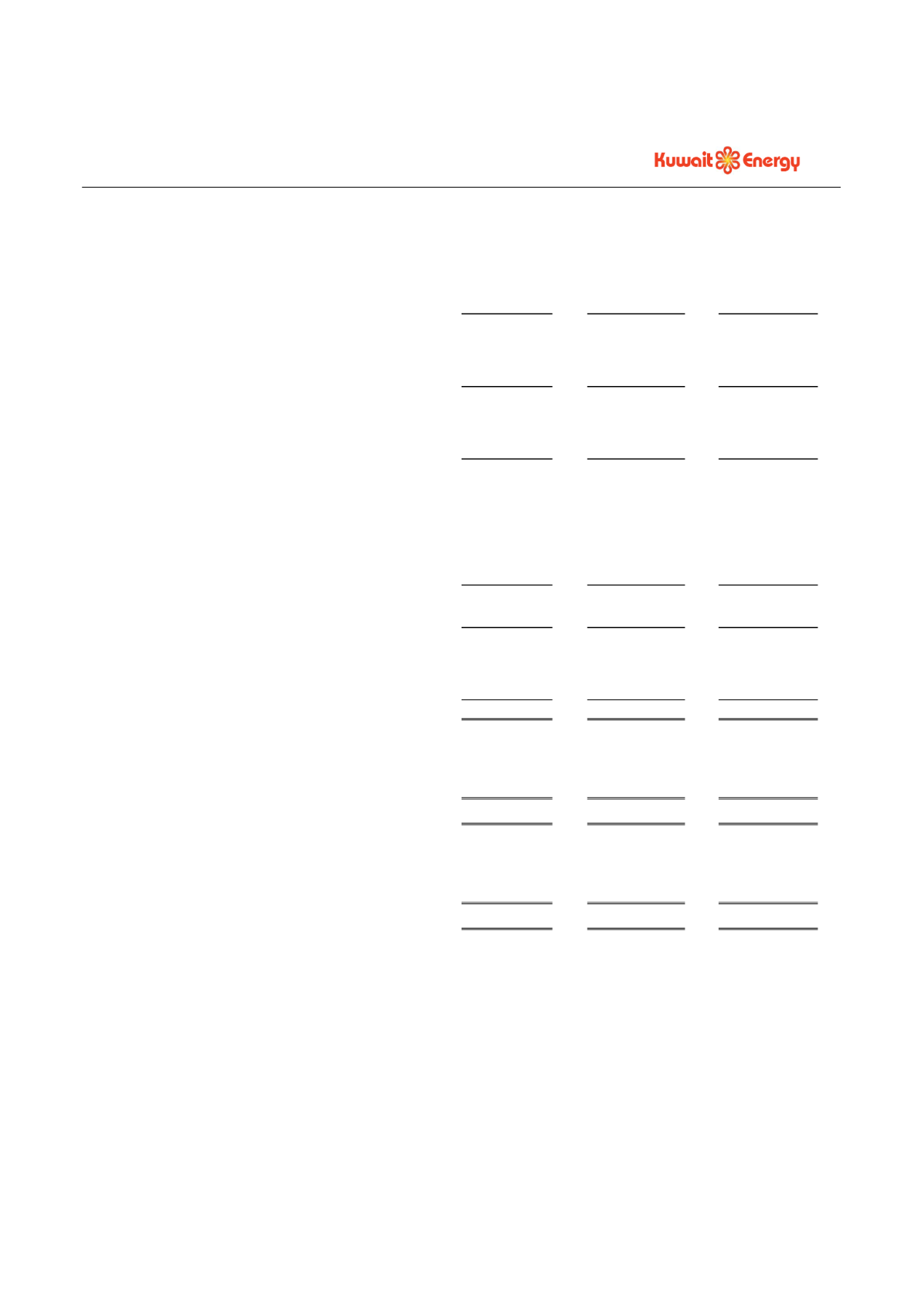

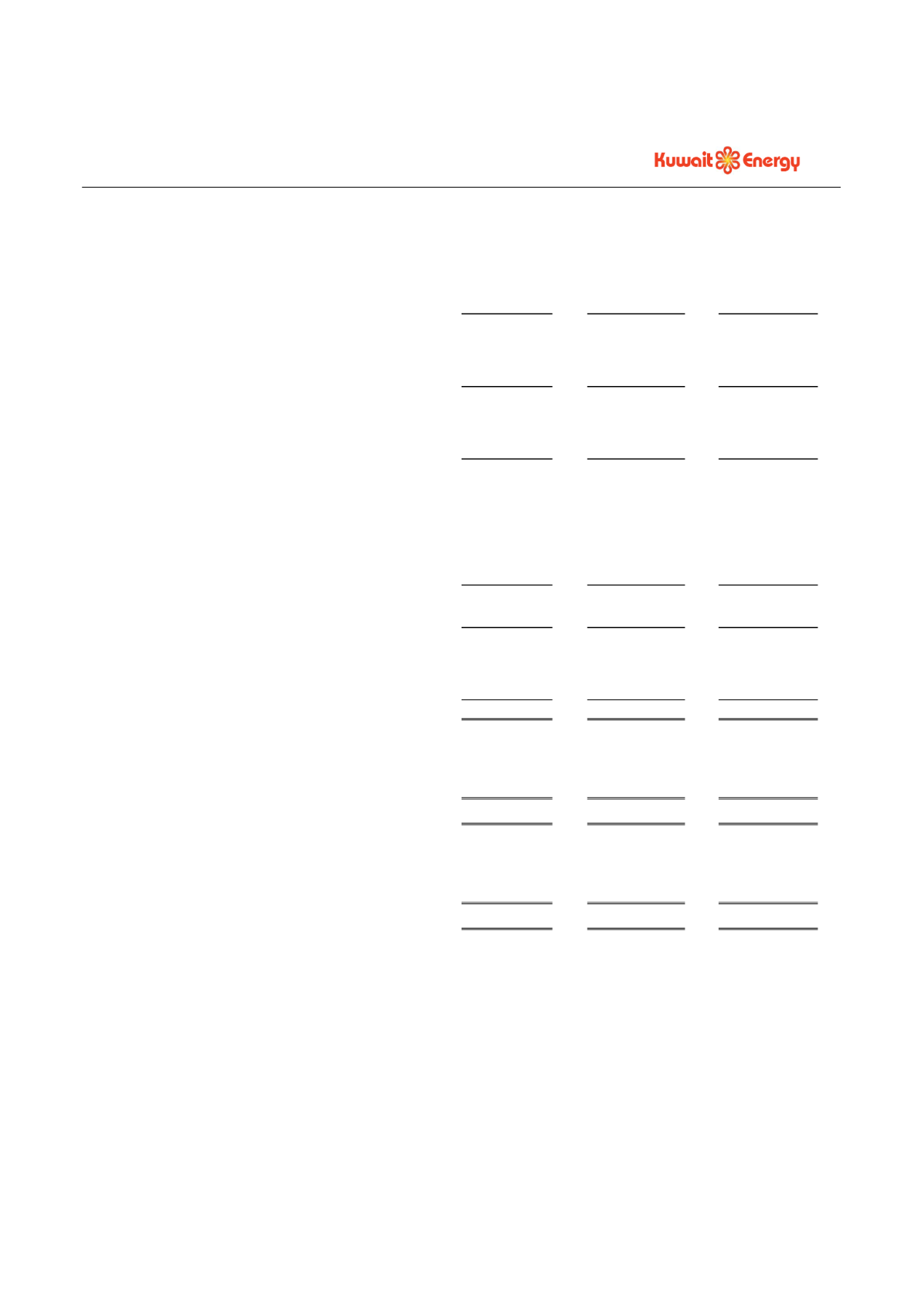

KUWAIT ENERGY plc GROUP

CONDENSED CONSOLIDATED INCOME STATEMENT

Three months ended 31 March 2014

F-5

3 Months

ended

31.03.14

Unaudited

3 Months

ended

31.03.13

Unaudited

Year ended

31.12.13

Audited

(Restated)

(1)

Notes USD 000’s

USD 000’s

USD 000’s

Continuing Operations

Revenue

67,321

56,732

262,494

Cost of sales

(35,161)

(31,762)

(134,919)

Gross profit

32,160

24,970

127,575

Exploration expenditure written off

7

-

-

(47,822)

Impairment losses

8

-

-

(1,801)

General and administrative expenses

(6,695)

(6,389)

(26,261)

Operating profit

25,465

18,581

51,691

Share in results of joint venture

9

1,075

386

1,543

Gain on held for trading derivative

81

78

322

Fair value loss on convertible loan

12

(3,016)

(2,899)

(12,071)

Other income

142

80

599

Foreign exchange loss

(8)

-

(3,762)

Finance costs (net)

(1,351)

(2,446)

(10,068)

Profit before tax

22,388

13,780

28,254

Taxation charge

4

(2,100)

(2,032)

(8,097)

Profit for the period from continuing

operations

20,288

11,748

20,157

Discontinued operations

Loss for the period from discontinued operations

5

(1,400)

(2,669)

(278,787)

Profit /(loss) for the period

18,888

9,079

(258,630)

Earnings per share from continuing

operations

-

Basic (cents)

6

6.2

3.6

6.2

-

Diluted (cents)

6

6.2

3.6

6.2

Earnings/(loss) per share from continuing and

discontinued operations

-

Basic (cents)

6

5.8

2.8

(79.6)

-

Diluted (cents)

6

5.8

2.8

(79.6)

(1)

Restated to show the investment and results from the Group’s joint venture in Oman using the equity method following

adoption of IFRS 11 on 1 January 2014 (see note 2). Equivalent restatements have also been made to the balance sheet,

cash flow statement and related supporting notes.