KUWAIT ENERGY plc GROUP

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

For the year ended 31 December 2013

F-57

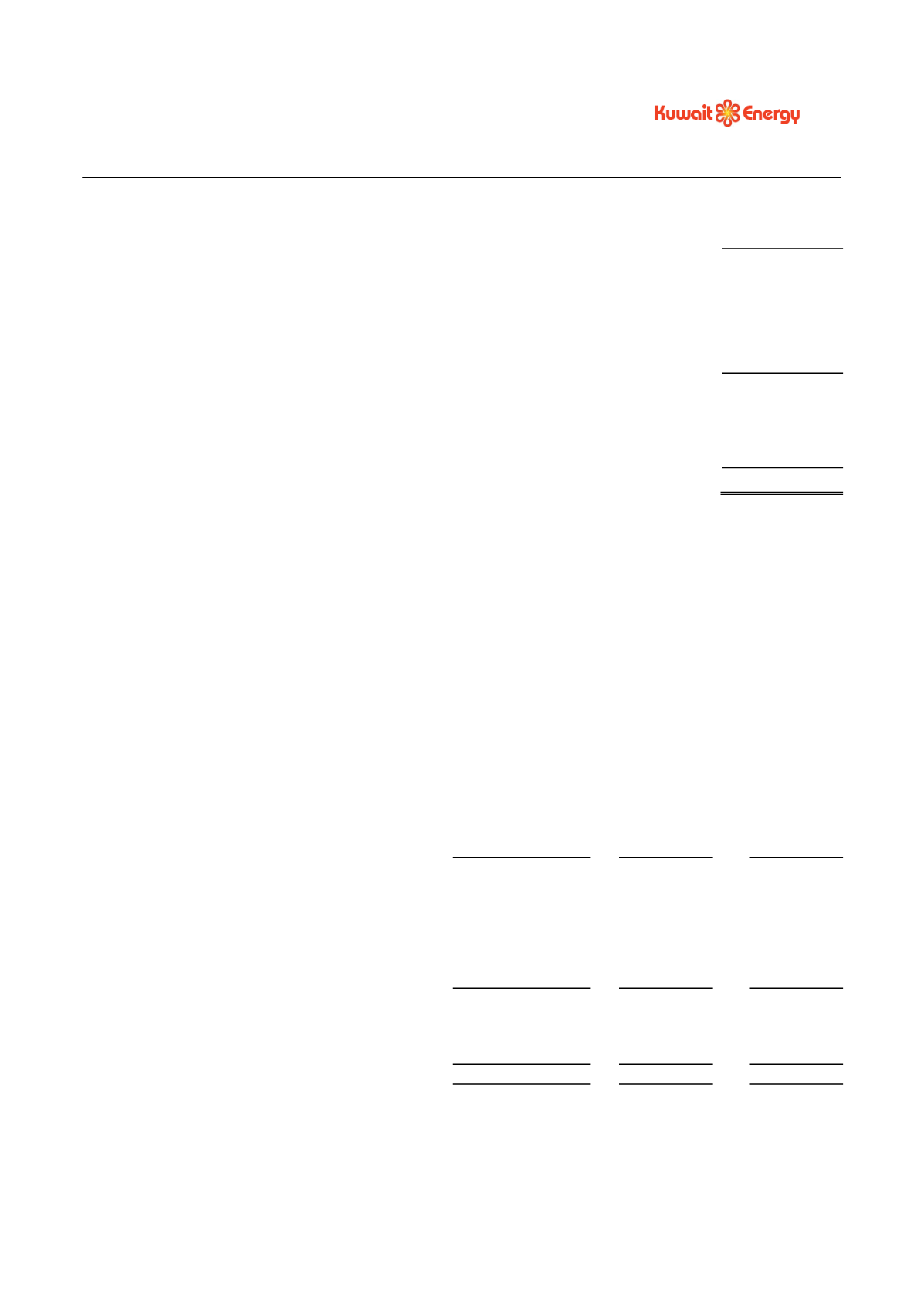

16.

INTANGIBLE EXPLORATION AND EVALUATION (‘E&E’) ASSETS

E&E assets

USD 000’s

Cost

As at 1 January 2012

149,201

Additions

37,447

Exploration expenditure written off

(3,680)

As at 31 December 2012

182,968

Additions

78,928

Exploration expenditure written off in relation to discontinued operations (see note 14)

(18,622)

Other exploration expenditure written off

(47,822)

As at 31 December 2013

195,452

As at 31 December 2013, exploration costs of USD 195,452 thousand (2012: USD 182,968) thousand were not

amortised, pending further evaluation of whether or not the related oil and gas properties are commercially viable.

Of the total amount held on the Balance Sheet, USD 46,866 thousand (December 2012: 41,771 thousand) relates

to unsuccessful exploration expenditure that is supported by the estimated value of the residual exploration assets

in the relevant cost pool.

Exploration expenditure written off of USD 47,822 thousand includes USD 29,181 thousand relating to Licence 1

in Latvia where, due to unsuccessful exploration well results, the Group has decided to exit the country. Further

the Company has written off exploration expenditure amounting to USD 1,750 thousand related to block 83 in

Yemen, USD 15,796 thousand in Pakistan Jherruk and Kunri fields and USD 1,095 thousand in Somalia due to

unsuccessful exploration results. Exploration expenditure written off during the previous year of USD 3,680

thousand was related to block 74 in Yemen where the license was surrendered. With the exception of Yemen, all

these write offs have been reported within the “other” segment in note 5.

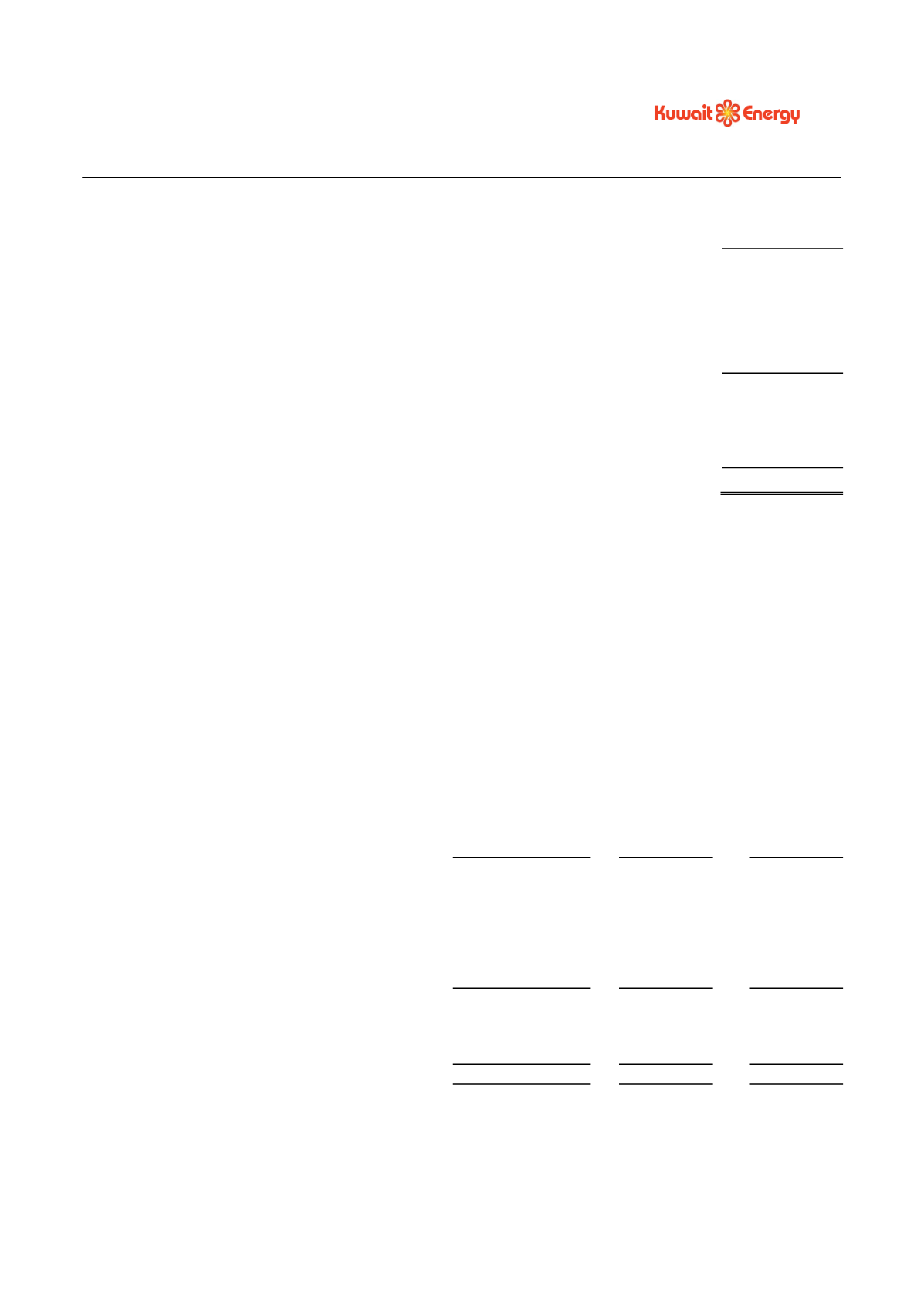

17.

PROPERTY PLANT AND EQUIPMENT

Oil and

gas assets

Other

fixed assets

Total

USD 000’s

USD 000’s USD 000’s

Cost

As at 1 January 2012

693,164

11,195

704,359

Additions

78,614

3,756

82,370

Write-back of asset

5,374

-

5,374

Impairment reversal

540

-

540

Disposal

(763)

(511)

(1,274)

As at 1 January 2013

776,929

14,440

791,369

Additions

109,152

2,869

112,021

Acquisition of subsidiary (note 15)

129,922

-

129,922

Reclassified as held for sale (note 14)

(331,625)

-

(331,625)

As at 31 December 2013

684,378

17,309

701,687

Accumulated Depreciation, depletion, amortisation and impairment

As at 1 January 2012

208,134

3,098

211,232

Charge for the year

65,835

1,888

67,723

Impairment

30,862

-

30,862

Write-back of asset

1,308

-

1,308