137

(1) Gas and condensate volumes have been converted by the Group to oil equivalent volumes using conversion factors of 6.0 mscf/boe and 1.0

bbl/boe respectively.

(2) Sum totals may differ from sums of line items presented as a result of rounding.

(3) Group 1P and 2P Reserves in this table are presented on a “net entitlement” basis, and present reserves estimated to be attributable to the

Group based on its contractual working interest of the costs, benefits and ownership of a particular asset, including cost recovery and profit

share amounts, and reduced by royalties or share of production owing to others under applicable lease and fiscal terms, as adjusted up for

any corporation tax paid on their behalf and in kind. In assets governed by a PSC or a service agreement (as opposed to assets under a

tax/royalty regime), the Group’s net entitlement reserves are calculated in accordance with the terms of the PSC or service contract on the

basis of forecast price and cost assumptions as evaluated in reports prepared by GCA.

According to GCA’s report, the Group’s estimated contingent oil resources in Yemen include 10.0 mmboe of 1C (low

estimate), 18.7 mmboe of 2C (best estimate) and 31.7 mmboe of 3C (high estimate) on a working interest basis as at 31

May 2014, of which 5.8 mmboe of 1C (low estimate), 11.5 mmboe of 2C (best estimate) and 20.3 mmboe of 3C (high

estimate) are located in Block 49 and 4.2 mmboe of 1C (low estimate), 7.1 mmboe of 2C (best estimate) and 11.4

mmboe of 3C (high estimate) are located in Block 5. GCA also reports that the Group’s contingent condensate resources

in Yemen include 0.3 mmboe of 1C (low estimate), 0.5 mmboe of 2C (best estimate) and 0.6 mmboe of 3C (high

estimate) on a working interest basis as at 31 May 2014, of which 0.1 mmboe of 1C (low estimate), 0.1 mmboe of 2C

(best estimate) and 0.2 mmboe of 3C (high estimate) are located in Block 49 and 0.3 mmboe of 1C (low estimate), 0.3

mmboe of 2C (best estimate) and 0.4 mmboe of 3C (high estimate) are located in Block 5.

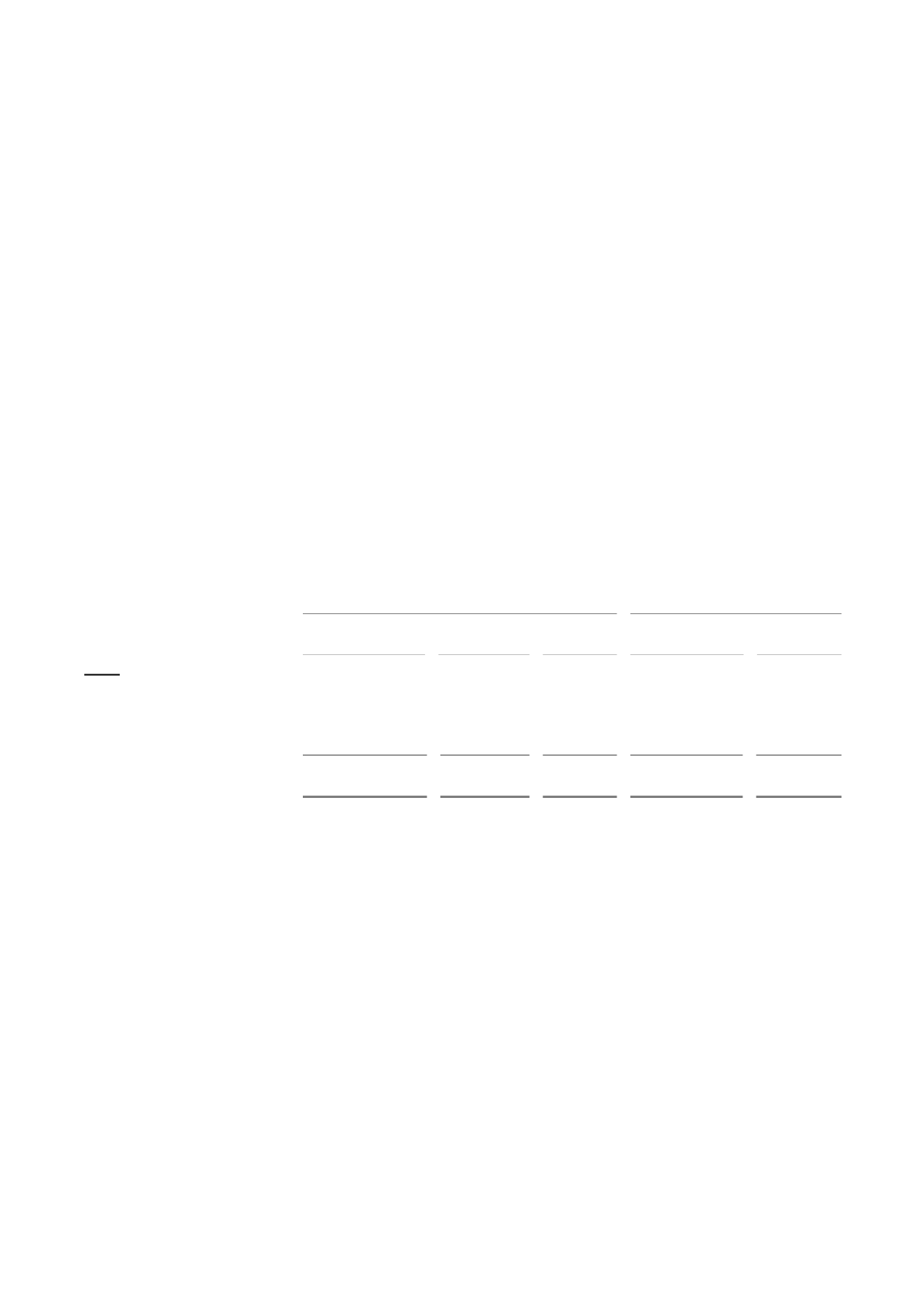

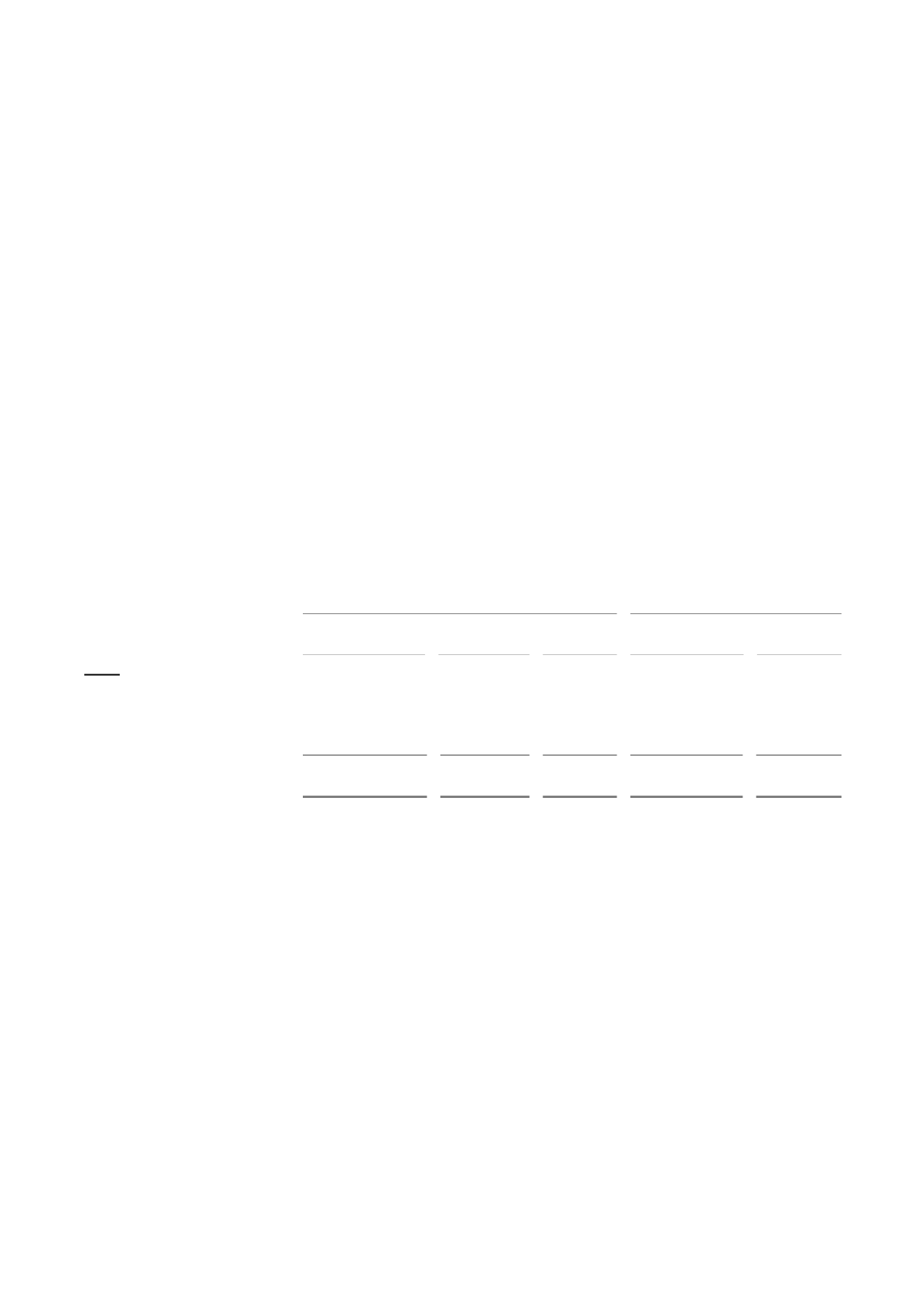

The Group currently has oil production from Block 43 and Block 5 in Yemen. During the first three months of 2014,

Block 43 and Block 5 produced an average of 376 boepd oil and 4,012 boepd oil, respectively, on a working interest

basis, representing approximately 1.7% and 17.9%, respectively, of the Group’s average daily working interest

production. For the six months ended 30 June 2014, Yemen produced an average of 4,164 boepd, with an exit rate as at

30 June 2014 of 4,724 boepd. The following table sets out the Group’s average daily oil production from its oil-

producing assets in Yemen for the periods indicated on a working interest basis.

Year ended 31 December

Three months ended 31 March

2011

2012

2013

2013

2014

Asset

(boepd)

Block 5..................................

-

-

4,185

5,108

4,012

Block 43................................

636

725

532

645

376

Total .....................................

636

725

4,717

5,753

4,388

Production assets

Block 5

One of the Group’s most significant producing assets is the Block 5 licence area. Block 5 covers a gross area of

approximately 280 km

2

and is located in central Yemen. In January 2013, the Group completed the acquisition of Jannah

Hunt Oil Company Limited (“

JHOC

”), a company operating in Yemen. JHOC has a 15% participating interest in Block

5, which it also operates on behalf of itself and the other participants, namely KUFPEC and government-owned YICOM,

which hold a 20% stake each, as well as Total, Exxon and Newco (Private Limited) Enterprises S.A., which hold a 15%

stake each.

The Block 5 licence will expire 8 June 2015, but as a result of lost production days due to the security situation in

Yemen, the Group is seeking to extend the Block 5 commitment period for 541 days (until 1 December 2016), according

to the terms of the licence. Although discussions are ongoing with the Yemeni government, the Group is still awaiting a

final confirmation. The Group is also seeking to obtain approval from the Yemeni government for an additional 5-year

extension of the licence.

Block 5 has three main producing fields: Al Nasr, Dhahab and Halewah. The Al Nasr field was discovered in October

1995, with first production in January 1997. The field was developed with 23 producing wells and nine water injection