Kuwait Energy

EL-12-211107

75

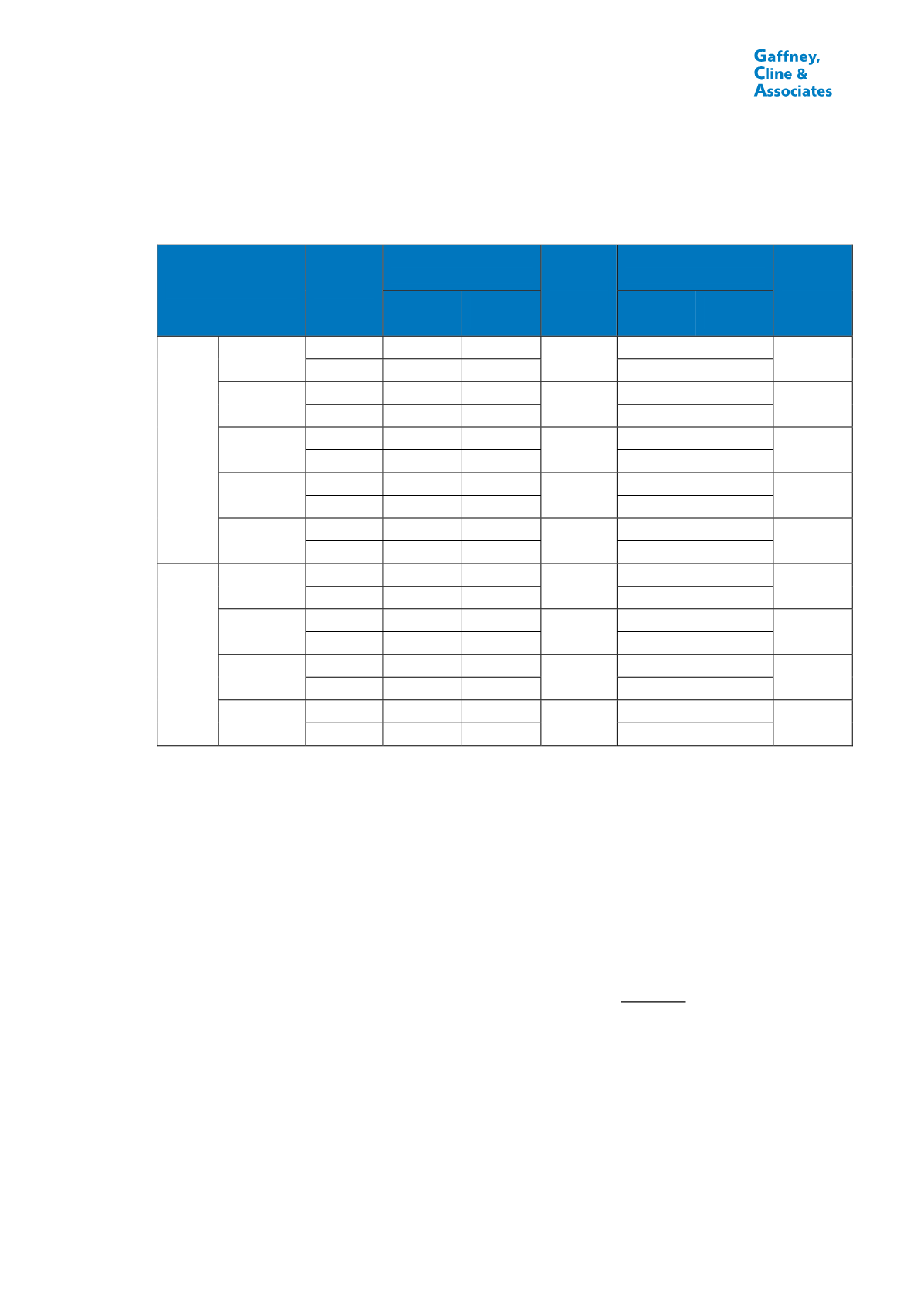

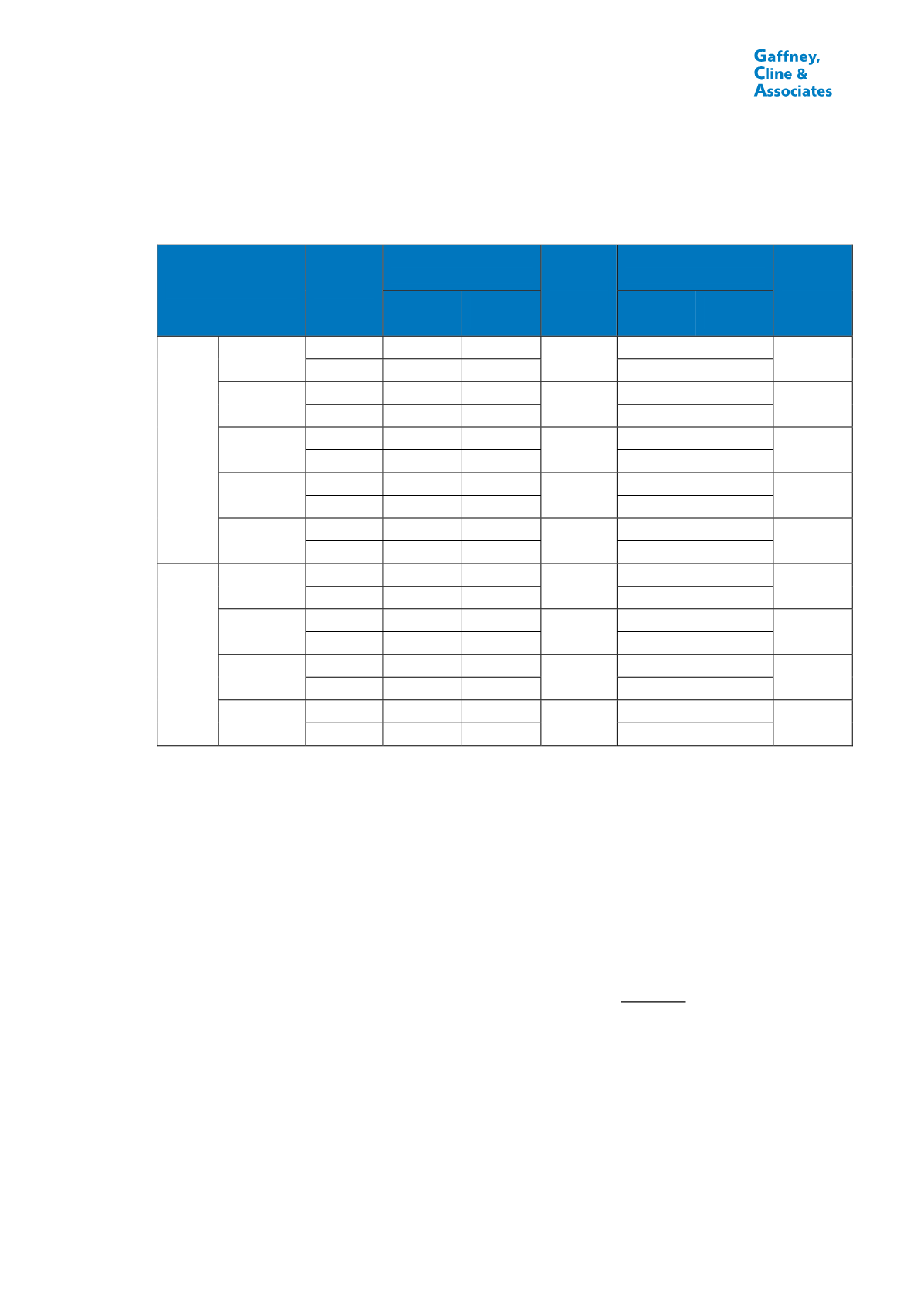

TABLE 6.2

(4 of 4)

SUMMARY OF PROSPECTIVE RESOURCES (LEADS)

AS AT 31

st

MAY, 2014: ABU SENNAN (EGYPT)

Lead

Case

Gross

Best Estimate

KE WI

(%)

Net to KE

Best Estimate

GCoS

(%)

Liquid

(MMBbl)

Gas

(Bscf)

Liquid

(MMBbl)

Gas

(Bscf)

LE-26

(Z7-D)

ARC-41

Oil

0.38

-

50

0.19

-

5

Gas

0.05

2.49

0.02

1.25

ARE-41

Oil

0.83

-

50

0.42

-

2

Gas

0.07

3.45

0.03

1.73

ARG-28

Oil

0.45

-

50

0.23

-

9

Gas

0.18

3.52

0.09

1.76

BAH-26

Oil

2.03

-

50

1.02

-

9

Gas

0.79

15.84

0.40

7.92

AEB-25

Oil

0.53

-

50

0.26

-

5

Gas

0.48

4.81

0.24

2.40

LE-27

(Z7-E)

ARC-34

Oil

0.19

-

50

0.10

-

6

Gas

0.02

1.24

0.01

0.62

ARE-34

Oil

0.24

-

50

0.12

-

2

Gas

0.02

0.97

0.01

0.49

ARG-30

Oil

0.28

-

50

0.14

-

9

Gas

0.11

2.19

0.05

1.10

BAH-30

Oil

0.72

-

50

0.36

-

9

Gas

0.28

5.62

0.14

2.81

Notes:

1.

Gross Prospective Resources are 100% of the volumes estimated to be recoverable from the Lead

in the event that a discovery is made and subsequently developed.

2.

KE Net Prospective Resources in this table are KE’s Working Interest fraction of the Gross

Prospective Resources; they do not represent KE’s actual Net Entitlement under the terms of the

PSC that governs the asset, which would be lower.

3.

The GCoS reported here represents an indicative estimate of the probability that drilling this Lead

would result in a discovery.

4.

The volumes reported here are “unrisked” in the sense that no adjustment has been made for

geological or commercial risk, i.e. the risk that no discovery will be made or that any discovery would

not be developed.

5.

Prospective Resources should not be aggregated with each other, or with Reserves or Contingent

Resources, because of the different levels of risk involved.

6.

Where both oil and gas cases are reported for a Lead, these are alternative cases.