KUWAIT ENERGY plc GROUP

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

Three months ended 31 March 2014

F-14

3.

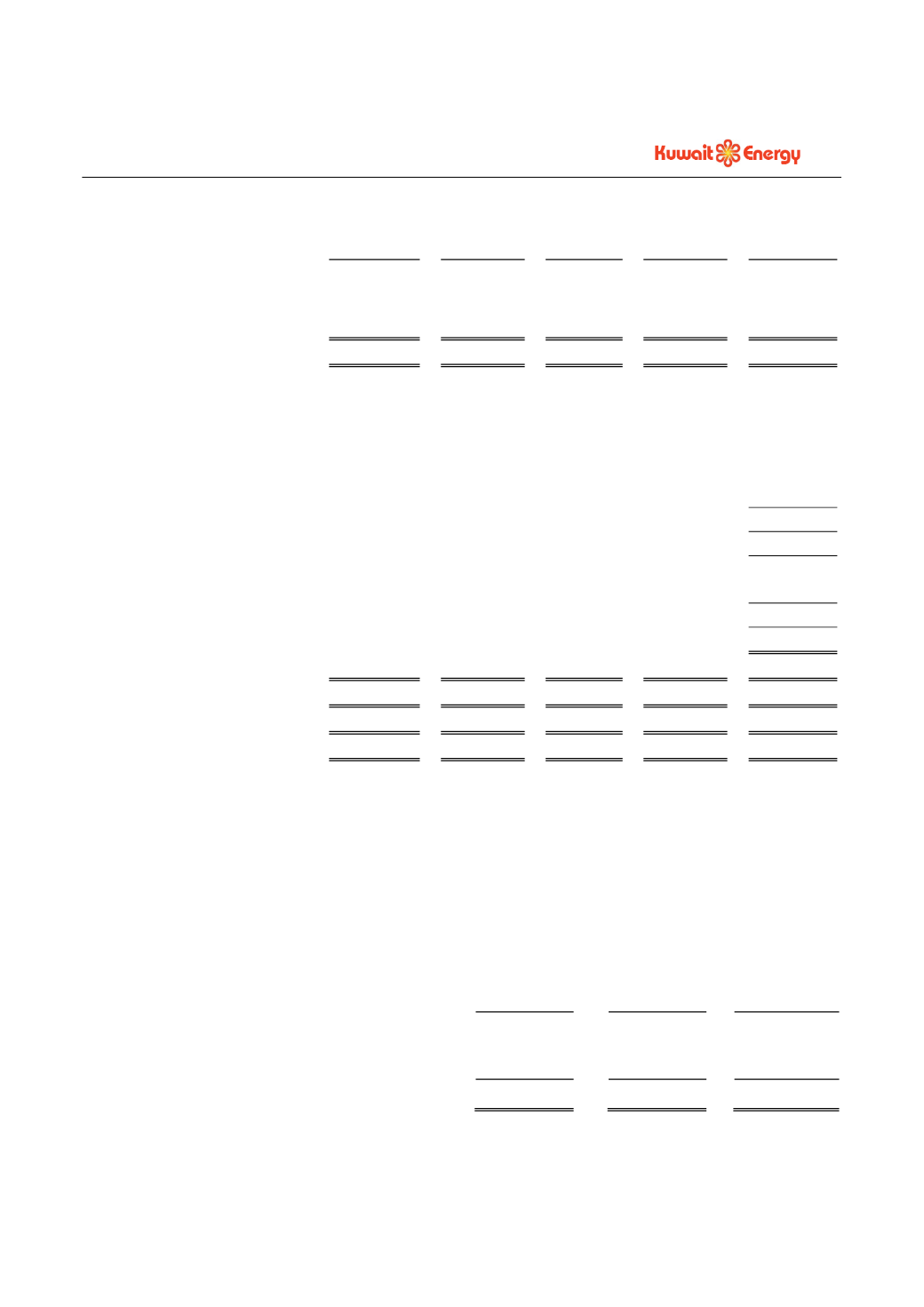

SEGMENTAL INFORMATION (CONTINUED)

Egypt

Yemen

Iraq

Others

Total

USD 000’s USD 000’s USD 000’s USD 000’s USD 000’s

(Restated)

31 December 2013

Segment revenues

193,487

69,007

-

-

262,494

Segment results

112,658

4,048

(146)

(64,869)

51,691

Share of results of joint venture

-

-

-

1,543

1,543

Gain on held for trading derivative

322

Fair value loss on convertible loans

(12,071)

Other income

599

Foreign exchange loss

(3,762)

Finance costs

(10,068)

Profit before tax

28,254

Taxation

(8,097)

Profit for the year from continuing

operations

20,157

Loss from discontinued operations

(278,787)

Loss for the year

(258,630)

Segment assets

480,790

179,827

94,494

175,740

930,851

E&E assets

119,094

49,029

27,329

-

195,452

PP&E

186,537

103,624

57,411

3,904

351,476

Segment liabilities

45,770

13,523

30,183

331,382

420,858

Other information

Additions to E&E

18,297

9,584

27,329

23,718

78,928

Additions to PP&E

39,969

5,822

33,704

32,526

112,021

Depreciation, Depletion and

Amortisation

46,689

34,353

-

1,615

82,657

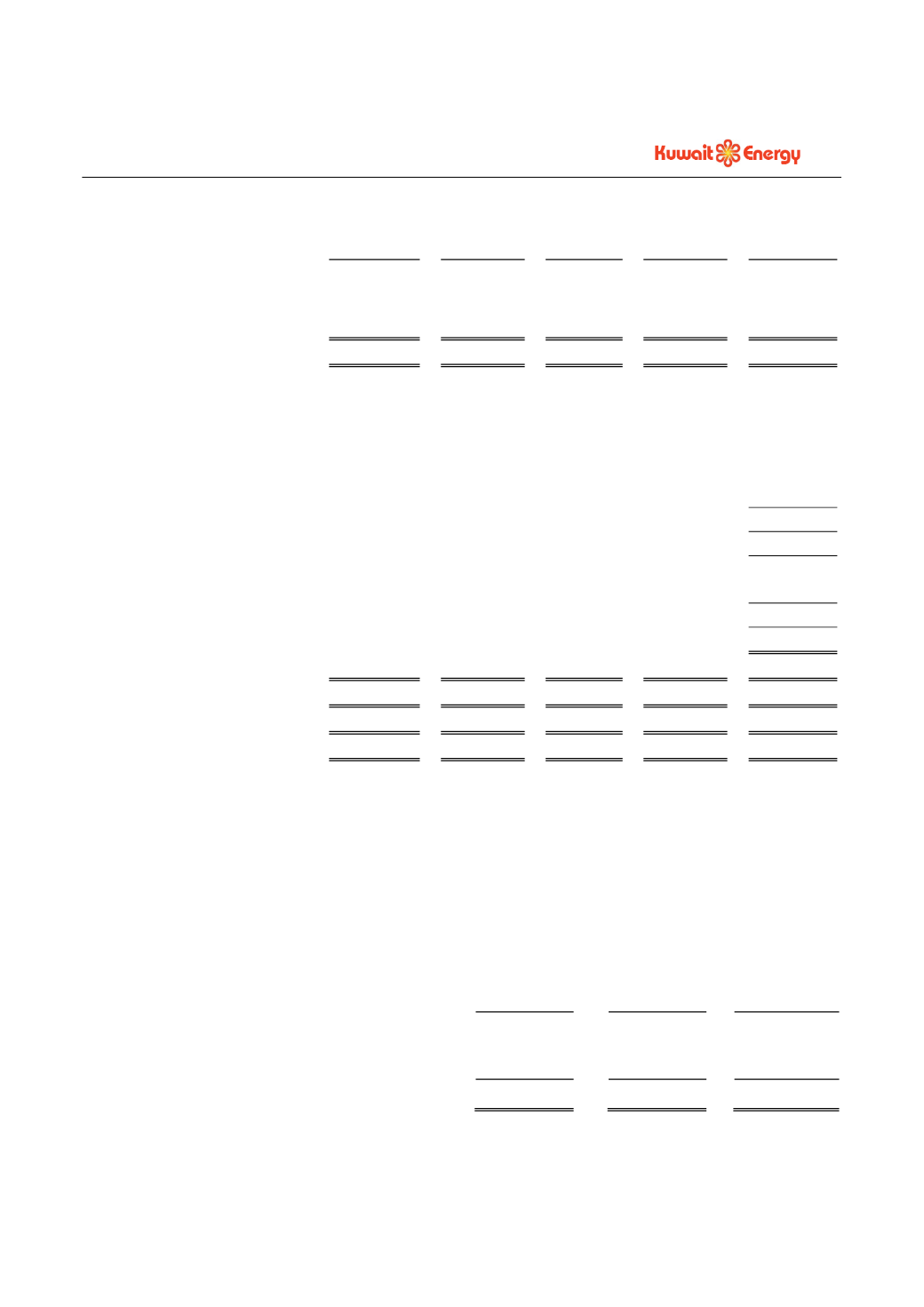

4.

INCOME TAX EXPENSE

3 Months

ended

31.03.14

Unaudited

3 Months

ended

31.03.13

Unaudited

Year ended

31.12.13

Audited

(Restated)

Tax on profit on ordinary activities

USD 000’s

USD 000’s

USD 000’s

Current tax:

Corporation tax

2,100

2,032

8,097

Tax charge on profit on ordinary activities

2,100

2,032

8,097

5.

DISCONTINUED OPERATIONS

During 2013 the management of the Group resolved to dispose of the Group’s Russia and Ukraine operations as a

part of its strategy to focus on Middle East and North Africa (MENA) region operations and negotiations with