KUWAIT ENERGY plc GROUP

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

For the year ended 31 December 2012

F-102

13.

INTANGIBLE EXPLORATION AND EVALUATION (‘E&E’) ASSETS (CONTINUED)

As at 31 December 2012, exploration costs of USD 182,968 thousand (2011: USD 149,201 thousand) were not

amortised, pending further evaluation of whether or not the related oil and gas properties are commercially

viable. Exploration expenditure written off amounting to USD 3,680 thousand relates to block 74 in Yemen,

where the licence was surrendered during the year.

14.

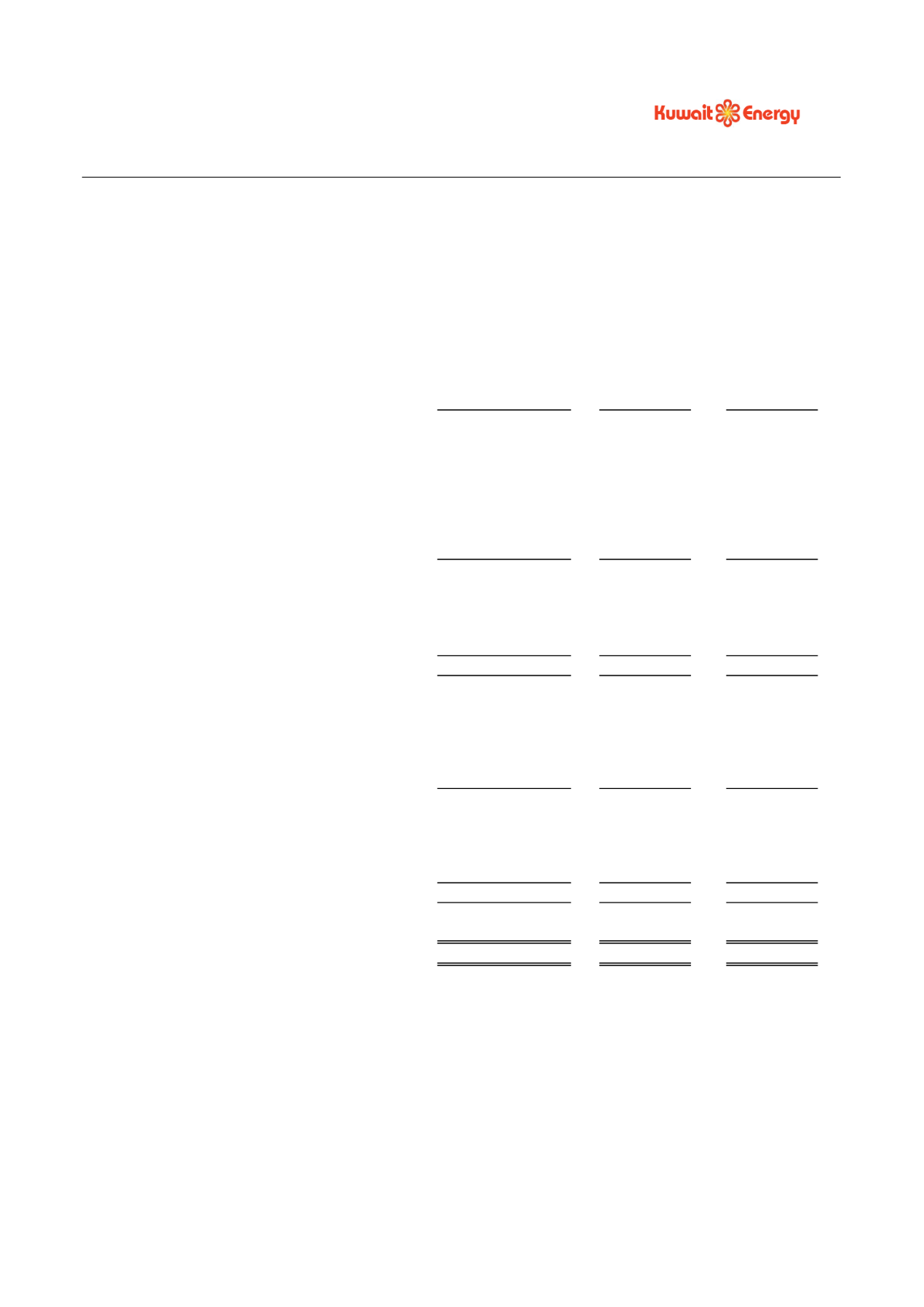

PROPERTY PLANT AND EQUIPMENT

Oil and

gas assets

Other

fixed assets

Total

USD 000’s

USD 000’s USD 000’s

Cost

As at 1 January 2011

462,373

8,323

470,696

Additions

105,530

2,894

108,424

Transfer from E&E assets

131,036

-

131,036

Write-off of asset

(5,374)

-

(5,374)

Disposal

(401)

(21)

(422)

Currency translation effect

-

(1)

(1)

As at 1 January 2012

693,164

11,195

704,359

Additions

78,614

3,756

82,370

Write-back of asset

5,374

-

5,374

Impairment reversal

540

-

540

Disposal

(763)

(511)

(1,274)

As at 31 December 2012

776,929

14,440

791,369

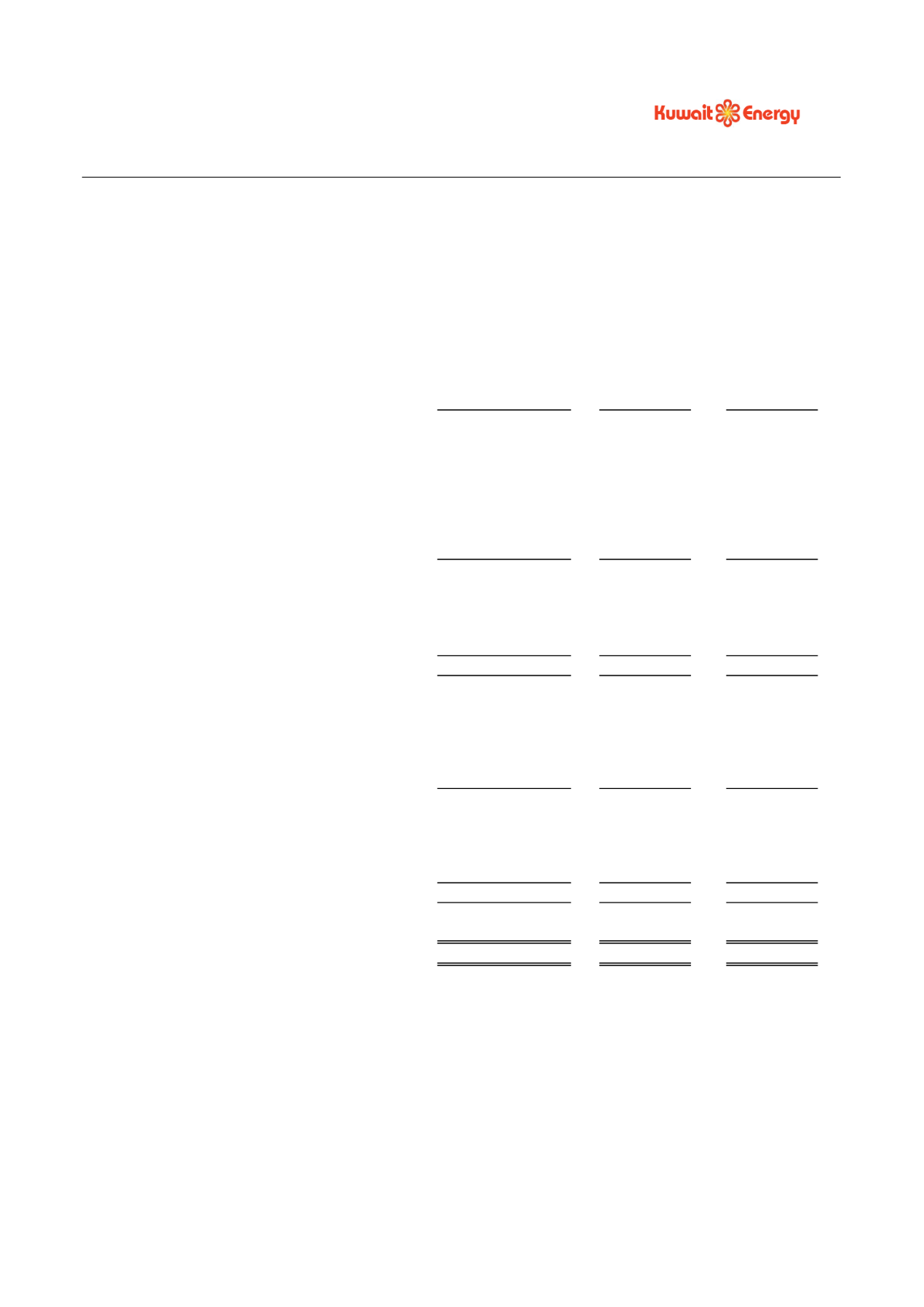

Depreciation, depletion, amortisation and

impairment losses

As at 1 January 2011

161,645

1,802

163,447

Charge for the year

48,145

1,307

49,452

Write-off of asset

(1,308)

-

(1,308)

Disposal

(348)

(11)

(359)

As at 1 January 2012

208,134

3,098

211,232

Charge for the year

65,835

1,888

67,723

Impairment

30,862

-

30,862

Write-back of asset

1,308

-

1,308

Disposal

(282)

(212)

(494)

As at 31 December 2012

305,857

4,774

310,631

Carrying amount

As at 31 December 2012

471,072

9,666

480,738

As at 31 December 2011

485,030

8,097

493,127

During the year, the Group incurred impairment losses on certain oil and gas properties of USD 30,862

thousand (2011: USD 4,066 thousand) and reversed impairment losses amounting to USD 4,606 thousand,

these impairment losses and reversals are described in more detail in note 9.

The additions to oil and gas assets include USD 4,053 thousand (2011: USD 4,997 thousand) of finance costs

on qualifying assets capitalised during the year using a weighted average interest rate of 6.62%, see note 30.

The property, plant and equipment of the subsidiaries Kuwait Energy Egypt Ltd and Kuwait Energy Ukraine

Limited, with a net book value at 31 December 2012 of USD 348,161 thousand are under registered mortgage

to secure certain bank loans (see note 20).