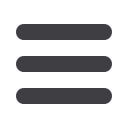

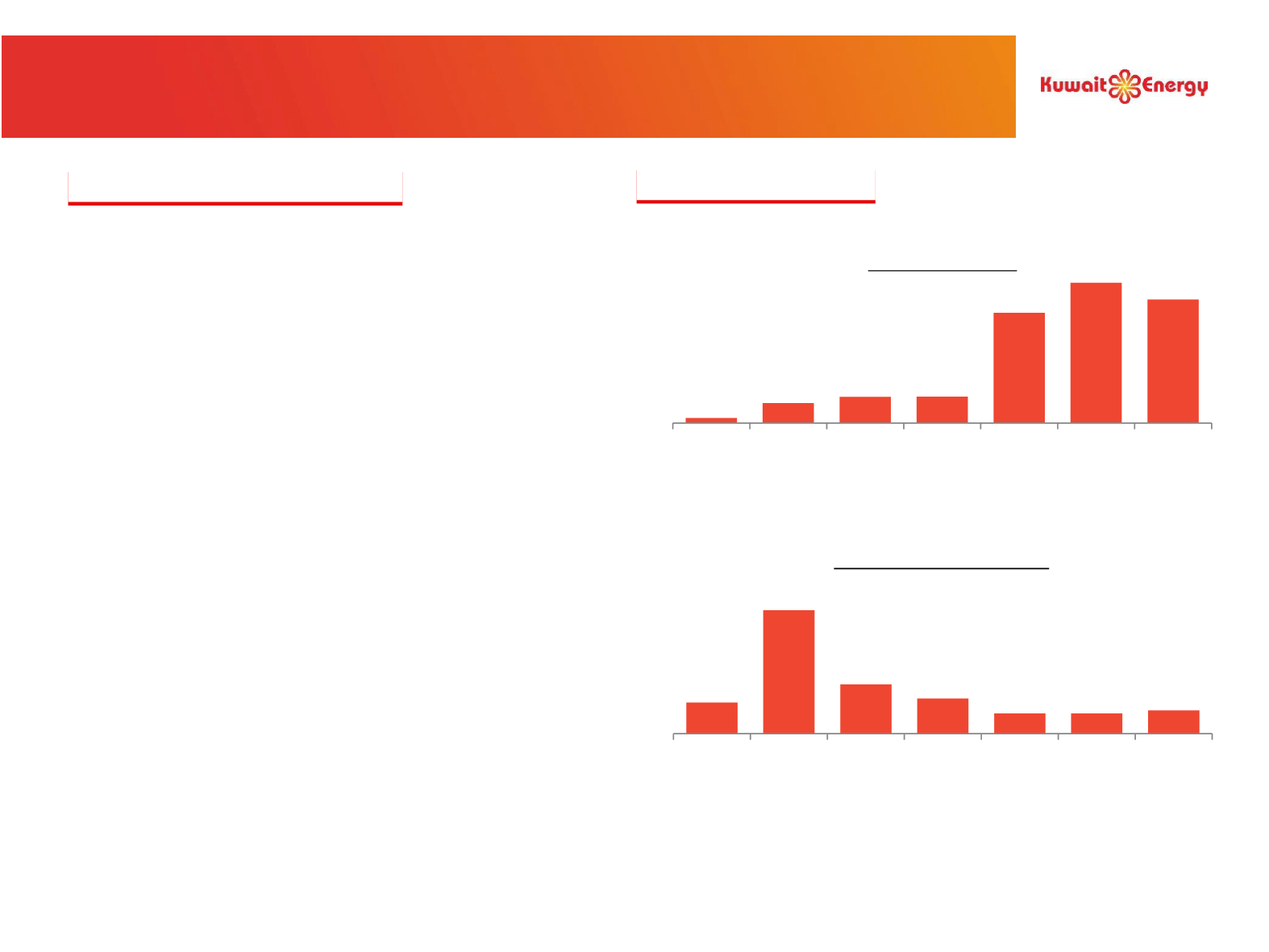

12.6x

1

28.9x

19.9x

14.2x

8.2x

8.2x

9.4x

2011 2012 2013 2014 2015 2016 YTD-Sept

2017

0.1x

0.6x

0.8x

0.8x

3.3x

4.2x

3.7x

2011 2012 2013 2014 2015 2016 YTD-Sept

2017

Key Elements of Financial Policy

Source: Company filing.

(1) Represents operating cash flow before change in working capital.

Key Leverage Metrics

OCF

(1)

/ Interest Expense

Net Debt / OCF

(1)

o

Funding policy aimed at ensuring that sufficient

facilities are available to support business plan

▪

3-year plan and 12-month budgeting process

o

Active portfolio management to optimise cash flows

▪

Sale of 10% interest in Block 9 in 2015

▪

Sale of 15% revenue WI / 20% cost WI in Siba

in 2017

▪

Sale of 25% interest in Abu Sennan in 2017

o

Investment opportunities evaluated based on NPV,

investment efficiency and payback period

▪

Targeting primarily operated assets, allowing

control of pace and quantum of spending

o

No commodity price hedging or borrowings at floating

interest rates

▪

Revenue is typically priced in USD, the

company’s functional and presentational

currency

▪

Large portion of funded debt carries a fixed

interest rate

25

Low Cost Operator with Prudent Capital Structure