KUWAIT ENERGY plc GROUP

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

Three months ended 31 March 2014

F-18

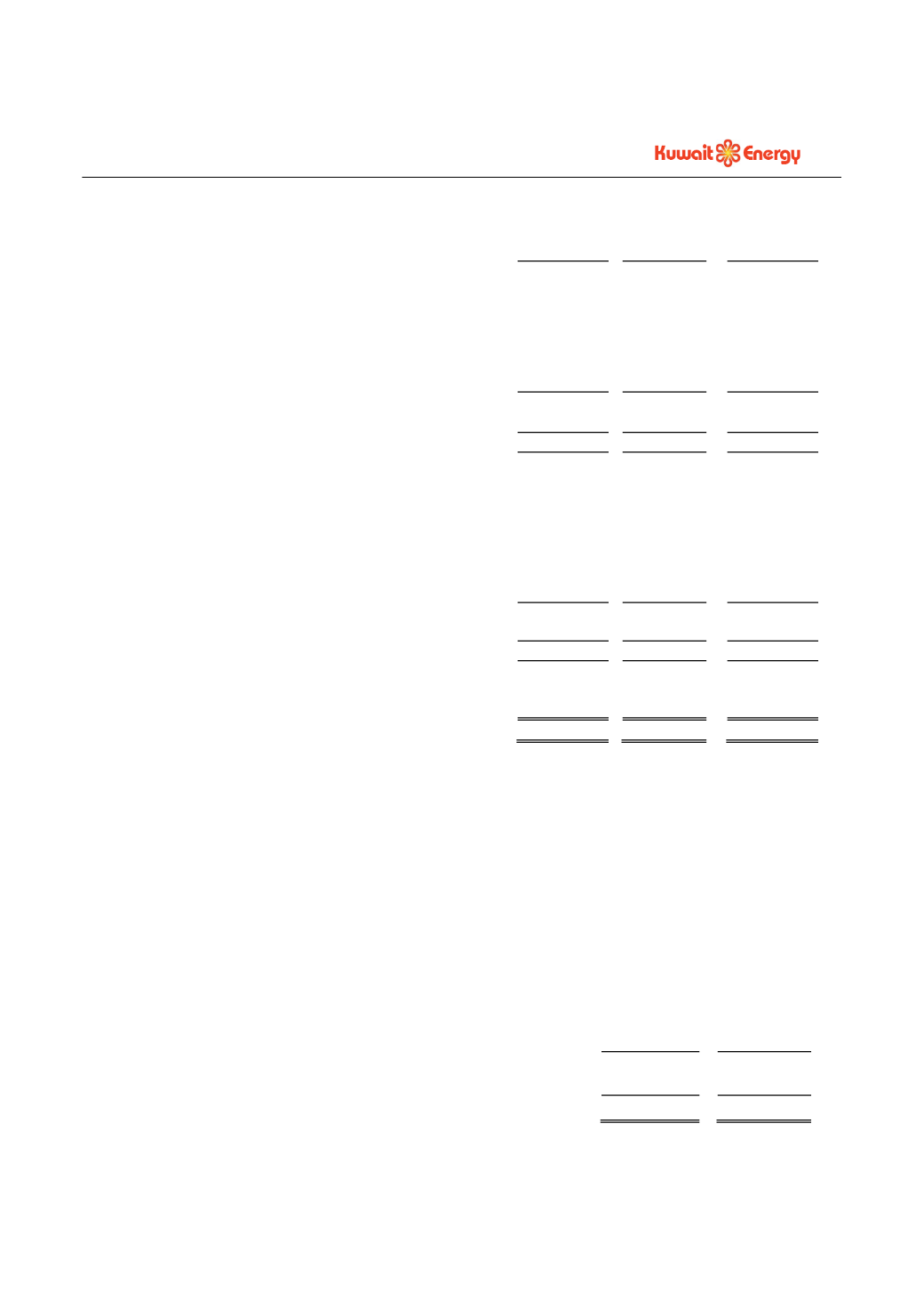

8.

PROPERTY PLANT AND EQUIPMENT

Oil and

gas assets

Other

fixed assets

Total

USD 000’s USD 000’s USD 000’s

Cost

(Restated)

As at 1 January 2013

776,929

14,440

791,369

Additions

109,152

2,869

112,021

Acquisition of subsidiary

129,922

-

129,922

Reclassified as held for sale

(331,625)

-

(331,625)

Reclassified to investment in joint venture (see note 9)

(91,809)

-

(91,809)

As at 31 December 2013

592,569

17,309

609,878

Additions

29,943

1,726

31,669

As at 31 March 2014

622,512

19,035

641,547

Depreciation, depletion, amortisation and impairment

losses

As at 1 January 2013

305,857

4,774

310,631

Charge for the period

93,201

1,912

95,113

Impairment

1,801

-

1,801

On assets reclassified as held for sale

(62,449)

-

(62,449)

Reclassified to investment in joint venture (see note 9)

(86,694)

-

(86,694)

As at 31 December 2013

251,716

6,686

258,402

Charge for the period

20,898

399

21,297

As at 31 March 2014

272,614

7,085

279,699

Carrying amount

As at 31 March 2014

349,898

11,950

361,848

As at 31 December 2013

340,853

10,623

351,476

The additions to oil and gas assets include USD 1,935 thousand (31 December 2013: USD 4,642 thousand) of

finance costs on qualifying assets capitalised during the period using a weighted average interest rate of 6.02%.

(31 December 2013: 6.62%)

The property, plant and equipment of certain subsidiary undertakings with a net book value of USD 277,016

thousand (31 December 2013: USD 287,733 thousand) are under registered mortgage to secure certain bank loans

(see note 12).

At 31 March 2014, the Group had committed capital expenditure of USD 114,677 thousand (31 December 2013:

USD 116,400 thousand)

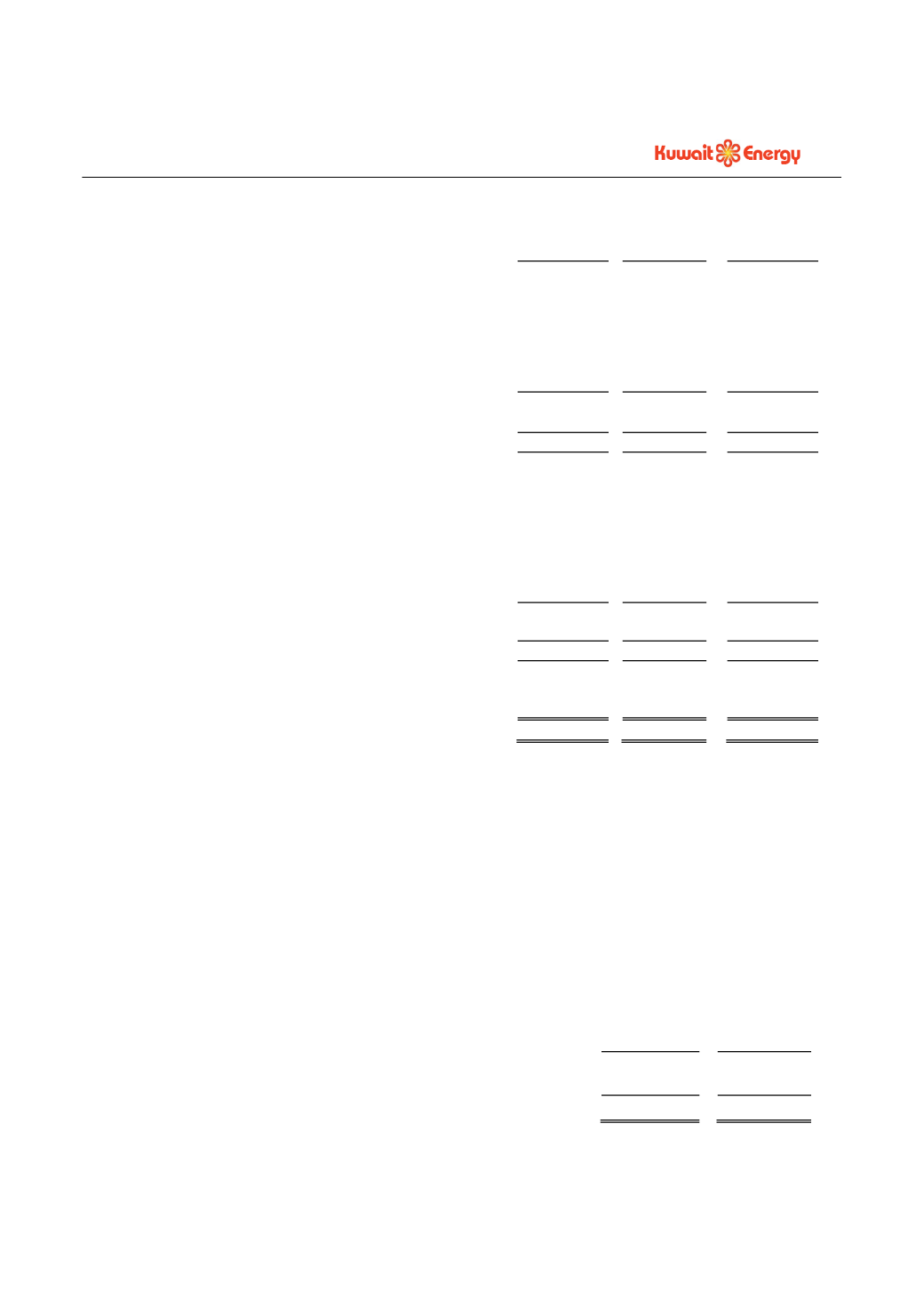

9.

INVESTMENT IN JOINT VENTURE

31.03.14

Unaudited

31.12.13

Audited

(Restated)

USD 000’s

USD 000’s

Investment in Medco LLC Oman

11,673

10,598

11,673

10,598

Investment in joint venture represents the 20% share in Medco LLC Oman. The Group has adopted IFRS 11 in

2014 and as a result the net carrying value of the joint venture is shown separately in the balance sheet. During the

period the Group recognised an income of USD 1,075 thousand (3 months to 31 March 2013: USD 386 thousand)

as its share in the results of the joint venture.