Kuwait Energy

EL-12-211107

76

6.2

Egypt: Burg El Arab (BEA)

BEA has already been described in Section 1.1 of this report. Figure 1.1 shows its

location and Figure 1.3 shows the existing wells, which produce from the AR-D, AR-G,

Upper, Middle and Lower Bahariya reservoirs. Three Prospects (Table 6.3) and one

Leads (Table 6.4) have been identified in fault blocks adjacent to the existing field.

Drilling of the Southwest BEA Prospect began on 21

st

May, 2014.

All Prospects and Leads are in proved reservoir intervals so are relatively low risk, but it

should be noted that not every reservoir has been productive in all the wells drilled to

date: several wells within the main field area have encountered some dry reservoir

intervals. This indicates risks associated with trapping and with reservoir facies variation,

which have been considered by GCA in estimating GCoS.

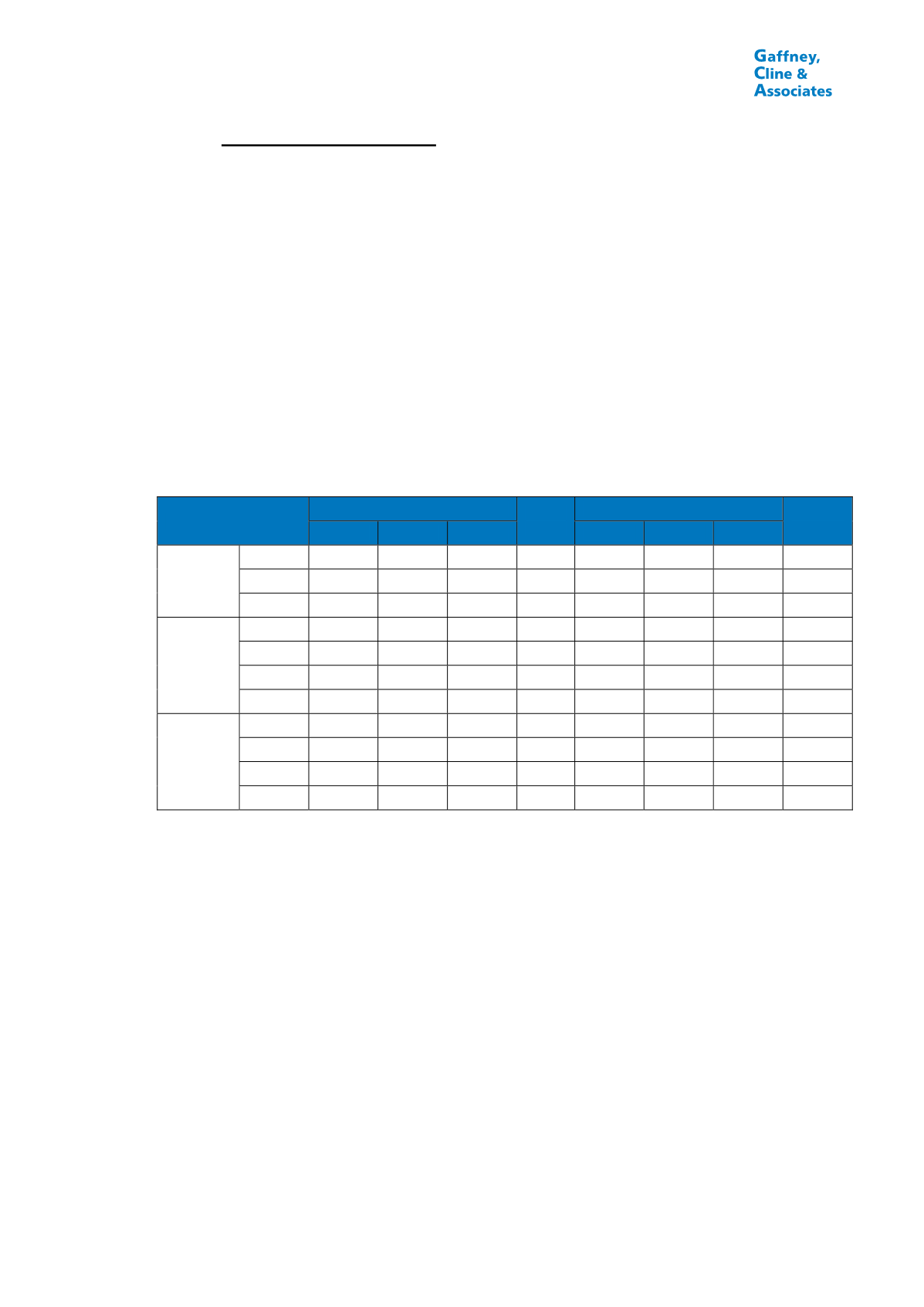

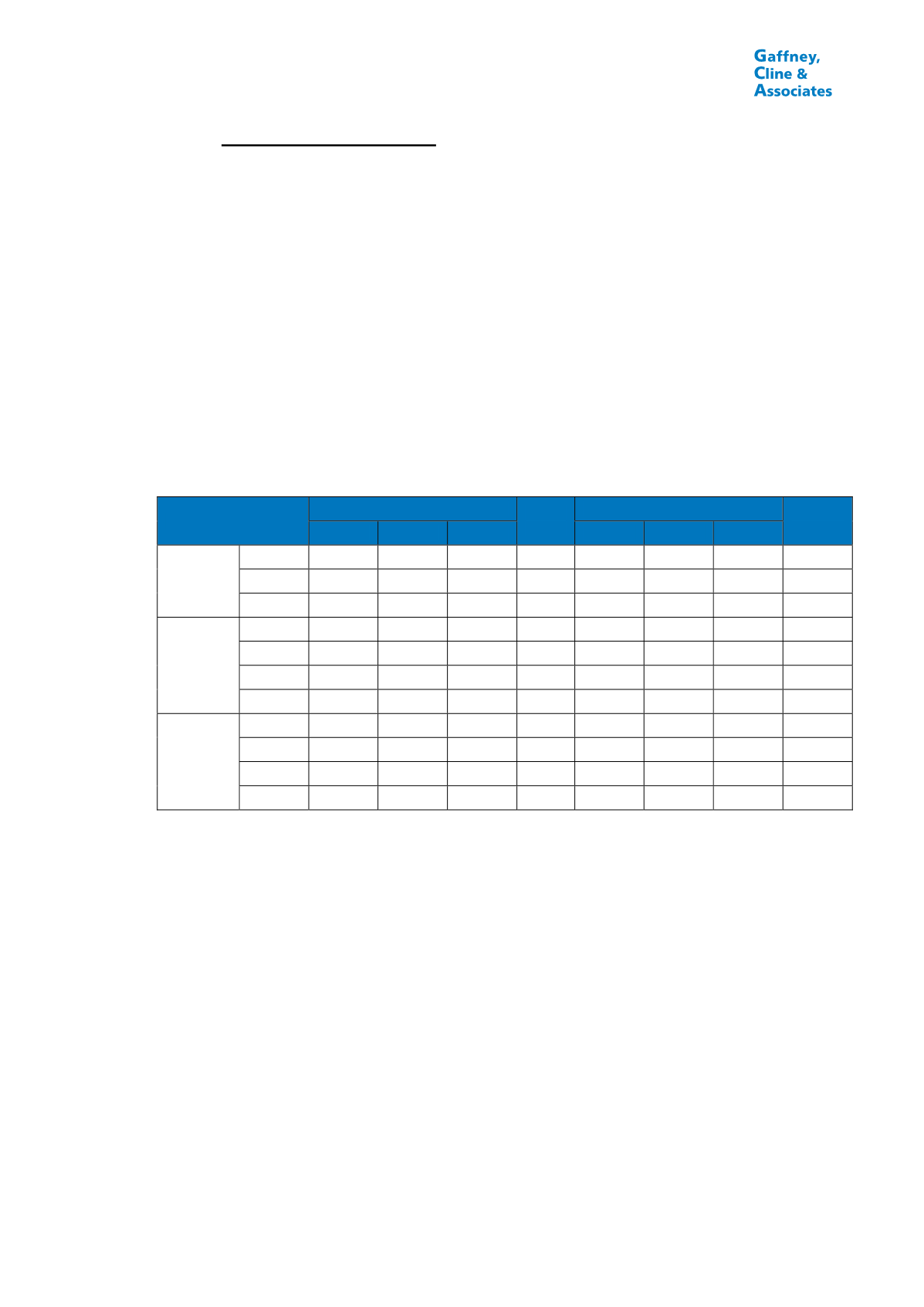

TABLE 6.3

SUMMARY OF OIL PROSPECTIVE RESOURCES (PROSPECTS)

AS AT 31

st

MAY, 2014: BURG EL ARAB (EGYPT)

Prospect

Gross (MMBbl)

KE WI

(%)

KE Net (WI Basis) (MMBbl)

GCoS

(%)

Low

Best

High

Low

Best

High

Northeast

BEA

L Bah

0.2

0.5

1.0

75

0.2

0.4

0.7

26

U Bah

0.2

0.5

1.1

75

0.1

0.4

0.8

26

ARG

0.1

0.3

0.7

75

0.1

0.3

0.6

34

Southwest

BEA

L Bah

0.2

0.4

0.7

75

0.1

0.3

0.6

20

M Bah

0.1

0.3

0.6

75

0.1

0.2

0.4

20

U Bah

0.1

0.2

0.4

75

0.0

0.1

0.3

20

ARG

0.1

0.2

0.3

75

0.0

0.1

0.2

20

South-1

BEA

L Bah

0.1

0.2

0.3

75

0.1

0.1

0.3

19

M Bah

0.1

0.2

0.3

75

0.0

0.1

0.2

19

U Bah

0.0

0.1

0.2

75

0.0

0.1

0.2

19

ARG

0.0

0.1

0.2

75

0.0

0.1

0.2

24

Notes:

1.

Gross Prospective Resources are 100% of the volumes estimated to be recoverable from the

Prospect in the event that a discovery is made and subsequently developed.

2.

KE Net Prospective Resources in this table are KE’s Working Interest fraction of the Gross

Prospective Resources; they do not represent KE’s actual Net Entitlement under the terms of the

PSC that governs the asset, which would be lower.

3.

The GCoS reported here represents an indicative estimate of the probability that drilling this

Prospect would result in a discovery.

4.

The volumes reported here are “unrisked” in the sense that no adjustment has been made for

geological or commercial risk, i.e. the risk that no discovery will be made or that any discovery would

not be developed.

5.

Prospective Resources should not be aggregated with each other, or with Reserves or Contingent

Resources, because of the different levels of risk involved.

6.

L Bah = Lower Bahariya; M Bah = Middle Bahariya; U Bah = Upper Bahariya; ARG = Abu Roash G.