129

Dragon Oil (Holdings) Limited

30.00

30.00

(1) SC = Service Contract.

(2) Revenue Interest is the percentage interest of the Group in the revenues derived from sale of production from an asset, before taking into

account any taxes, fees, royalties or other payments

(3) Cost Interest is the percentage contribution of the Group to the exploration, development and operating costs for an asset, before taking into

account contractual cost recovery available to the Group, if any.

(4) The party indicated is the operator of the asset.

(5) A “carried” cost interest indicates that the carried entity’s undivided interest in the costs, obligations and liabilities associated with the asset

are not borne by the carried entity but are instead borne by its JV partners pursuant to the relevant licence.

(6) The Group is currently seeking opportunities to sell its interest in its Mansuriya asset in Iraq or otherwise exit the asset and intends to spend

only the minimum capital expenditures required under the Mansuriya licence.

The Group’s exploration, appraisal and development programme through to the end of 2016 is summarised under “—

Planned capital expenditure and near-term exploration and appraisal programmes

.” With regard to its assets in Iraq, the

Group’s exploration, appraisal and development programme includes expected capital expenditures of $359.6 million

through the end of 2016. Additional detail is set out in the description of each asset below.

The Group’s activities are mainly focused on development activities and production planning. The Group will continue

to seek growth opportunities to complement its global portfolio.

Reserves data

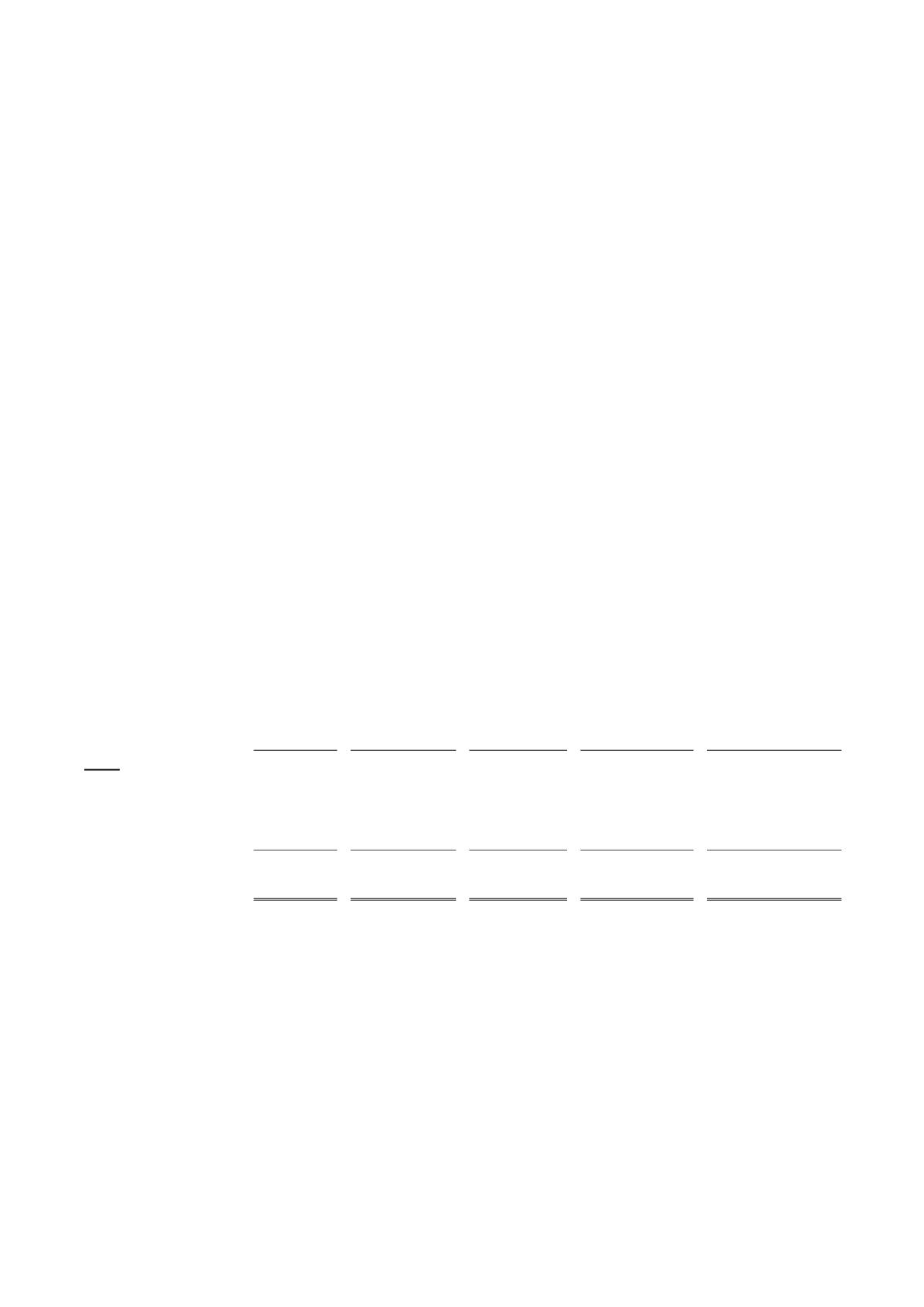

The Group currently has reserves in two of its assets in Iraq. Set out below is a table summarising, as at 31 May 2014,

estimates of the Group’s net entitlement hydrocarbon reserves in Iraq. These estimates are derived from the

“Competent

Person’s Report.”

Proved

(1P)

Developed

Proved (1P)

Undeveloped

Proved (1P)

Total

Proved +

Probable (2P)

Proved, Probable +

Possible (3P)

Asset

(mmboe)

(1)

Siba ..........................

-

7.7

7.7

9.6

10.4

Mansuriya

(2)

.............

-

14.4

14.4

15.7

16.0

Iraq net entitlement

reserves

(3)(4)

.............

-

22.1

22.1

25.3

26.3

(1) Gas and condensate volumes have been converted by the Group to oil equivalent volumes using conversion factors of 6.0 mscf/boe and 1.0

bbl/boe respectively.

(2) The Group is currently seeking opportunities to sell its interest in its Mansuriya asset in Iraq or otherwise exit the asset and intends to spend

only the minimum capital expenditures required under the Mansuriya licence.

(3) Sum totals may differ from sums of line items presented as a result of rounding.

(4) Group 1P and 2P Reserves in this table are presented on a “net entitlement” basis, and present reserves estimated to be attributable to the

Group based on its contractual working interest of the costs, benefits and ownership of a particular asset, including cost recovery and profit

share amounts, and reduced by royalties or share of production owing to others under applicable lease and fiscal terms, as adjusted up for

any corporation tax paid on their behalf and in kind. In assets governed by a service contract, the Group’s net entitlement reserves are

calculated in accordance with the terms of the service contract on the basis of forecast price and cost assumptions as evaluated in reports

prepared by GCA.

According to GCA’s report, on a net entitlement basis as at 31 May 2014, the Group’s estimated 1P gas reserves in Iraq

totalled approximately 118.5 Bscf (19.8 mmboe), its 2P gas reserves in Iraq totalled approximately 115.8 Bscf (19.3

mmboe), and its 3P gas reserves totalled approximately 111.9 Bscf (18.7 mmboe). On a net entitlement basis as at 31