KUWAIT ENERGY plc GROUP

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

Three months ended 31 March 2014

F-13

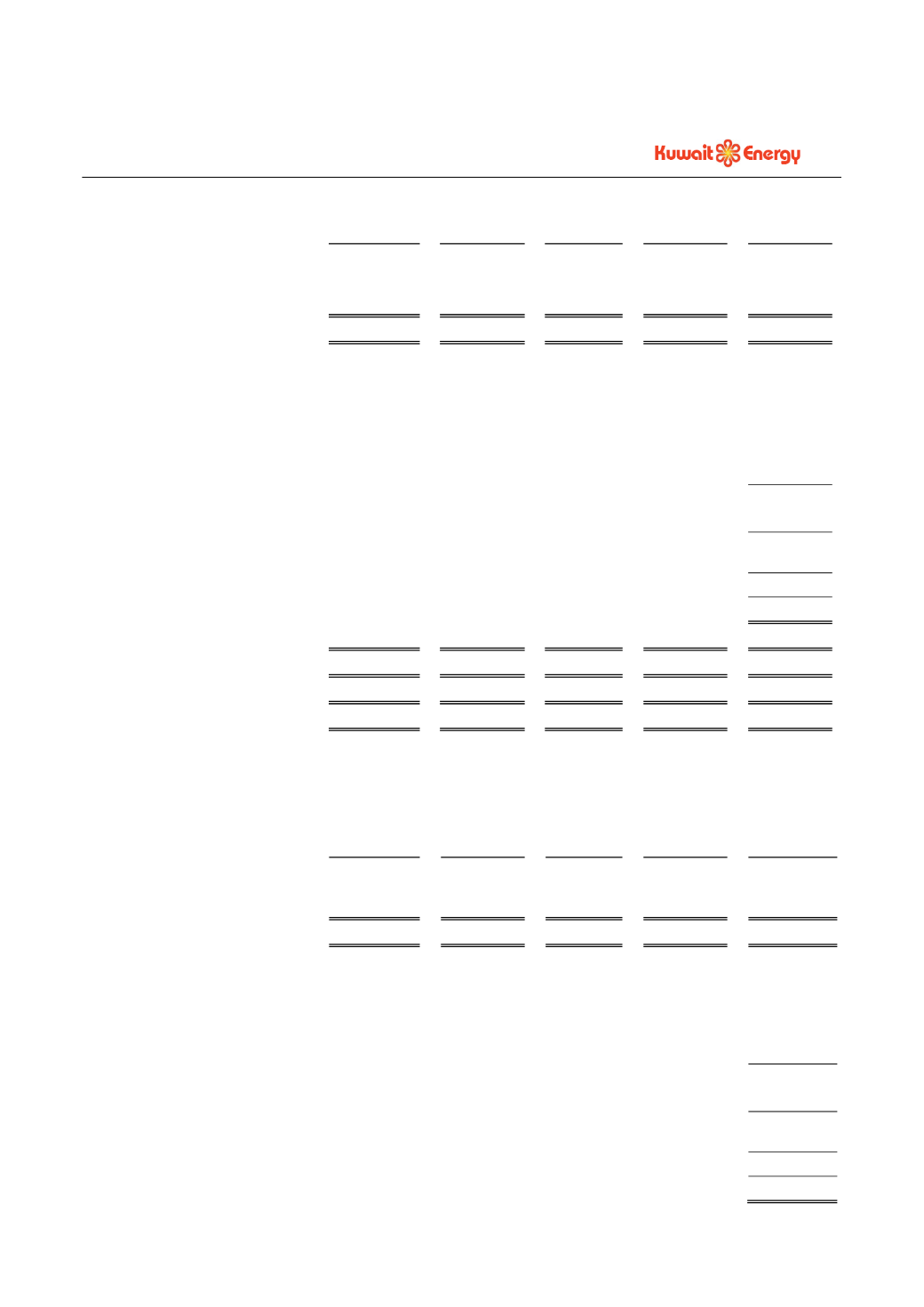

3.

SEGMENTAL INFORMATION (CONTINUED)

Egypt

Yemen

Iraq

Others

Total

31 March 2014

USD 000’s USD 000’s USD 000’s USD 000’s USD 000’s

Segment revenues

51,592

15,729

-

-

67,321

Segment results

29,220

1,319

-

(5,074)

25,465

Share in results of joint venture

-

-

-

1,075

1,075

Gain on held for trading derivative

81

Fair value loss on convertible loans

(3,016)

Other income

142

Foreign exchange loss

(8)

Finance costs

(1,351)

Profit before tax

22,388

Taxation

(2,100)

Profit for the period from

continuing operations

20,288

Loss from discontinued operations

(1,400)

Profit for the period

18,888

Segment assets

505,597

180,390

116,071

130,092

932,150

E&E assets

125,008

50,272

28,802

-

204,082

PP&E

186,873

100,353

71,053

3,569

361,848

Segment liabilities

57,714

17,387

30,493

294,511

400,105

Other information

Additions to E&E

5,913

1,243

1,474

-

8,630

Additions to PP&E

11,663

4,651

13,628

1,727

31,669

Depreciation, Depletion and

Amortisation

13,032

7,922

-

342

21,296

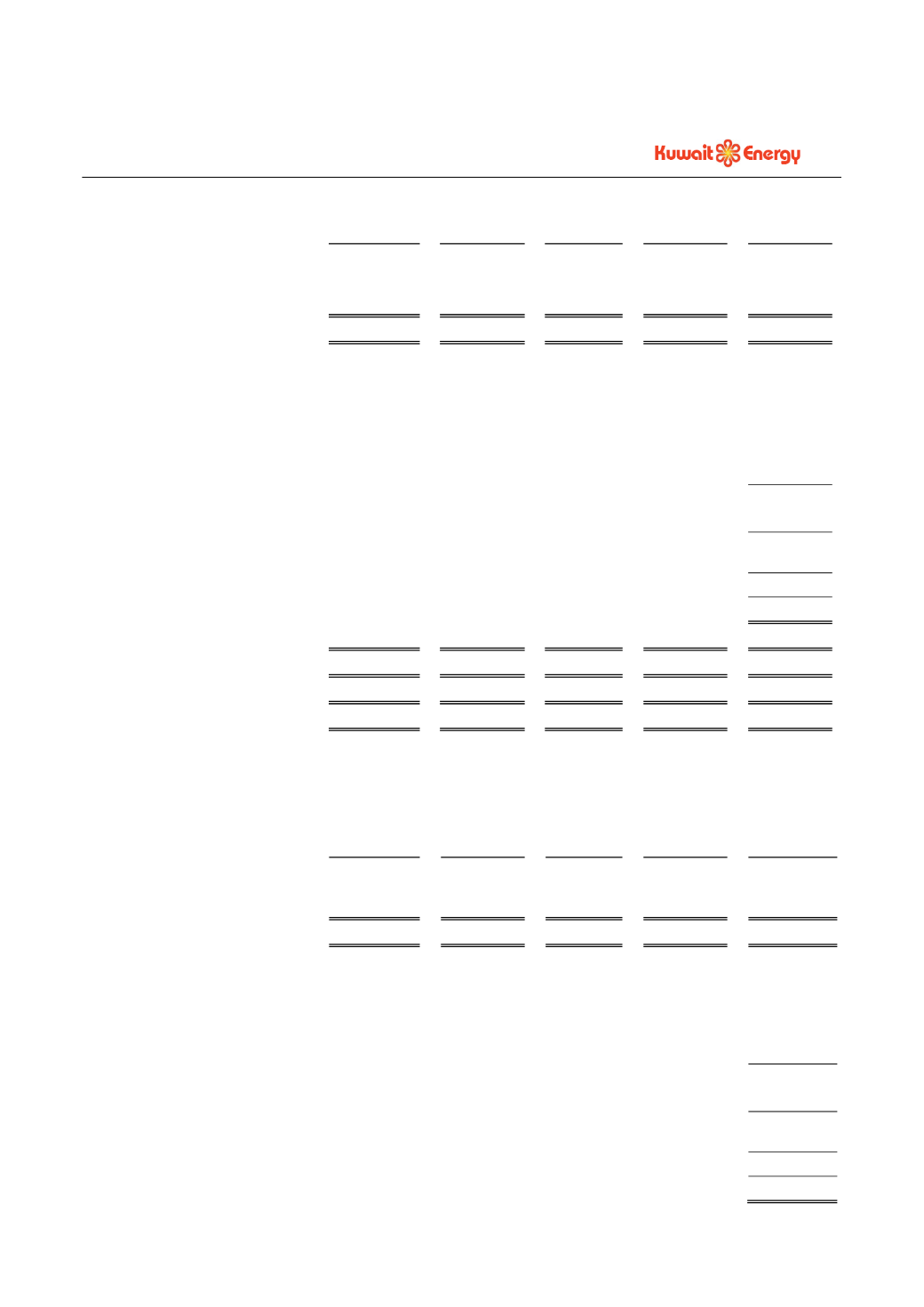

Egypt

Yemen

Iraq

Others

Total

31 March 2013

USD 000’s USD 000’s USD 000’s USD 000’s USD 000’s

(Restated)

Segment revenues

39,931

16,801

-

-

56,732

Segment results

21,449

1,518

-

(4,386)

18,581

Share in result of joint venture

-

-

-

386

386

Gain on held for trading derivative

78

Fair value loss on convertible loans

(2,899)

Other income

80

Finance costs

(2,446)

Profit before tax

13,780

Taxation

(2,032)

Profit for the period from

continuing operations

11,748

Loss from discontinued operations

(2,669)

Profit for the period

9,079