140

The fiscal regime under the PSCs operates on a cost oil/profit oil basis. The JV partners are entitled to recover a

proportion of their costs after payment to the Yemeni Government of a royalty. The oil royalty is based on the monthly

average oil production level in a given PSC area. For Block 82, for average daily production of 25,000 bopd or less the

government is entitled to an oil royalty of 12% and 10% of production, respectively. After payment of the royalty, the JV

partners can recover a proportion of their costs, with cost recovery oil and cost recovery gas entitlements capped at the

following cost oil / cost gas percentage of gross production in a given quarter:

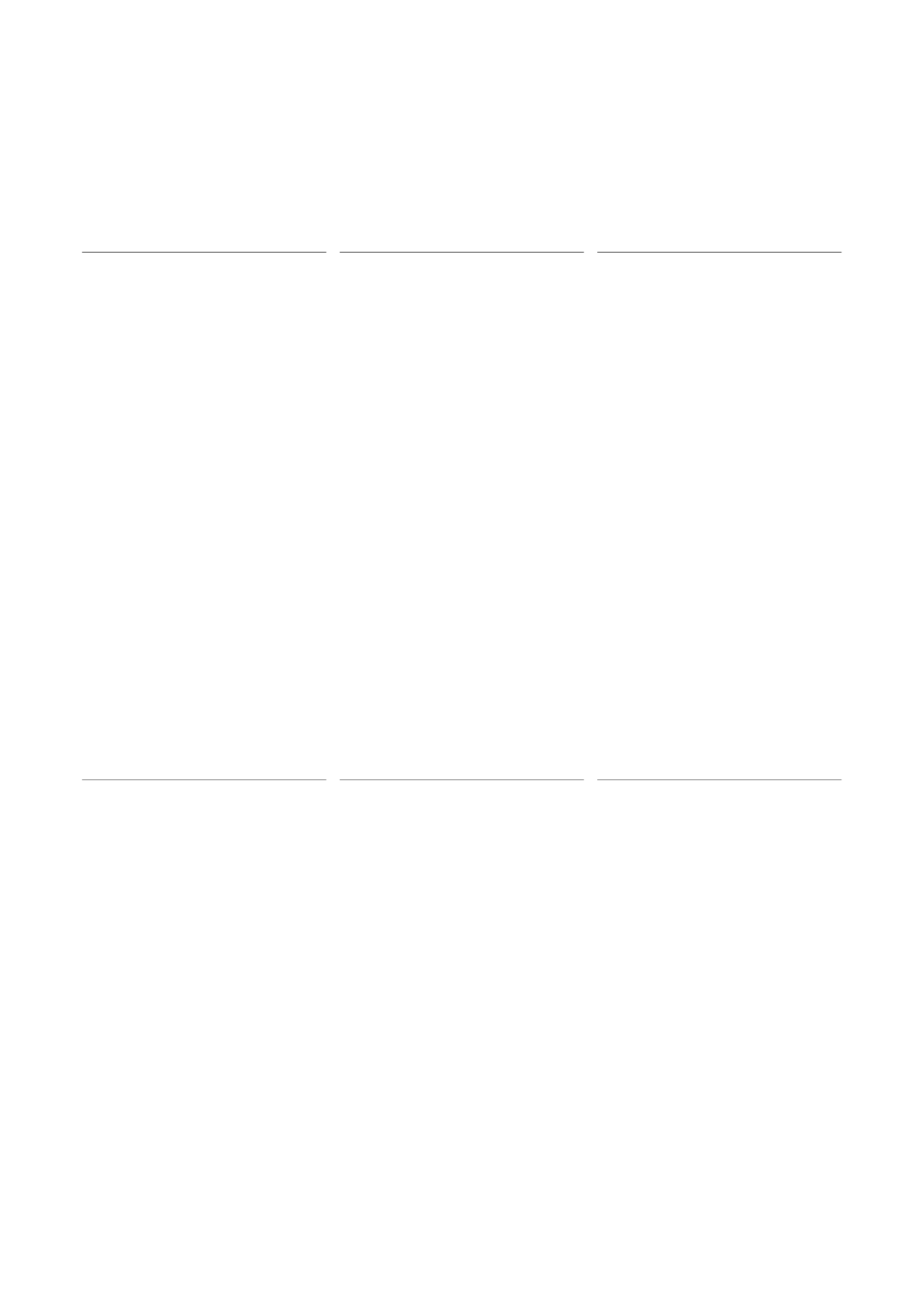

PSC

Cost oil entitlement cap

(1)

(%)

Cost gas entitlement cap

(2)

(%)

Block 5...........................................

15.00

-

Block 43.........................................

50.00

-

Block 49.........................................

50.00

-

Block 82.........................................

30.00

30.00

(1) The maximum percentage of quarterly petroleum produced from all the development leases in that PSC area out of which the Group can

apply to recover its costs.

(2) The maximum percentage of exploration and development costs the Group can apply to recover exploration and development costs per

annum. Operating costs are recovered in the year incurred.

Unrecovered costs can be carried forward from a given quarter until complete recovery is achieved (or, if sooner, until

the contract terminates or finally expires, at which point unrecovered costs are lost). Should all costs not be recovered by

the end of the PSC, such costs cannot be cost recovered from another PSC. For the remaining Blocks in Yemen, for

average daily gross production volumes per block of 2,500 bopd or less (12,500 or less for Block 43) the government is

entitled to a royalty of 3% of production. The gas royalty applicable to Block 82 is 12.5% of production.

Following deductions for government royalties and cost recovery, the percentage of profit oil and gas allocated to the JV

partners is calculated on a sliding scale based on average daily gross production volumes as set out in the table below.

The remainder is allocated to the Ministry of Oil and Mineral Resources.

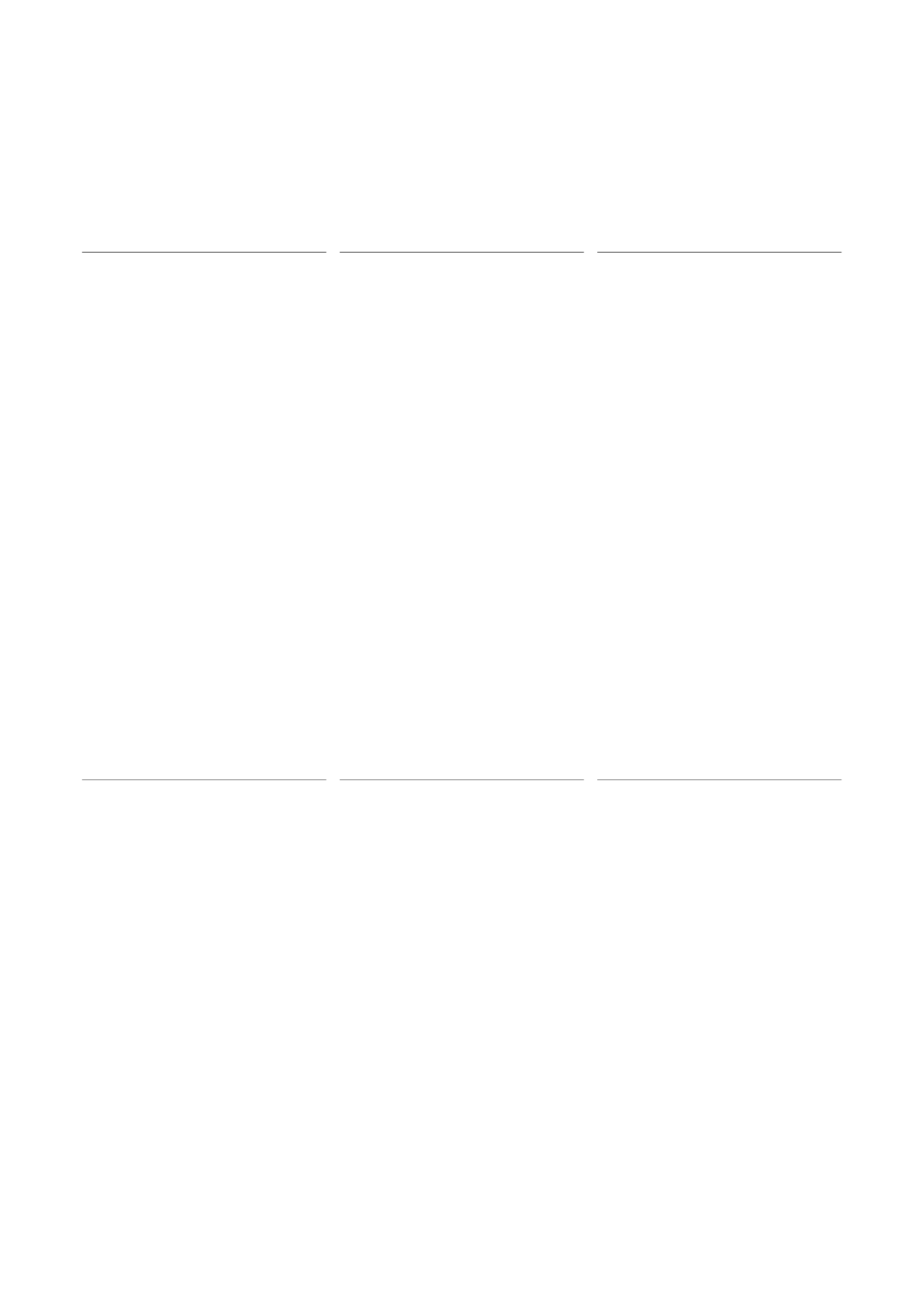

Block

Average daily production

JV partner profit oil (%)

Block 5...........................................

35,000 or less

15.00

Block 43.........................................

25,000 or less

30.00

Block 49.........................................

15,000 or less

35.00

Block 82.........................................

25,000 or less

20.00

For Block 82, the share of profit gas allocated to the JV partners when average daily production of gas is 25,000 or less

is 27.5%. For Blocks 5, 43 and 49, profit gas is allocated 100% to the Yemeni government.

The Ministry of Oil and Mineral Resources has the option to purchase up to 50.00% of each JV partner’s profit oil at

market price.

Yemen income tax is applied at a rate of 35% such that each JV partner’s share of profit oil is net after tax profit. This

tax is paid by the Ministry of Oil and Mineral Resources on behalf of the JV partners out of the government’s share of

profit oil. The volume equivalent to this tax revenue is reflected in net entitlement reserves. The Group is also required to

pay a 3% exploration tax on all exploration expenditures for each PSC.