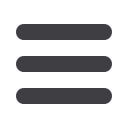

139

183

262

271

156

139

146

2011 2012 2013 2014 2015 2016 YTD-Sept

2017

105 107 106

96

50

39

48

2011 2012 2013 2014 2015 2016 YTD-Sept

2017

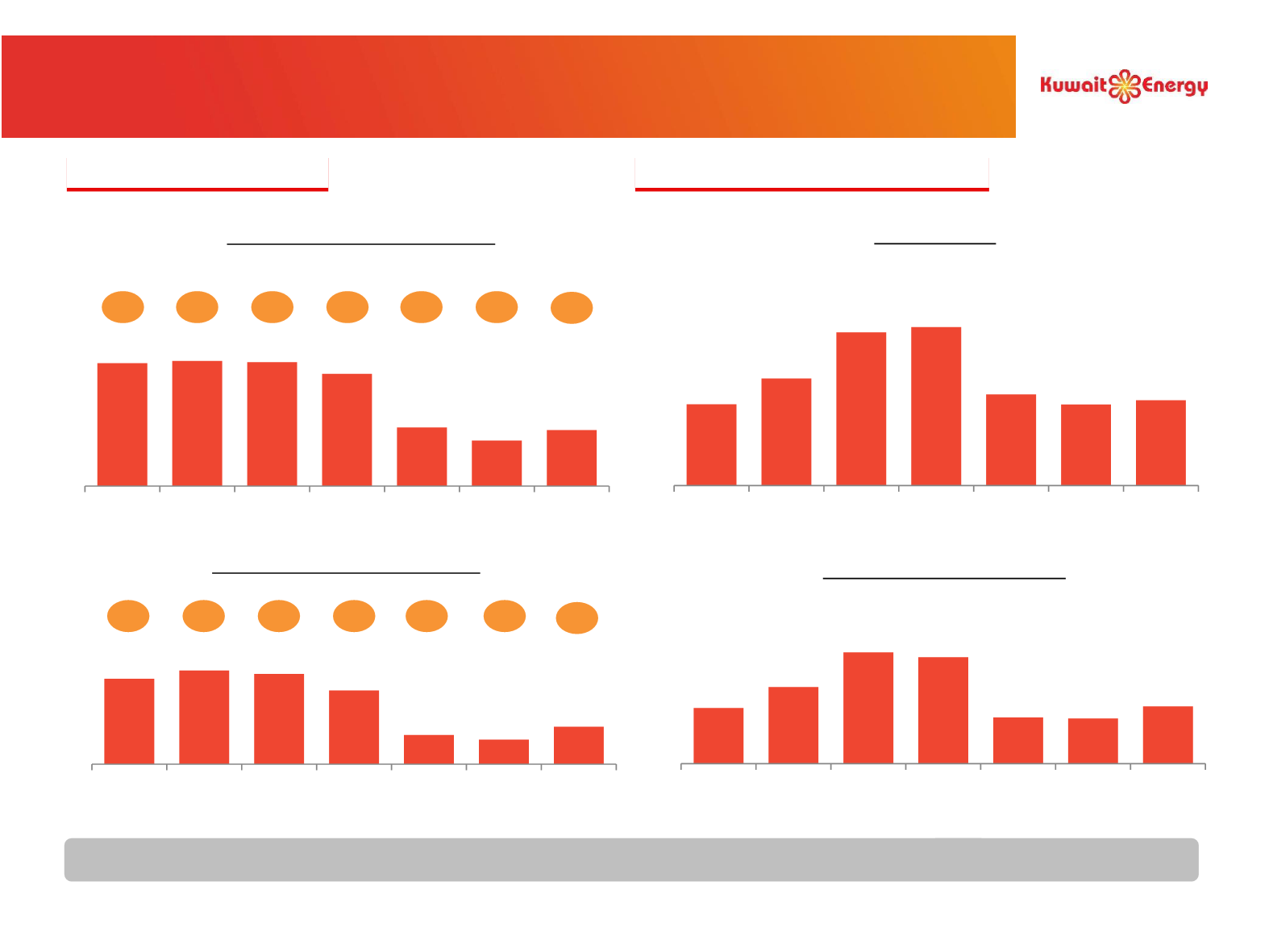

High Margin Production

Consistent Cash Flow Generation

73

80

77

63

25

21

32

2011 2012 2013 2014 2015 2016 YTD-Sept

2017

Average Realised Price ($/boe)

Operating Cash Flow ($/boe)

(1)

95

131

190 182

79

77

98

2011 2012 2013 2014 2015 2016 YTD-Sept

2017

Revenue ($m)

Operating Cash Flow ($m)

(1)

69% 72% 72% 67% 51% 56%

OCF

margin

Source: Company filing.

(1) Represents operating cash flow before change in working capital.

(2) Mansuriya on administrative hold; remuneration fee in respect of Siba and Mansuriya deferred until cost pool is below 50% of revenue in a given period; ‘remuneration’ revenue is as defined/interpreted in the

underlying concession agreements.

Iraqi remuneration revenue is not sensitive to oil price volatility

8.3

7.1

8.0

7.2

7.8

5.9

Opex/boe

24

Operations with Cash Generative Assets

(2)

4.5

67%