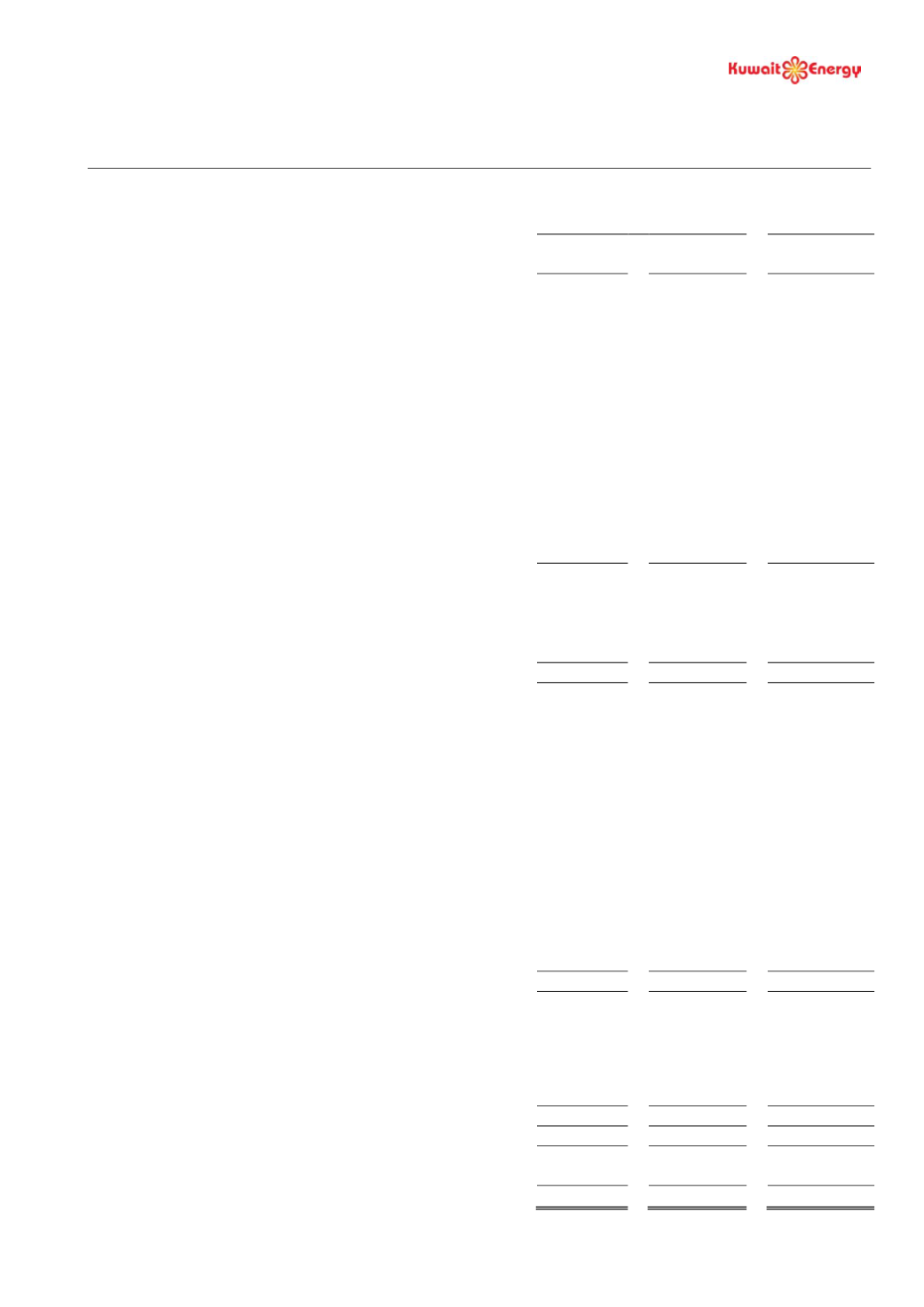

KUWAIT ENERGY PLC

CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS

For the nine month period ended 30 September 2016

6

Nine month period ended

30 September

Year ended

31 December

2016

2015

2015

Unaudited

Unaudited

Audited

Note

US$ 000’s

US$ 000’s

US$ 000’s

OPERATING ACTIVITIES

(Loss)/profit for the period

(12,407)

15,477

(62,367)

Adjustments for:

Share in results of joint venture

767

(2,071)

(445)

Depreciation, depletion and amortisation

48,171

65,010

69,147

Exploration expenditure written off

-

2,519

14,218

Impairment of oil and gas assets

-

-

69,010

Profit on farm-out of working interest

-

(35,000)

(33,876)

Tax charge

837

1,768

2,259

Foreign exchange loss

42

1,789

1,851

Fair value loss on convertible loans

10,118

12,296

9,261

Finance costs

6,975

7,004

9,654

Interest income

(401)

(967)

(1,177)

Provision for retirement benefit obligation

469

505

1,487

Operating cash flow before movement in working capital

54,571

68,330

79,022

(Increase)/decrease in trade and other receivables

(26,946)

32,995

58,776

Decrease in trade and other payables

(2,628)

(31,912)

(25,807)

(Increase)/decrease in inventories

(384)

1,290

1,793

Tax paid

(532)

(9,624)

(9,624)

Net cash generated by operating activities

24,081

61,079

104,160

INVESTING ACTIVITIES

Purchase of intangible exploration and evaluation assets

(2,446)

(9,213)

(10,596)

Purchase of oil & gas assets

(68,834)

(115,052)

(205,922)

Purchase of other fixed assets

(132)

(7,625)

(10,802)

Decrease/(increase) in capital inventory stores

391

(5,310)

(4,562)

Proceeds from farm-out of working interests

-

43,190

43,190

Proceeds from disposal of other fixed assets

60

-

-

(Additions to)/ withdrawal from decommissioning and

retirement benefit obligation fund

(114)

1,050

300

Net increase in liquid investment

-

(50,000)

-

Investment in Joint Venture

(945)

-

(945)

Dividend received from joint venture

2,000

2,000

4,000

Interest received

503

743

1,157

Net cash used in investing activities

(69,517)

(140,217)

(184,180)

FINANCING ACTIVITIES

Proceeds from finance lease

-

5,902

5,902

Repayment of obligations under finance leases

(1,468)

-

(489)

Finance costs paid

(31,551)

(31,274)

(34,342)

Net cash used in financing activities

(33,019)

(25,372)

(28,929)

Effect of foreign currency translation

(50)

(1,513)

(1,746)

Net decrease in cash and cash equivalents

(78,505)

(106,023)

(110,695)

Cash and cash equivalents at beginning of the period

105,297

215,992

215,992

Cash and cash equivalents at end of the period

8

26,792

109,969

105,297