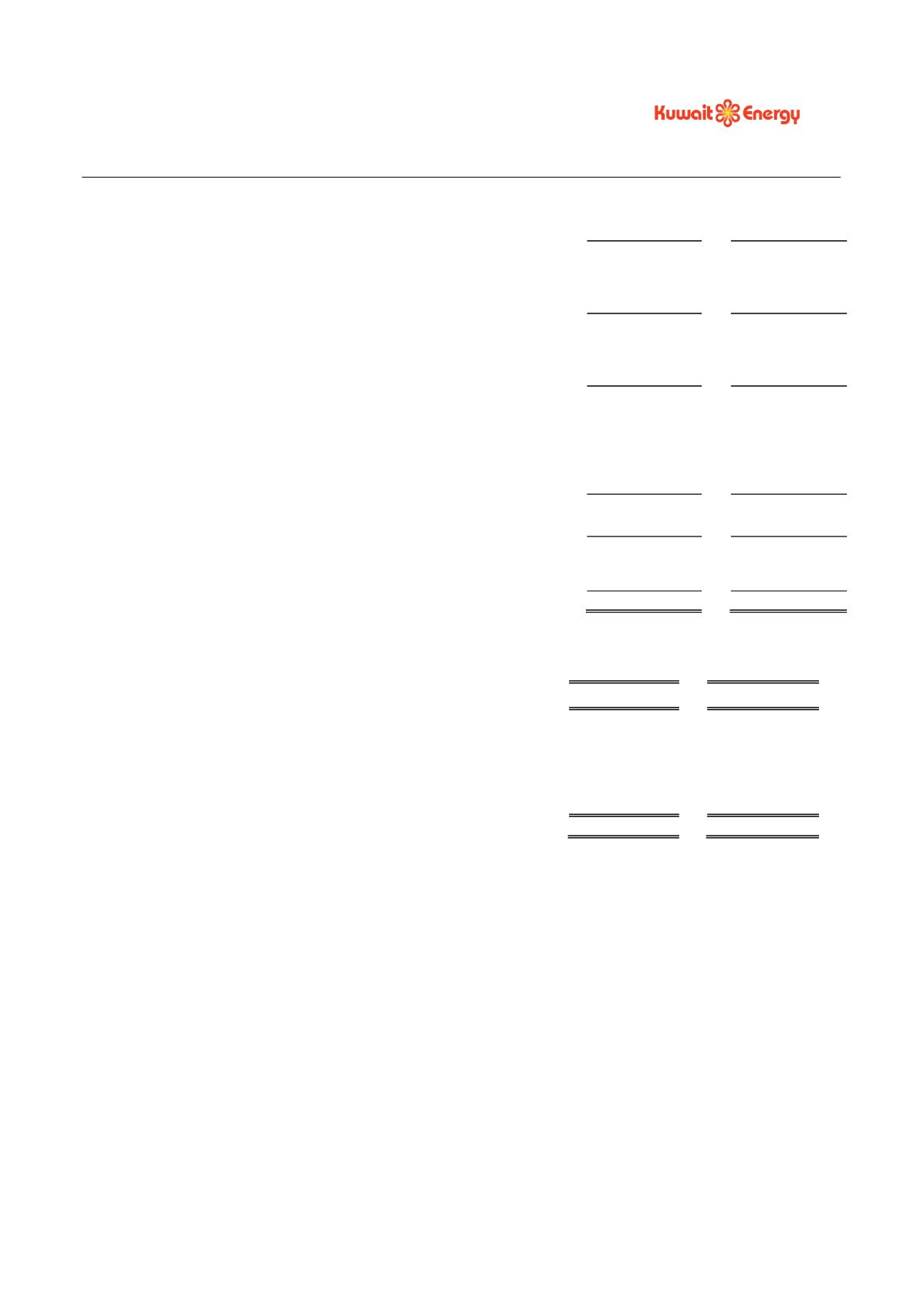

KUWAIT ENERGY plc GROUP

CONSOLIDATED INCOME STATEMENT

For the year ended 31 December 2013

F-28

2013

2012

(Restated)

(1)

Notes

USD 000’s

USD 000’s

Continuing Operations

Revenue

6

284,392

203,583

Cost of sales

8

(154,984)

(96,711)

Gross profit

129,408

106,872

Net impairment (loss) / reversal

9

(1,801)

540

Exploration expenditure written off

16

(47,822)

(3,680)

General and administrative expenses

(26,261)

(20,791)

Operating profit

53,524

82,941

Gain on held for trading derivative

26

322

266

Fair value loss on convertible loans

23

(12,071)

(4,528)

Other income

10

599

223

Foreign exchange (loss) / gain

(3,762)

320

Finance costs (net)

11

(10,068)

(1,157)

Profit before tax

28,544

78,065

Taxation charge

12

(8,387)

(8,700)

Profit for the year from continuing operations

7

20,157

69,365

Discontinued operations

Loss for the year from discontinued operations

14

(278,787)

(24,401)

(Loss) / profit for the year

(258,630)

44,964

Earnings per share from continuing operations

- Basic (cents)

13

6.2

21.7

- Diluted (cents)

13

6.2

21.7

(Loss) / earnings per share from continuing and discontinued

operations

- Basic (cents)

13

(79.6)

14.1

- Diluted (cents)

13

(79.6)

14.1

(2)

Restated to show separately the results from discontinued operations (see note 14). Equivalent restatements have also

been made to the statements of comprehensive income and cash flow and related supporting notes.