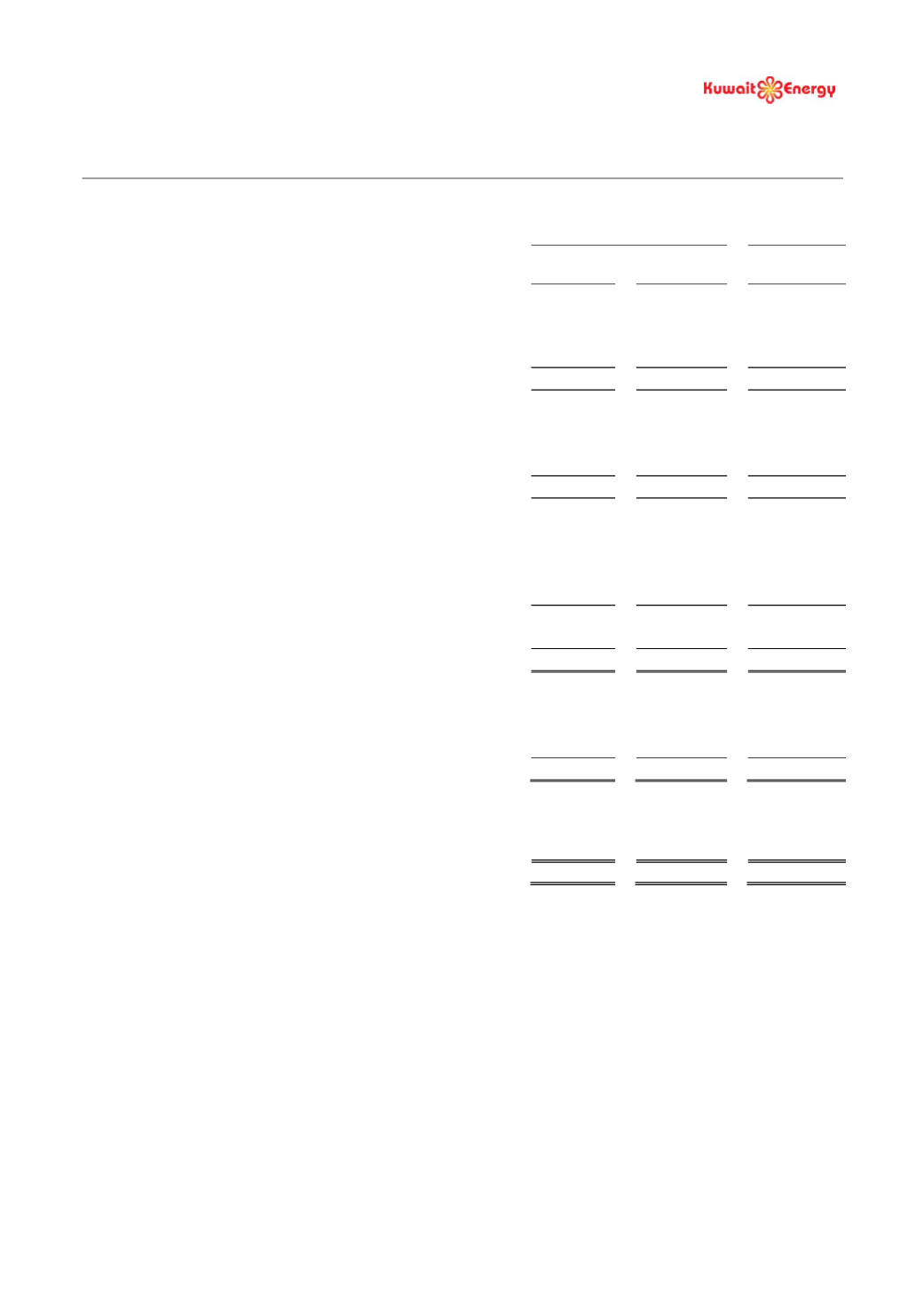

KUWAIT ENERGY PLC

CONDENSED CONSOLIDATED INCOME STATEMENT

For the nine month period ended 30 September 2016

2

Nine month period ended

30 September

Year ended

31 December

2016

2015

2015

Unaudited

Unaudited

Audited

Notes

US$ 000’s

US$ 000’s

US$ 000’s

Continuing Operations

Revenue

97,446

125,162

155,642

Cost of sales

(80,506)

(108,145)

(129,087)

Gross profit

16,940

17,017

26,555

Exploration expenditure written off

5

-

(2,519)

(14,218)

Impairment of oil and gas assets

6

-

-

(69,010)

Profit on farm-out of working interest

-

35,000

33,876

General and administrative expenses

(11,657)

(14,319)

(18,221)

Operating profit/(loss)

5,283

35,179

(41,018)

Share of results of Joint Venture

(767)

2,071

445

Fair value loss on convertible loans

(10,118)

(12,296)

(9,261)

Other income

1,049

1,084

1,231

Foreign exchange loss

(42)

(1,789)

(1,851)

Finance costs

(6,975)

(7,004)

(9,654)

(Loss)/profit before tax

(11,570)

17,245

(60,108)

Taxation charge

(837)

(1,768)

(2,259)

(Loss)/profit for the period

(12,407)

15,477

(62,367)

Attributable to:

Owners of the Company

(12,430)

15,481

(62,220)

Non-controlling interests

23

(4)

(147)

(12,407)

15,477

(62,367)

(Loss)/earnings per share attributable to owners of the Company

-

Basic (cents)

4

(3.8)

4.7

(19.1)

-

Diluted (cents)

4

(3.8)

4.7

(19.1)