KUWAIT ENERGY plc GROUP

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

For the year ended 31 December 2013

F-50

Depreciation of other fixed assets

1,912

1,888

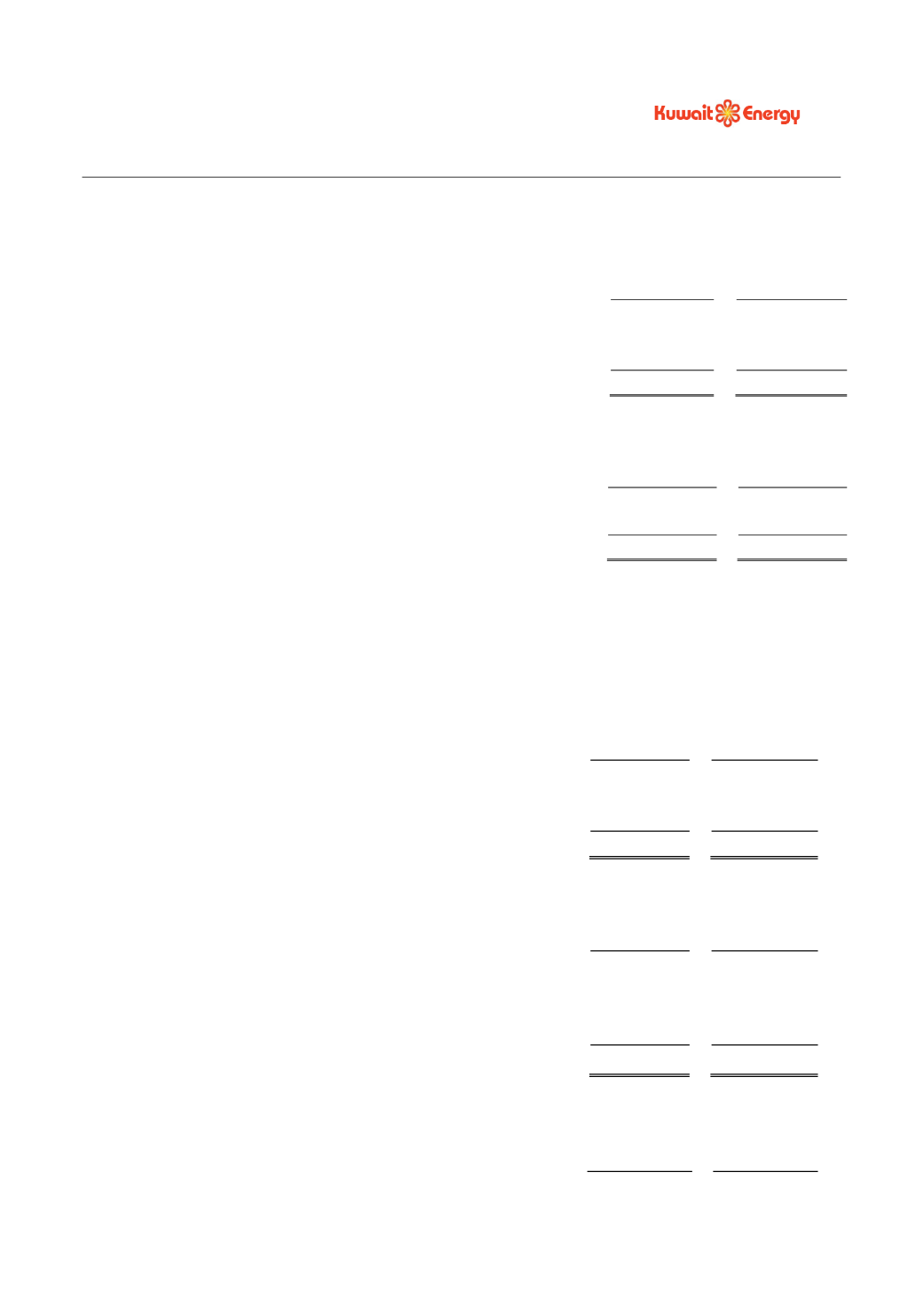

8.

COST OF SALES

2013

(Restated)

2012

USD 000’s

USD 000’s

Operating costs

61,783

35,738

Depletion of oil and gas assets

93,201

60,973

154,984

96,711

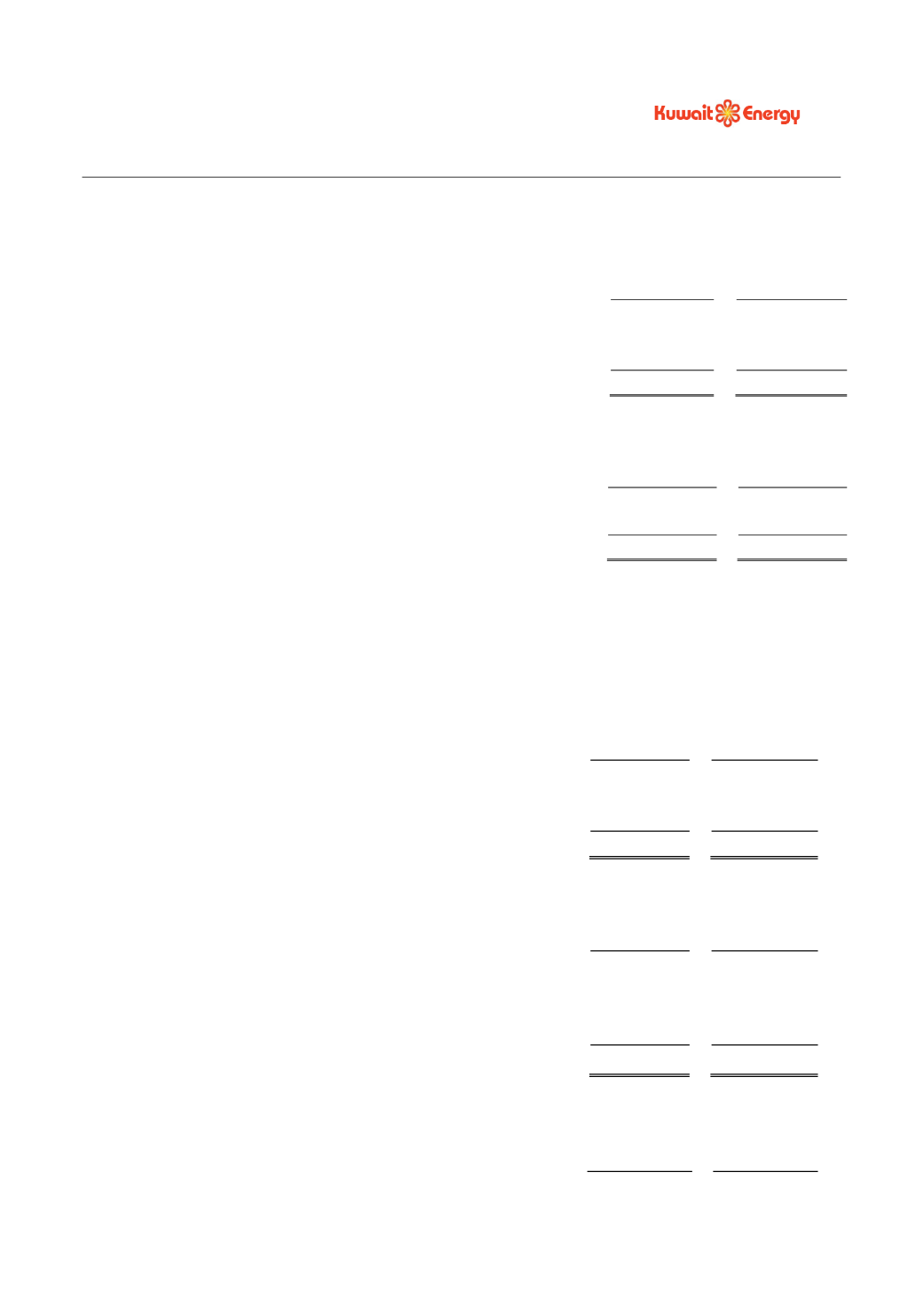

9.

NET IMPAIRMENT LOSS

2013

(Restated)

2012

USD 000’s

USD 000’s

Impairment charge / (reversal)

1,801

(540)

1,801

(540)

During the year the company recognised an impairment loss on the block 5 and block 43 fields in Yemen

amounting to USD 1,541 thousand and 260 thousand respectively to match the carrying value of the assets to the

recoverable value measured on a value in use basis. During the previous year the company reversed an

impairment of USD 540 thousand earlier recognised on the Karim Small fields in Oman due to an increase in

commercial reserves. The pre-tax discount rate used in this calculation was 10% (2012: 10%).

10.

OTHER INCOME

2013

(Restated)

2012

USD 000’s

USD 000’s

Interest income

527

138

Others

72

85

599

223

11.

FINANCE COSTS

2013

(Restated)

2012

USD 000’s

USD 000’s

Unwinding of decommissioning provision

158

121

Borrowing costs on bank overdrafts and loans

14,552

3,356

Less: amount capitalised in cost of qualifying assets

(4,642)

(2,320)

10,068

1,157

12.

TAXATION

INCOME TAX EXPENSE

(Restated)

2013

2012

Tax on profit on ordinary activities

USD 000’s

USD 000’s

Current tax: