KUWAIT ENERGY plc GROUP

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

For the year ended 31 December 2013

F-58

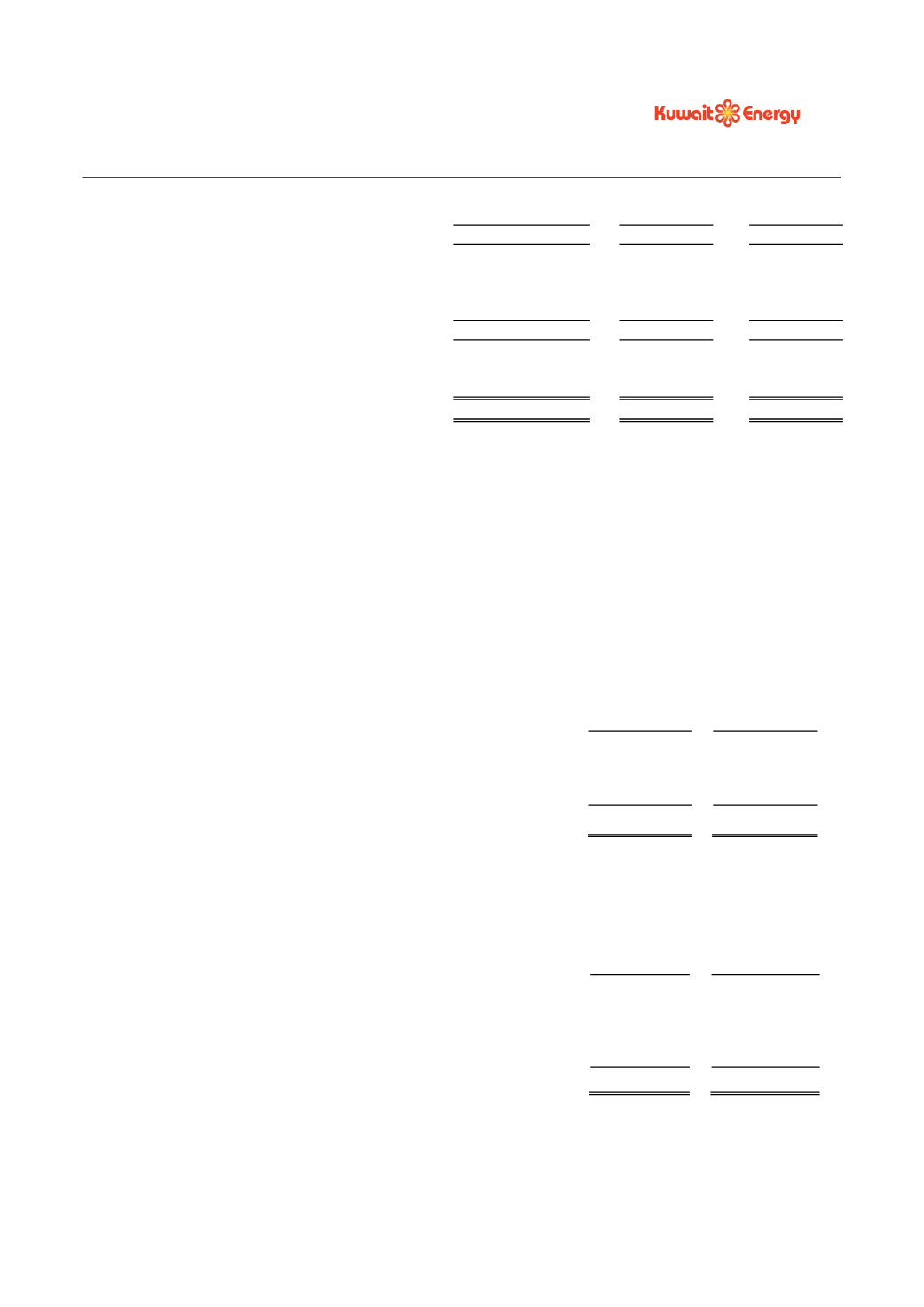

Oil and

gas assets

Other

fixed assets

Total

Disposal

(282)

(212)

(494)

As at 1 January 2013

305,857

4,774

310,631

Charge for the year

93,201

1,912

95,113

Impairment

1,801

-

1,801

On assets reclassified as held for sale (note 14)

(62,449)

-

(62,449)

As at 31 December 2013

338,410

6,686

345,096

Carrying amount

As at 31 December 2013

345,968

10,623

356,591

As at 31 December 2012

471,072

9,666

480,738

During the year the company recognised an impairment loss on the block 5 and block 43 fields in Yemen

amounting to USD 1,541 thousand and 260 thousand respectively to match the carrying value of the assets to the

recoverable value measured on a value in use basis (see note 9). The impairment loss of USD 30,862 thousand

recognised in 2012 pertains to operations classified as discontinued operations in the current year (see note 14).

The additions to oil and gas assets include USD 4,642 thousand (2012: USD 2,320 thousand) of finance costs on

qualifying assets capitalised during the year using a weighted average interest rate of 6.62% (2012: 6.62%) and

USD 3,612 thousand (2012 : USD 2,586 thousand) of fair value loss on convertible loans capitalised.

The property, plant and equipment of certain subsidiary undertakings with a net book value of USD 287,733

thousand (2012: 348,165 thousand) are under registered mortgage to secure certain bank loans (see note 22).

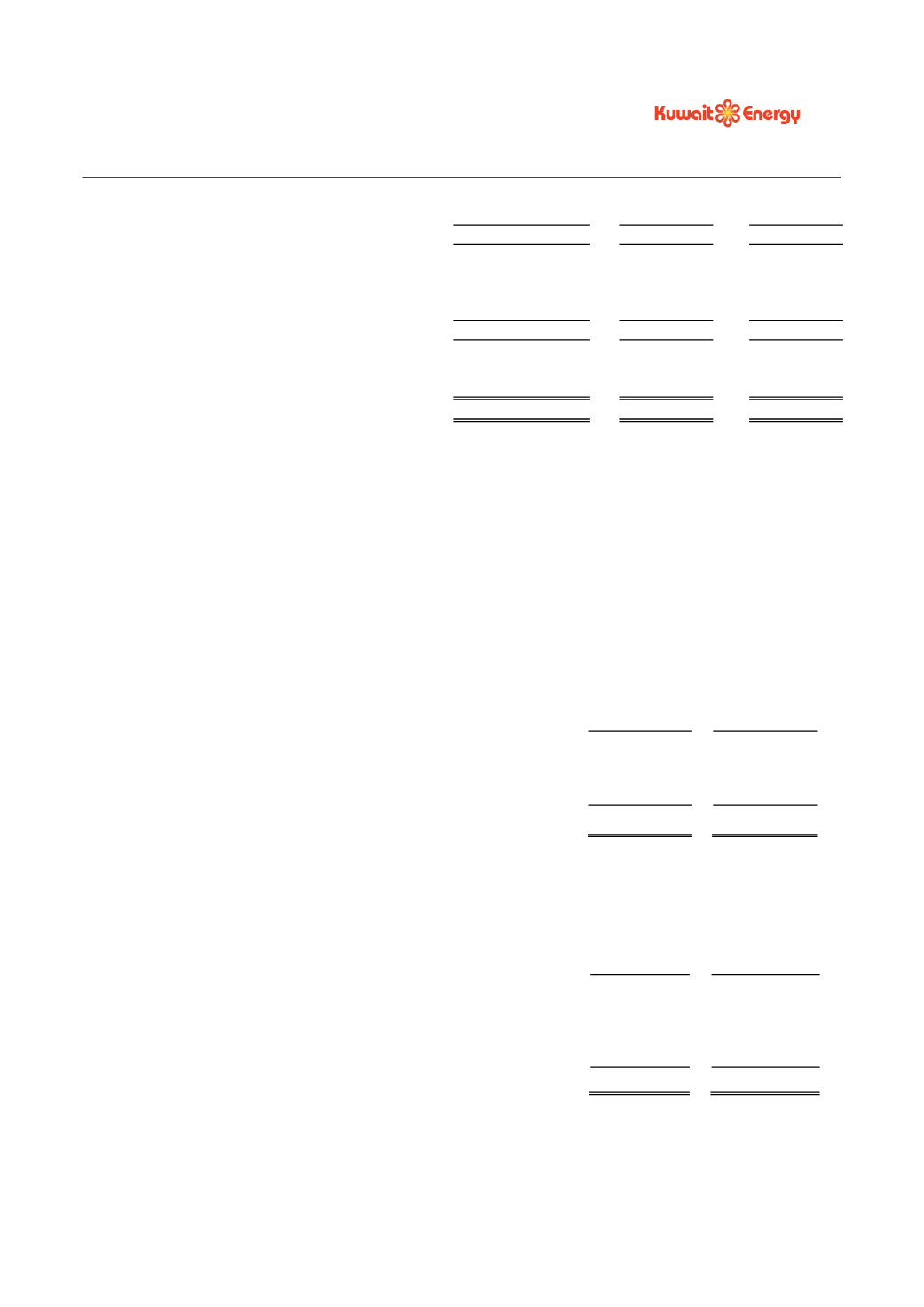

18.

INVENTORIES

2013

2012

USD 000’s

USD 000’s

Crude oil

4,656

3,060

Spare parts, materials and supplies

19,493

16,805

24,149

19,865

Crude oil is measured at net realisable value. Spare parts, materials and supplies are used in operations and are not

held for re-sale.

19.

TRADE AND OTHER RECEIVABLES

2013

2012

USD 000’s

USD 000’s

Trade receivables

127,967

169,427

Prepayments, deposits and advances

13,458

11,917

Other receivables

28,846

38,676

170,271

220,020

Other receivables include amounts owed by joint venture partners.

The average credit period on sales is 60 days. No interest is charged on the overdue trade receivables.

Included in the Group’s trade receivables balance are debtors with a carrying amount of USD 89,530 thousand