Kuwait Energy

EL-12-211107

77

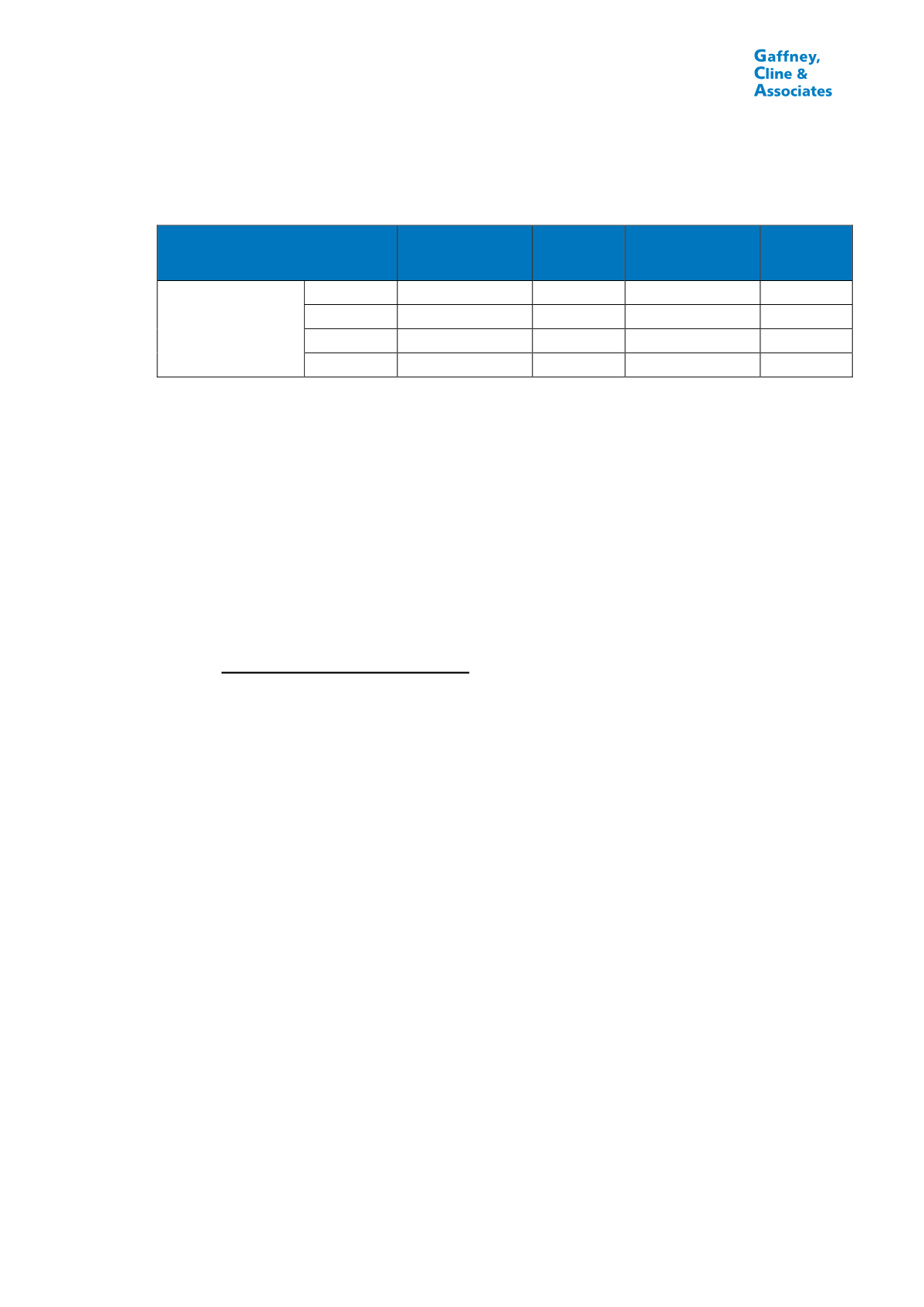

TABLE 6.4

SUMMARY OF OIL PROSPECTIVE RESOURCES (LEADS)

AS AT 31

st

MAY, 2014: BURG EL ARAB (EGYPT)

Lead

Gross

Best Estimate

(MMBbl)

KE WI (%)

Net to KE

Best Estimate

(MMBbl)

GCoS (%)

South 2 BEA

L Bah

0.2

75

0.2

14

M Bah

0.2

75

0.1

14

U Bah

0.1

75

0.1

14

ARG

0.1

75

0.1

16

Notes:

1.

Gross Prospective Resources are 100% of the volumes estimated to be recoverable from the Lead

in the event that a discovery is made and subsequently developed.

2.

KE Net Prospective Resources in this table are KE’s Working Interest fraction of the Gross

Prospective Resources; they do not represent KE’s actual Net Entitlement under the terms of the

PSC that governs the asset, which would be lower.

3.

The GCoS reported here represents an indicative estimate of the probability that drilling this Lead

would result in a discovery.

4.

The volumes reported here are “unrisked” in the sense that no adjustment has been made for

geological or commercial risk, i.e. the risk that no discovery will be made or that any discovery would

not be developed.

5.

Prospective Resources should not be aggregated with each other, or with Reserves or Contingent

Resources, because of the different levels of risk involved.

6.

L Bah = Lower Bahariya; M Bah = Middle Bahariya; U Bah = Upper Bahariya; ARG = Abu Roash G.

6.3

Egypt: East Ras Qattara (ERQ)

ERQ has already been described in Section 1.3 of this report. Figure 1.1 shows its

general location and Figure 1.5 shows the nine development areas around the developed

fields. Although the exploration license expired in 2011, exploration is still permitted

within the development areas. Existing production is mainly from the reservoirs in the

Lower Bahariya Formation, with minor production from the Upper Bahariya and Kharita

Formations. One Prospect has been identified (Table 6.5) and it is planned to drill it in

the near future. There is also a commitment to drill two exploration wells in the Diaa

development area; potential locations for these are under review but no Prospective

Resources are as yet attributed to these two wells.

Shebl East-2 targets a structural high at the north-eastern end of the fault block

containing Shebl East-1, which discovered 45 ft of oil pay in the Lower Bahariya

sandstone but declined rapidly when put into production. Shebl East-1 also had shows in

the AR-E Formation, and Shebl East-2 targets a closure at this level, but on the opposite

side of the controlling fault to the previous well. The prospective closure is a tight

anticline formed as a pop-up between two normal fault systems. The proven oil column in

Shebl East-1 suggests good operation of the required fault seals at Lower Bahariya level.

The key risks are in the detail of the structure of the northern part of the Prospect and in

reservoir quality.