KUWAIT ENERGY plc GROUP

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

For the year ended 31 December 2013

F-54

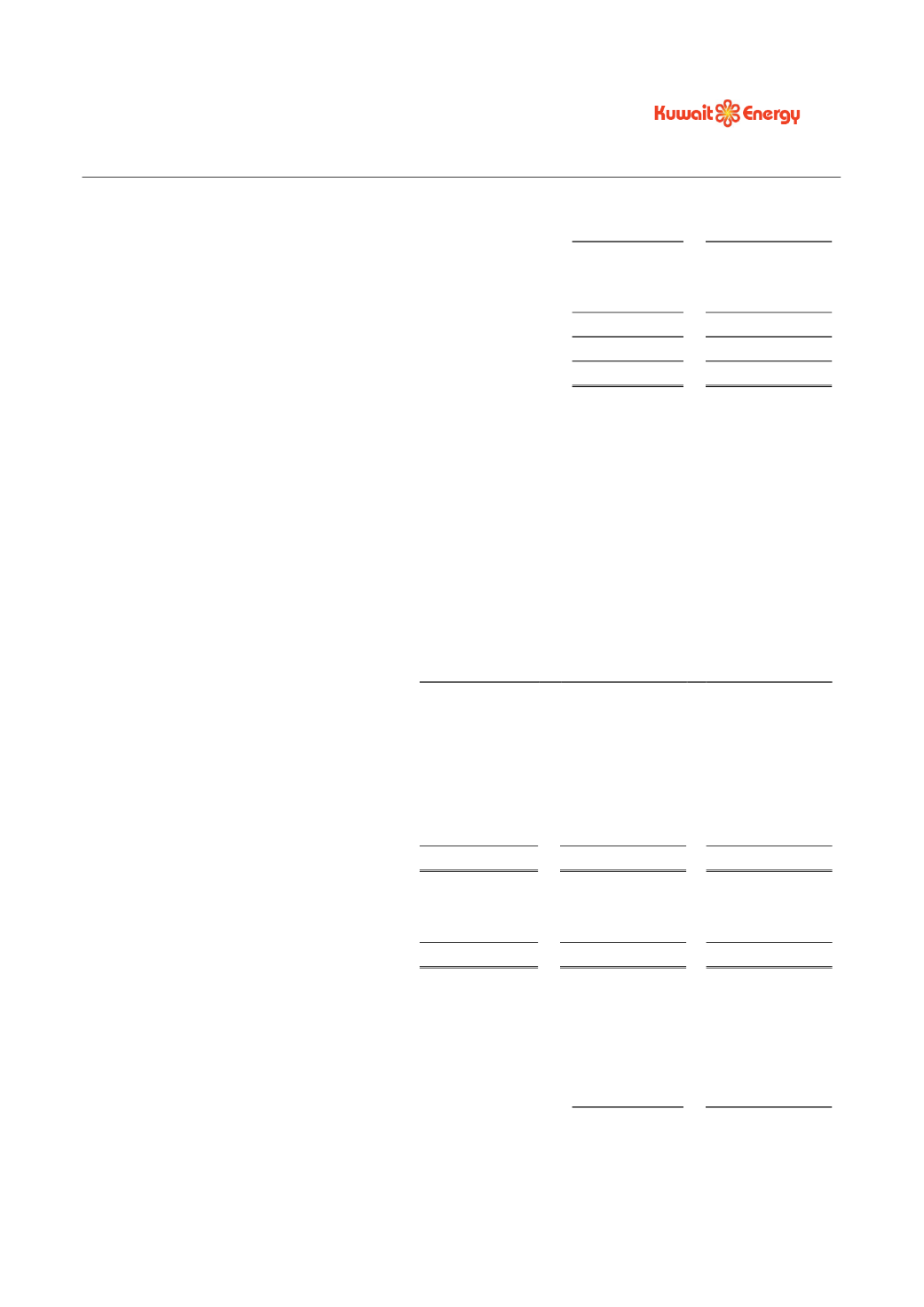

14.

DISCONTINUED OPERATIONS (Continued)

2013

2012

USD 000’s

USD 000’s

Revenue

23,363

21,684

Expenses

(307,808)

(52,832)

Loss before tax

(284,445)

(31,148)

Attributable tax gain

5,658

6,747

Loss for the year from discontinued operations

(278,787)

(24,401)

The loss for the year from discontinued operations includes an impairment charge of USD 236,940 thousand

(2012: USD 26,031 thousand) of which USD 89,031 thousand arose in Russia and USD 147,909 thousand in

Ukraine. The impairment includes a charge of USD 8,766 thousand relating to the recycling of amounts

previously recorded within the foreign currency translation reserve.

The assets and liabilities held for sale were written down to their fair value less cost to sell of USD 15,000

thousand. The fair value of assets classified as held for sale is classified as Level 3. Level 3 fair value

measurements are those derived from inputs that are not based on observable market data. This is a non-recurring

fair value arrived at by management judgement based on the non-binding offers received.

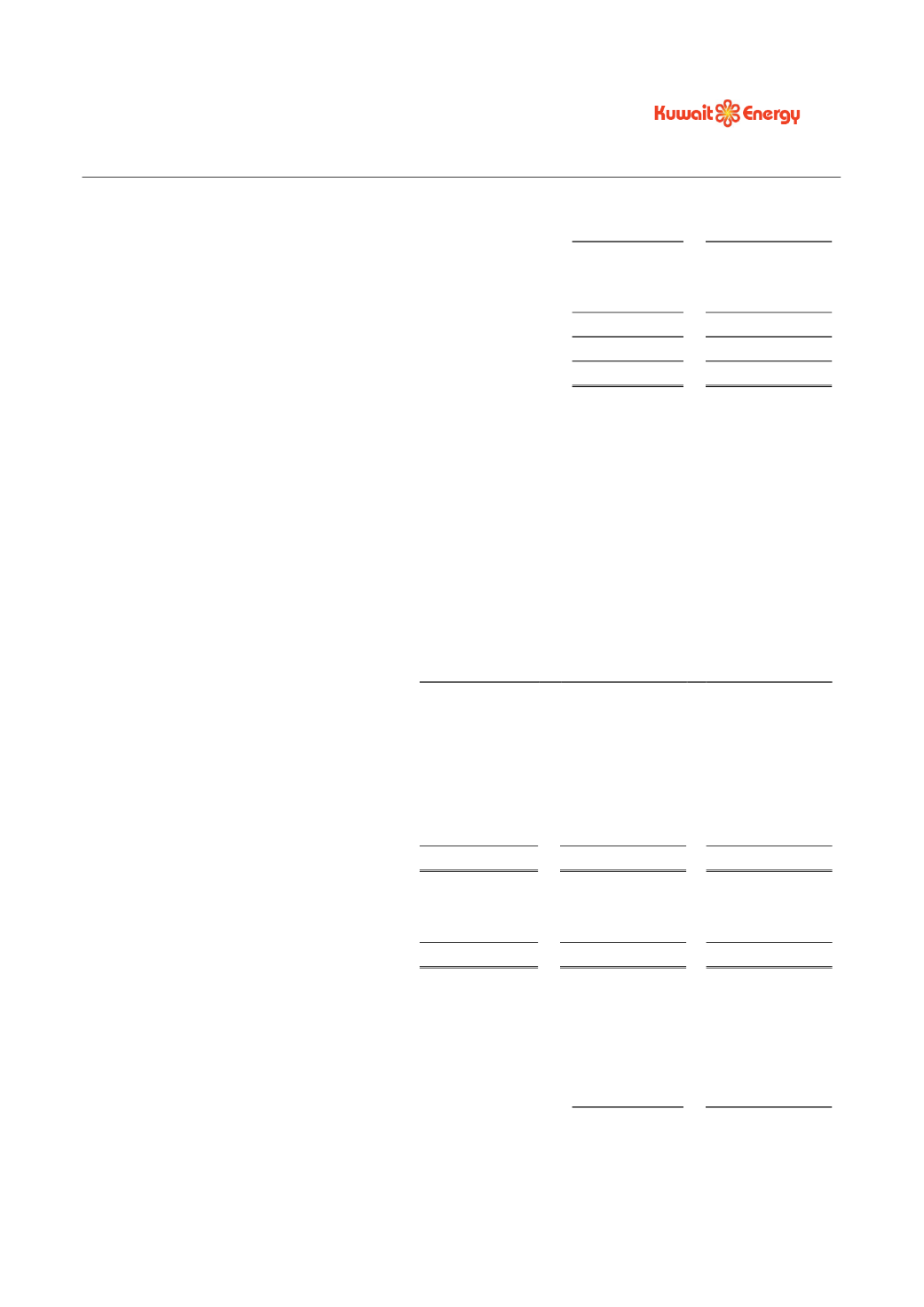

The major classes of assets and liabilities of Russia and Ukraine operations classified as held for sale are as

follows.

2013

Ukraine

Russia

Total

USD 000’s

USD 000’s

USD 000’s

Property, plant and equipment

26,185

6,051

32,236

Deferred tax assets

1,109

9,994

11,103

Inventories

385

709

1,094

Trade and other receivables

5,630

270

5,900

Cash and bank balances

151

790

941

Total assets classified as held for sale

33,460

17,814

51,274

Trade and other payables

11,021

4,590

15,611

Deferred tax liabilities

17,439

3,224

20,663

Total liabilities classified as held for sale

28,460

7,814

36,274

Net assets of operations classified as held

for sale

5,000

10,000

15,000

The cash flows associated with Russia and Ukraine operations classified as held for sale are as follows

2013

2012

USD 000’s

USD 000’s

Operating cash out flows

(2,440)

(3,634)

Investing cash out flows

(18,450)

(30,384)

Financing cash flows

-

-