141

In addition to the above, the JV partners are required under each PSC to pay annual training, institutional and social

development bonuses in fixed amounts of between $75,000 and $700,000 per PSC. The JV partners are also obliged to

pay certain bonuses to the Ministry of Oil and Mineral Resources upon reaching various production milestones, with the

amount of such bonuses under each PSC ranging from $500,000 to $12,000,000. Payment of these bonuses to Yemen

Ministry of Oil and Mineral Resources is divided amongst the JV partners on the basis of their cost interest percentages.

Security in Yemen

The Group’s operations in Yemen have, over recent years, become increasingly challenging. The popular uprising

against former President Saleh’s regime, tribal opposition groups, the presence of extremist elements and regional

security issues are factors contributing to a challenging operating environment in Yemen. At the end of 2010, the Group

withdrew its non-Yemeni employees from Yemen. As a result, the Group did not engage in any exploration, appraisal or

development activities in Yemen during the course of 2011. Although the Group resumed full operations in Yemen in

2012, the security situation remains challenging. Yemen has again recently experienced a surge in violence and, as a

result, certain other international oil and gas companies have decided to withdraw foreign staff. For example, in February

2014 the Group’s production in Block 43 in Yemen was suspended due to export pipeline sabotage, and development

work was suspended for security reasons. Collection of 3D seismic data in Block 82 has also been suspended for security

reasons. Additionally, in May 2014, Yemen’s main oil export pipeline was sabotaged by tribesmen, the latest of several

attacks on pipelines. See “

Risk factors—Risks relating to the jurisdictions in which the Group operates—The security

situation in Yemen has in the past caused, and may again cause the Group to cease exploration, appraisal and

development operations in the country, and may affect the validity of the Group’s licences if it is unable to obtain and

maintain effective security arrangements for Group personnel and assets in the country.

”

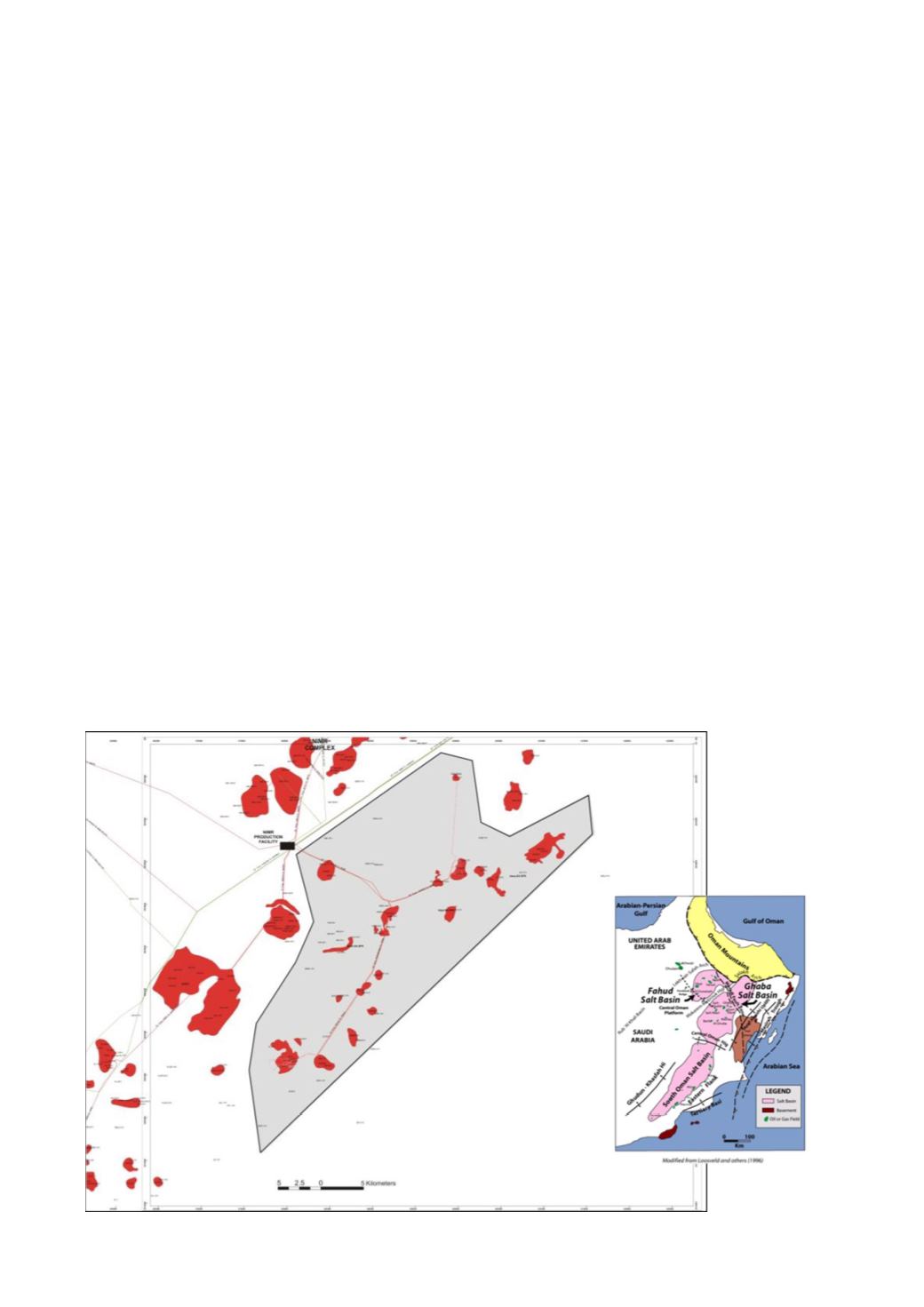

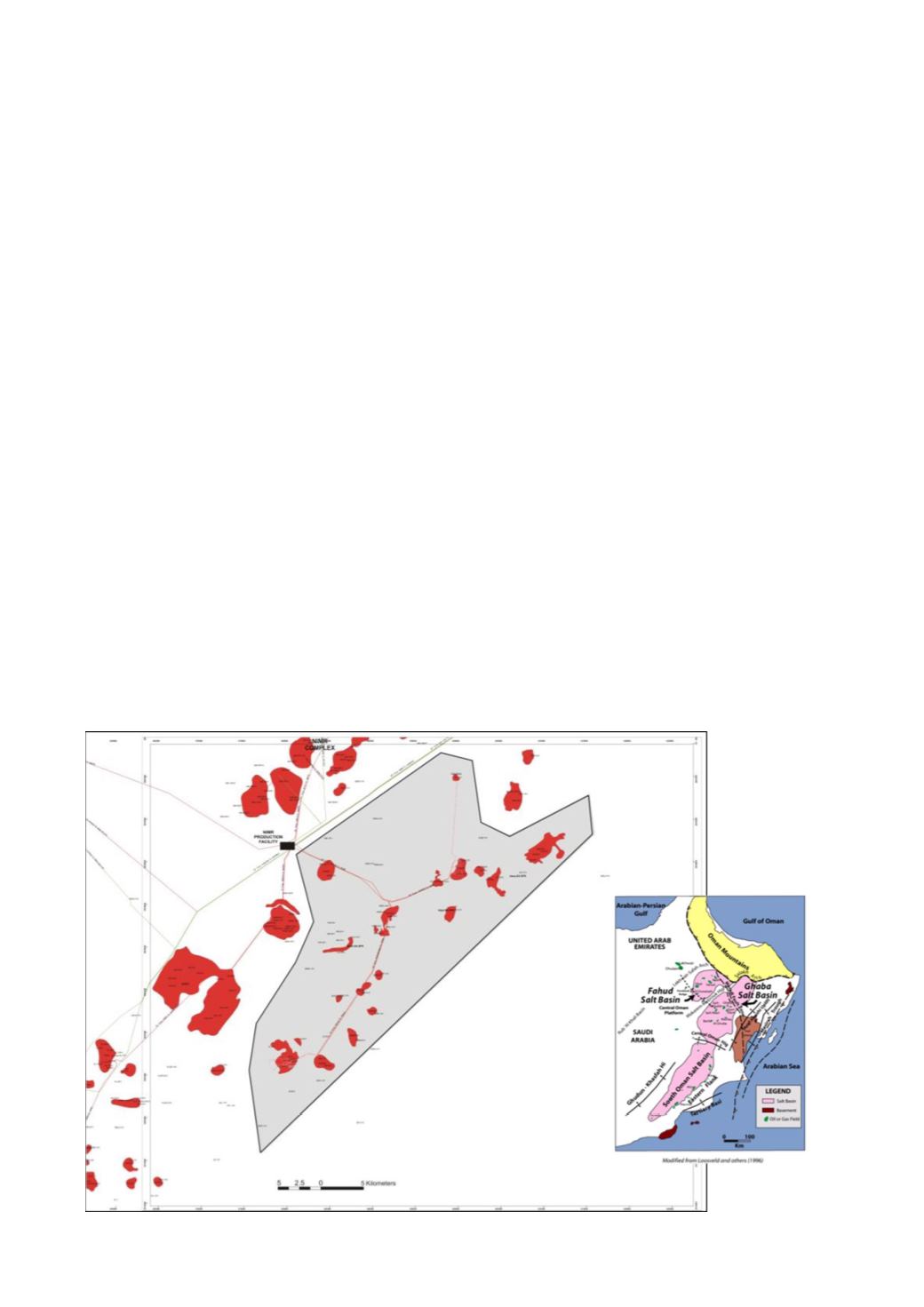

Oman

Summary

In Oman, the Group currently produces oil from the Karim Small Fields, which is a cluster of 18 mature oil fields

covering an area of 768 km

2

in Shuwaimiah in the southern province of Oman. Karim Small Fields generated 11.4% of

the Group’s average daily working interest production in the three months ended 31 March 2014, and 12.0% of the

Group’s average daily working interest production in 2013. The Group has a 20% cost interest and a 15% revenue

interest in the Karim Small Fields and its operations are governed by a service contract with Oman Oil Company

Exploration & Production LLC (“

OOCEP

”).

The map below presents an overview of the Group’s assets in Oman.