KUWAIT ENERGY PLC

NOTES TO THE CONDENSED SET OF FINANCIAL STATEMENTS

For the nine month period ended 30 September 2016

8

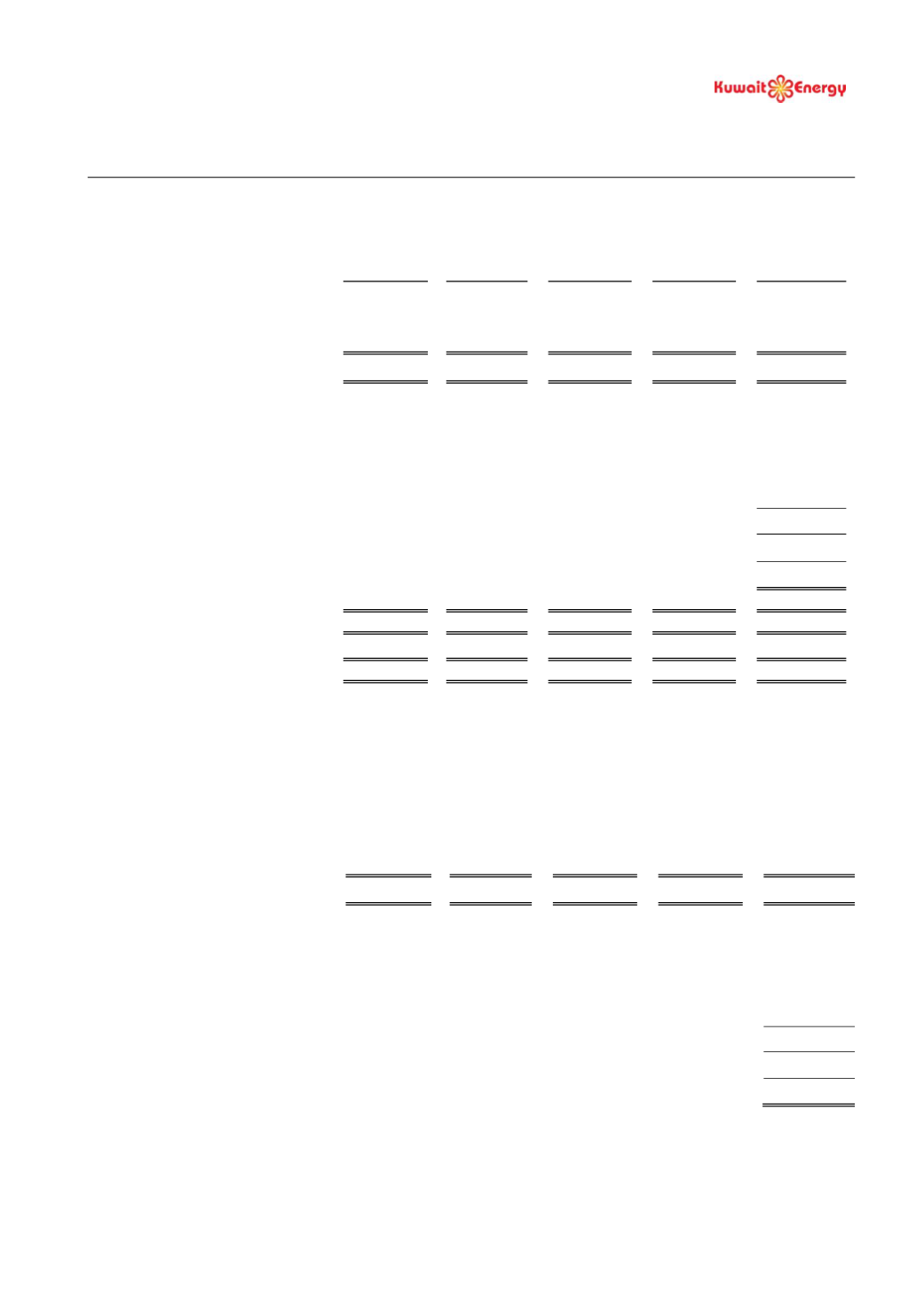

3. SEGMENTAL INFORMATION (CONTINUED)

The following is an analysis of the Group’s revenue and results by reportable segments:

Egypt

Iraq

Yemen

Others

Total

US$ 000’s US$ 000’s

US$ 000’s

US$ 000’s

US$ 000’s

30 September 2016 (Unaudited)

Segment revenues

77,330

20,116

-

-

97,446

Segment operating profit/(loss)

8,663

6,547

(3,497)

(6,430)

5,283

Share of results of Joint Venture

-

-

-

(767)

(767)

Fair value loss on convertible loans

(10,118)

Other income

1,049

Foreign exchange loss

(42)

Finance costs

(6,975)

Loss before tax

(11,570)

Taxation charge

(837)

Loss for the period

(12,407)

Segment assets

268,484

494,507

79,250

18,116

860,357

E&E assets

11,975

-

21,649

-

33,624

PP&E

177,410

467,888

45,412

1,122

691,832

Segment liabilities

32,572

81,310

21,604

382,136

517,622

Other information:

Additions to E&E

1,669

-

777

-

2,446

Additions to PP&E

11,413

105,825

(352)

121

117,007

Depreciation, Depletion and

Amortisation

38,233

9,405

-

533

48,171

30 September 2015 (Unaudited)

Segment revenues

116,294

-

8,868

-

125,162

Segment operating profit/(loss)

18,421

35,000

(9,694)

(8,548)

35,179

Share of results of Joint Venture

-

-

-

2,071

2,071

Fair value loss on convertible loans

(12,296)

Other income

1,084

Foreign exchange loss

(1,789)

Finance costs

(7,004)

Profit before tax

17,245

Taxation charge

(1,768)

Profit for the period

15,477