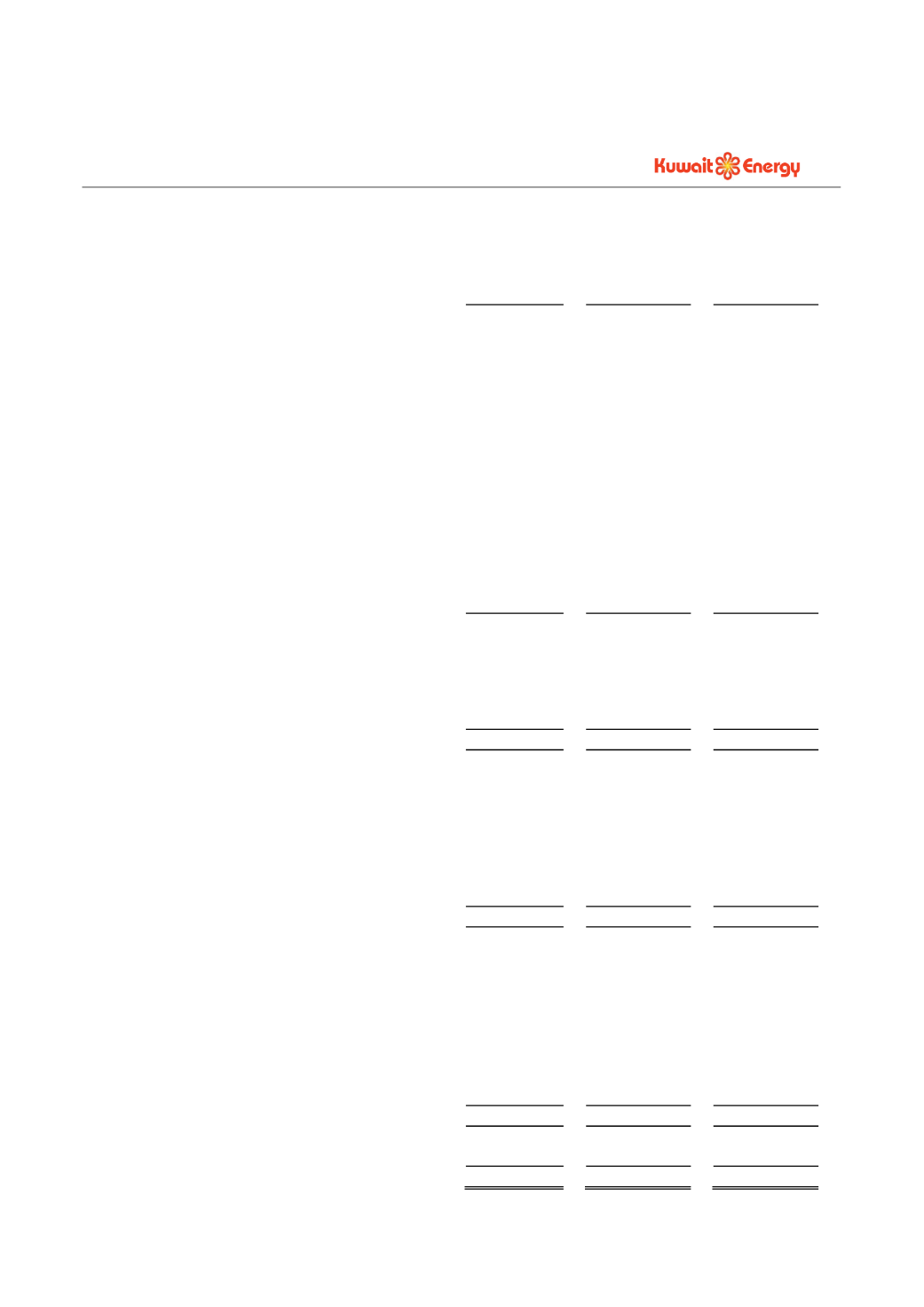

KUWAIT ENERGY plc GROUP

CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS

Three months ended 31 March 2014

F-9

3 Months

ended

31.03.14

Unaudited

3 Months

ended

31.03.13

Unaudited

Year ended

31.12.13

Audited

(Restated)

USD 000’s

USD 000’s

USD 000’s

operating activities

Profit/(loss) for the period

18,888

9,079

(258,630)

Adjustments for:

Share in results of joint venture

(1,075)

(386)

(1,543)

Depreciation, depletion and amortisation

21,296

20,548

82,657

Exploration expenditure written off

-

-

47,822

Impairment losses

-

-

1,801

Impairment charge on discontinued operations

500

-

236,940

Other non-cash items included in discontinued

operations

-

(1,033)

50,669

Tax charge

2,100

2,032

8,097

Gain on held for trading derivative

(81)

(79)

(322)

Fair value loss on convertible loan

3,016

2,899

12,071

Net finance costs

1,236

2,359

9,541

Provision for retirement benefit obligation

1,926

496

826

Operating cash flow before movement in working

capital

47,806

35,915

189,929

(Increase) / decrease in trade and other receivables

(24,342)

28,122

36,400

Increase in trade and other payables

10,134

18,611

17,905

Decrease in inventories oil & gas

1,431

6,995

3,024

Tax paid

-

-

(7,496)

Net cash generated by operating activities

35,029

89,643

239,762

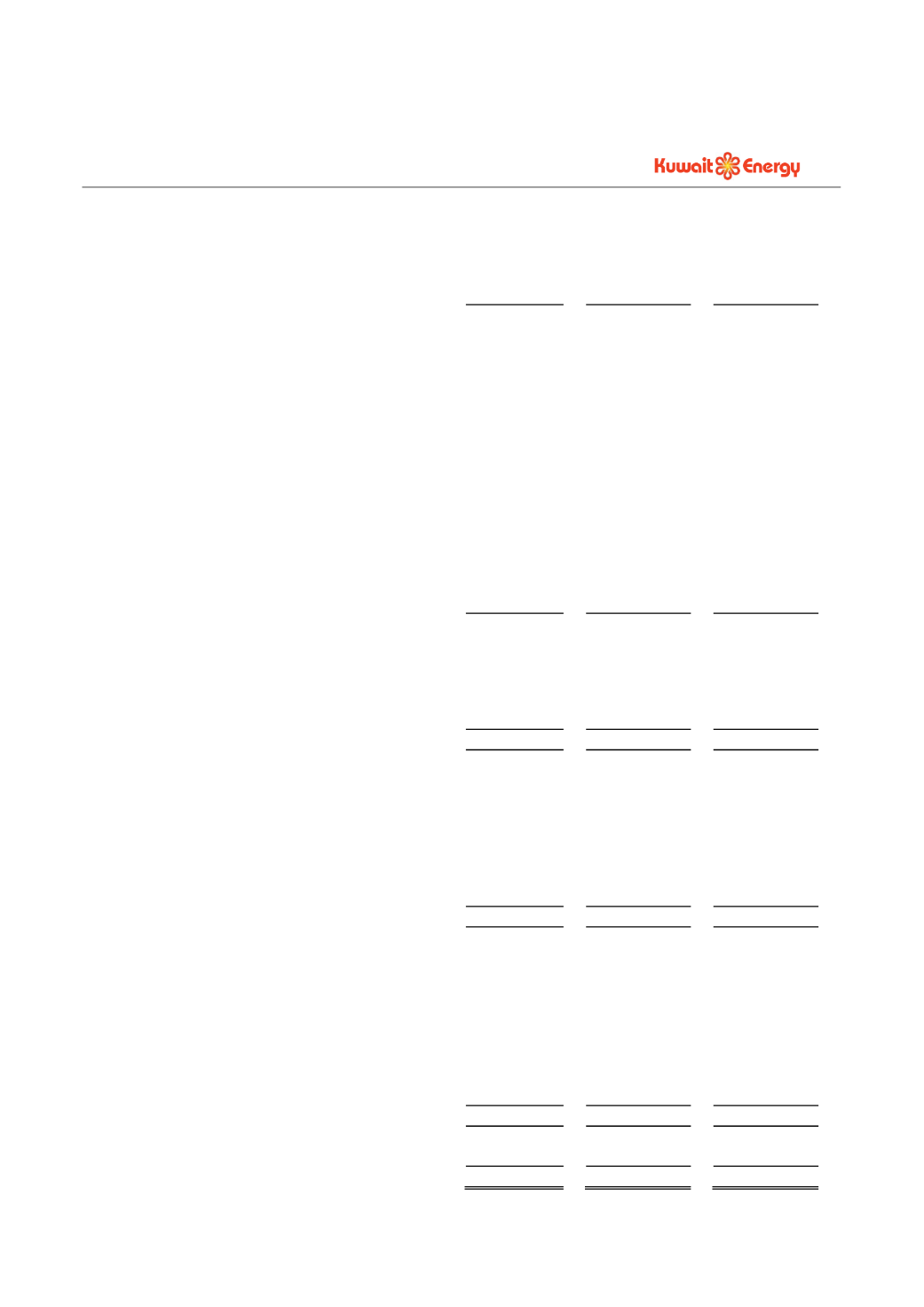

investing activities

Purchase of intangible exploration and evaluation assets

(8,306)

(39,930)

(78,358)

Purchase of property, plant and equipment

(25,656)

(23,253)

(83,712)

Acquisition of subsidiary, net of cash acquired

-

(102,414)

(102,414)

(Increase) / decrease in producing inventory stores

(430)

(2,753)

790

Purchase of other fixed assets

(1,726)

(658)

(2,869)

Interest received

115

80

527

Net cash used in investing activities

(36,003)

(168,928)

(266,036)

financing activities

Proceeds from short term loans

-

25,000

40,000

Repayment of short term loans

-

-

(40,000)

Proceeds from long term loans

15,019

50,000

110,000

Repayment of long term loans

(20,649)

-

(5,484)

Convertible loan received

-

17,000

17,000

Dividend paid

-

(217)

(6)

Finance costs paid

(3,690)

(2,446)

(14,408)

Net cash (used in)/generated by financing activities

(9,320)

89,337

107,102

Net (decrease)/increase in cash and bank balances

(10,294)

10,052

80,828

Cash and bank balances at beginning of the period

127,594

46,766

46,766

Cash and bank balances at end of the period

117,300

56,818

127,594