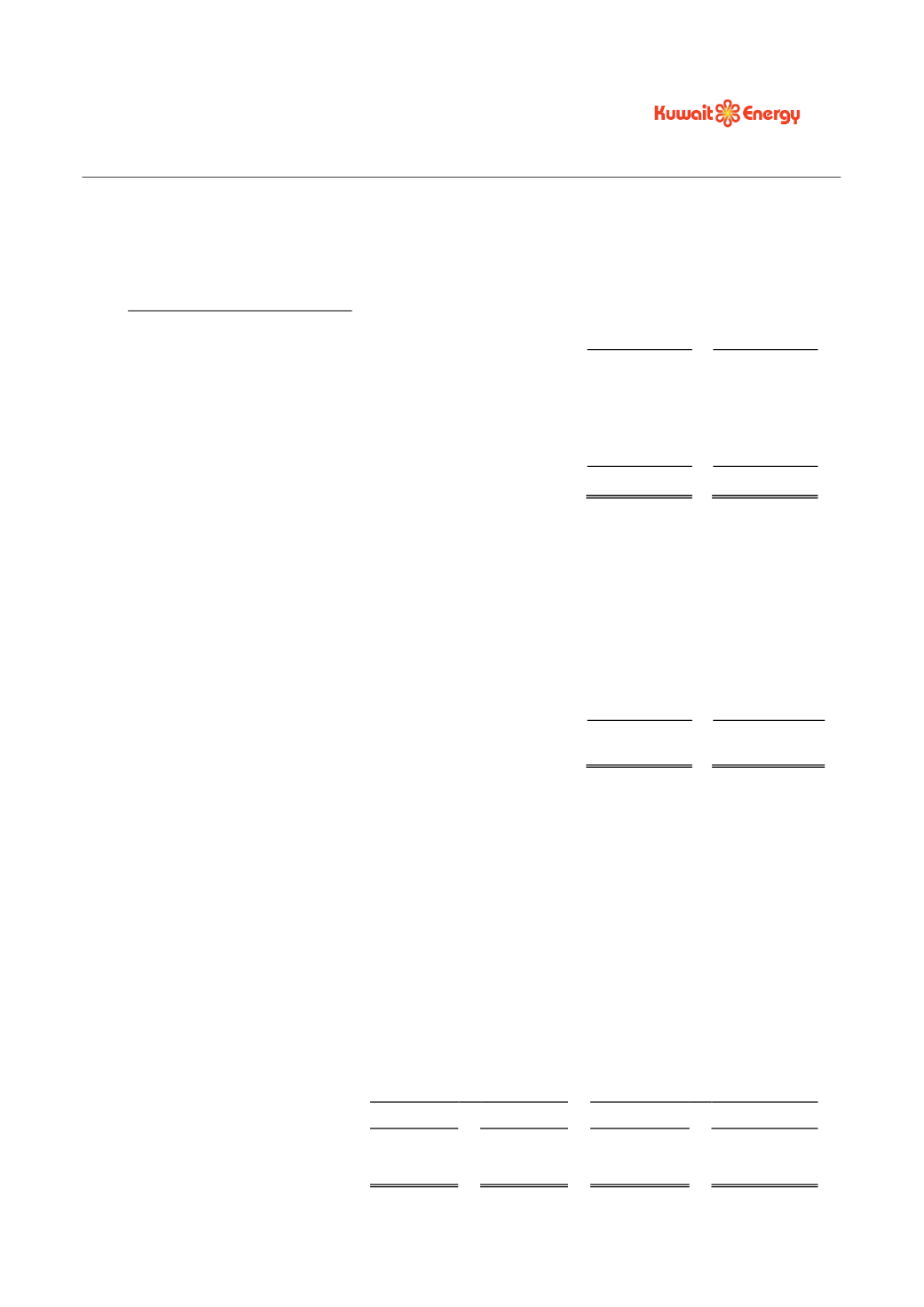

Ageing of past due but not impaired

2013

2012

USD 000’s

USD 000’s

61 – 90 days

15,858

16,982

91 – 120 days

-

26,524

121 – 180 days

-

1,707

> 180 days

73,672

80,014

Total

89,530

125,227

In determining the recoverability of a trade receivable, the Group considers any change in the credit quality of the

trade receivable from the date credit was initially granted up to the reporting date. Management believes that there

is no credit provision required as all the trade receivables are fully collectible.

The maximum exposure to credit risk at the reporting date is the carrying amount of each class of receivable

mentioned above. The directors consider that the carrying amount of trade and other receivables is approximately

equal to their fair value.

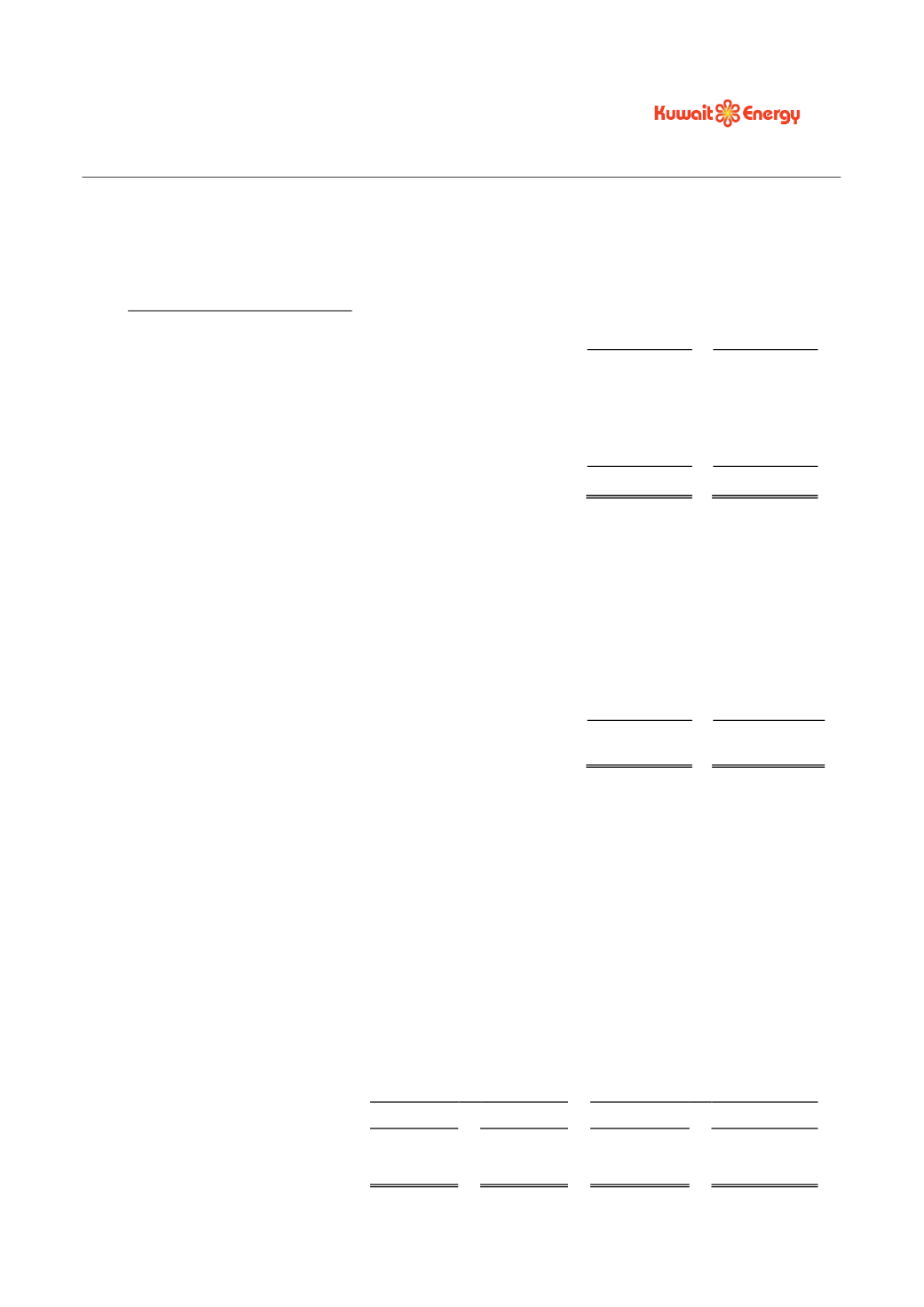

20.

CASH AND BANK BALANCES

2013

2012

USD 000’s

USD 000’s

Cash and bank balances

131,563

48,384

Bank balances amounting to USD 31,183 thousand (2011: USD 1,833 thousand) are restricted against issue of

letters of guarantee, debt service accrual account and cash retention account related to term loans. USD 936

thousand (2012: nil) is held in escrow for environmental restoration of block 5 in Yemen.

21.

SHARE CAPITAL

The authorised share capital of the Company consists of 450.7 million shares of one Pound Sterling (“Pound

Sterling”) each, amounting to Pound Sterling 450.7 million (2012: £395.9 million). The issued and paid up share

capital at the 31 December 2013 consists of 327.3 million shares (2012: 322.9 million).

On 22 July 2013 the Group issued 3.2 million shares to International Finance Corporation (IFC) in accordance

with the terms of the 2010 share subscription agreement signed with the lender. Further, the Company issued 1.2

million shares to employees as part of employee incentive scheme.

22.

LONG-TERM LOANS

Current

Non-current

2013

2012

2013

2012

USD 000’s

USD 000’s

USD 000’s

USD 000’s

Due to foreign banks

75,649

-

88,867

60,000

The details of the loans are as follows: