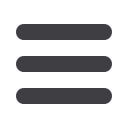

Abraaj

50

14%

QFB

50

14%

Notes

250

67%

Vitol

17

4%

Building Loan

3

1%

(2)

Convertible

Debt

Debt Outstanding as at September 2017 ($m)

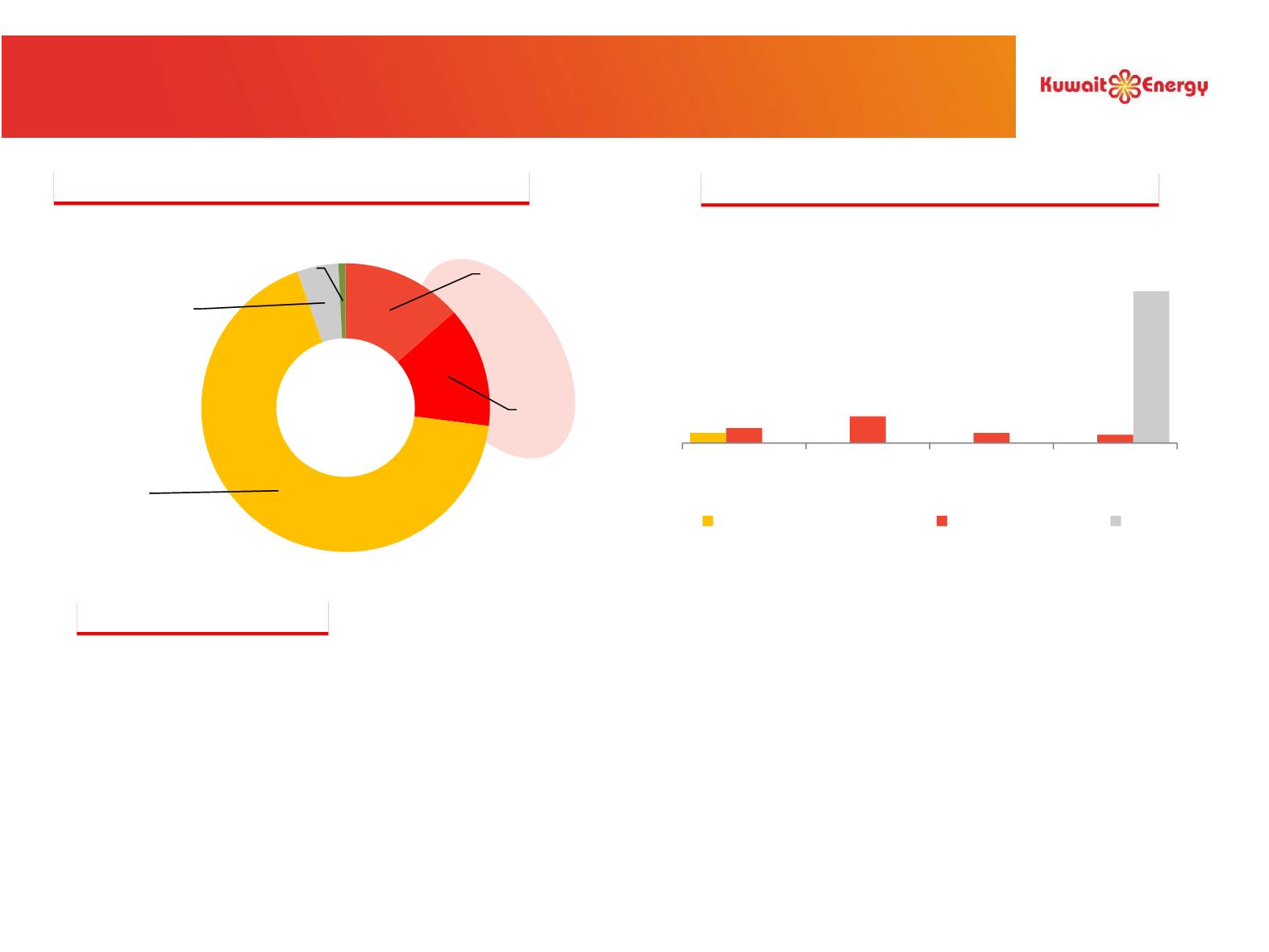

Debt Maturities for Existing Facilities ($m)

Credit Facilities Update

$370 m

17

25

44

17

14

250

1H 2018

2H 2018

1H 2019

2H 2019

Vitol prepayment facility Convertible Debt

Bond

Bond

o

Agreement signed with Vitol in December 2016 for a pre-payment facility of up to $100m

▪

$40m was drawn down in December 2016

▪

$20m was drawn down in May 2017

▪

$20m was drawn down in December 2017

o

$250m bond issued in August 2014 at 9.5% coupon rate, maturing in 2019

o

$50m Abraaj and $50m QBF convertible loans

Source: Company filing, loan agreements.

(1) Agreement reached with Abraaj to delay conversion decision till 30 June 2018

(2) Agreement reached with QFB to convert debt into equity

(1)

26

Capital Structure and Debt Profile