KUWAIT ENERGY plc GROUP

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

For the year ended 31 December 2012

F-112

29.

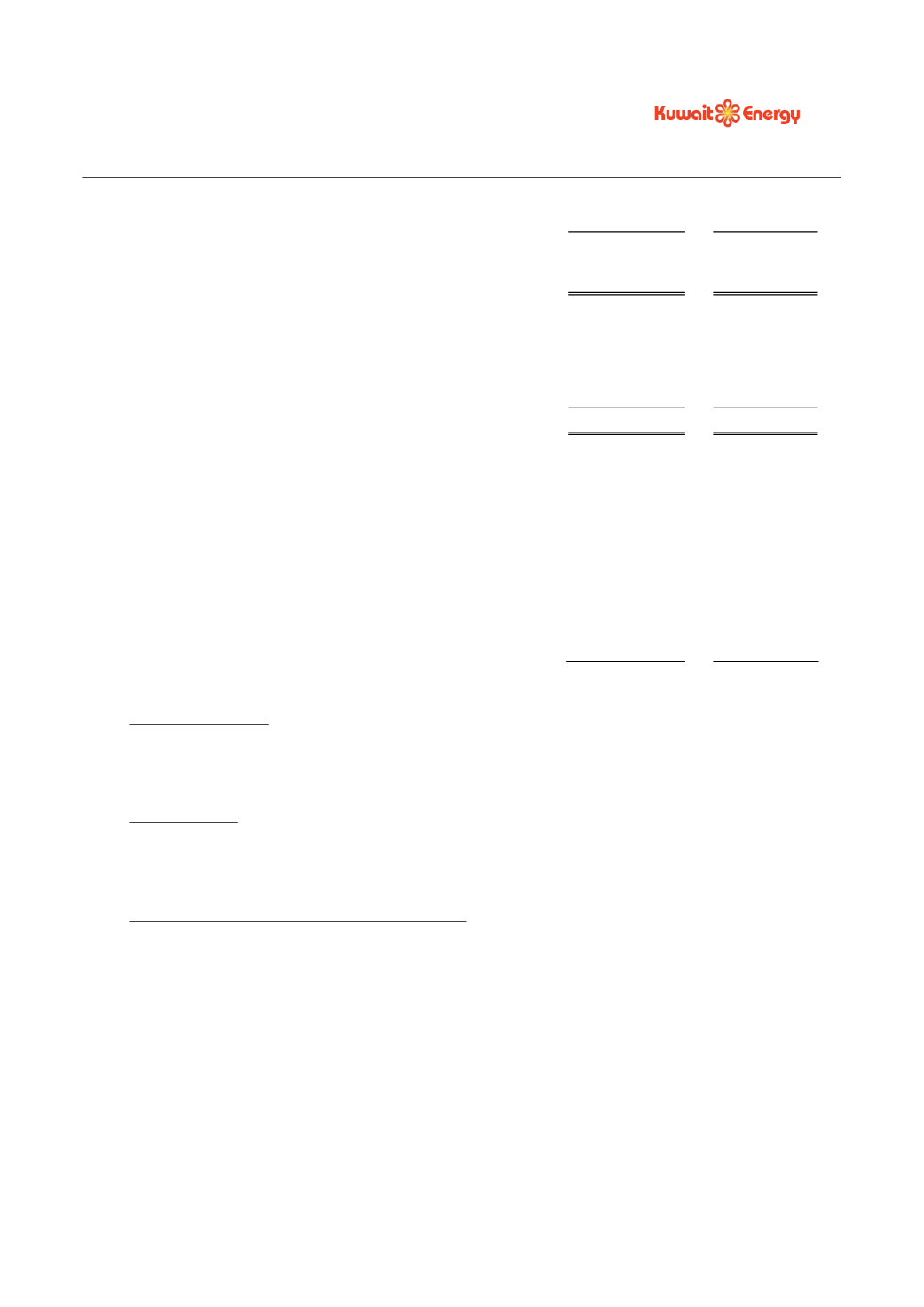

OPERATING LEASE ARRANGEMENTS

2012

2011

USD 000’s

USD 000’s

Minimum lease payments under operating leases recognised in

the consolidated statement of income

1,326

1,781

At the consolidated statement of financial position date, the Group had outstanding commitments for future

minimum lease payments under operating leases, which fall due as follows;

Within one year

1,888

1,410

Between two years and five years

215

591

2,103

2,001

Operating lease payments represent rentals payable by the Group for certain of its office properties. Leases

are negotiated for an average term of one to two years and rentals are fixed for an average of two years with

an option to extend for a further two years at the then prevailing market rate.

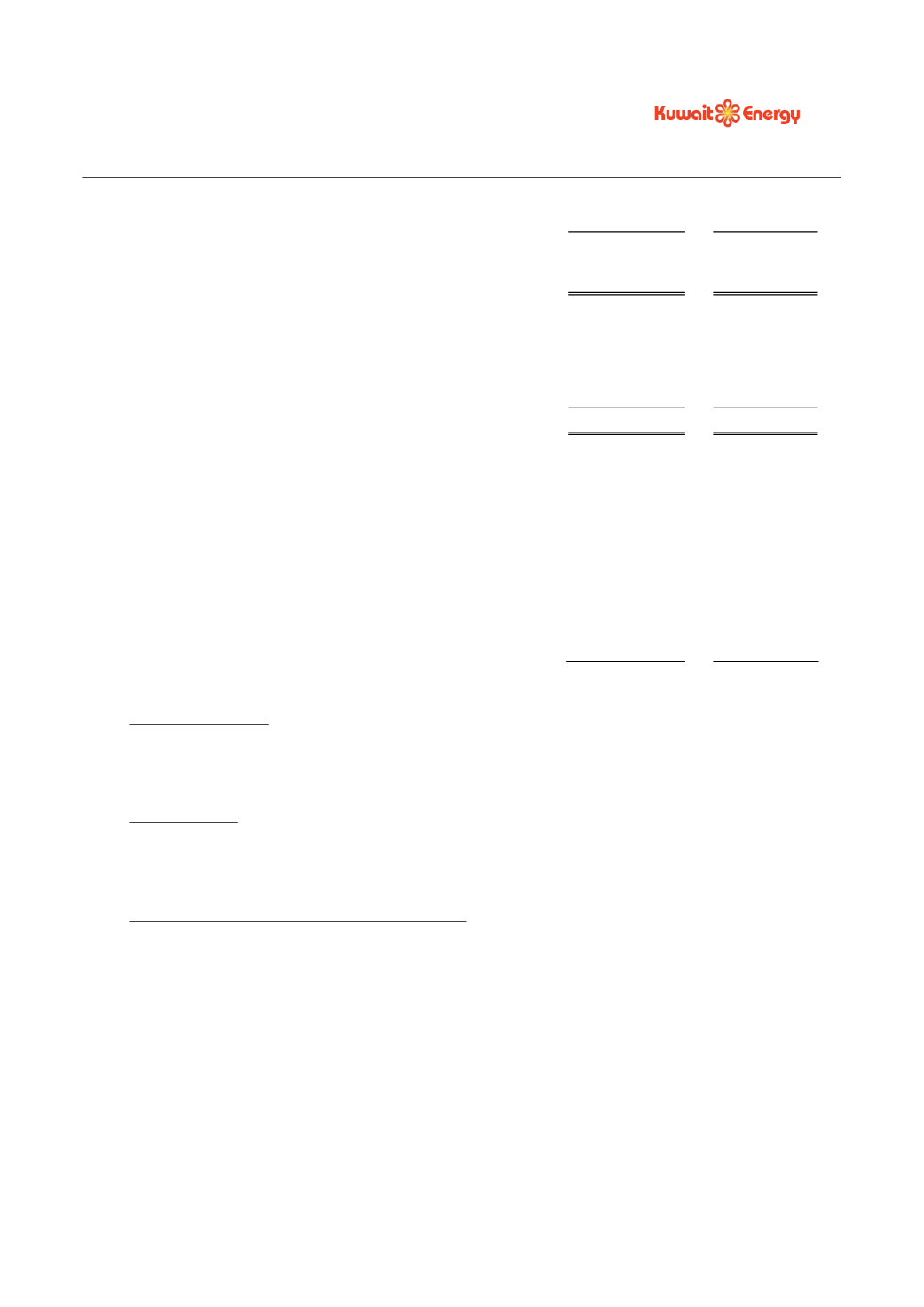

27.

FINANCIAL INSTRUMENTS

Significant accounting policies

Details of the significant accounting policies and methods adopted, including the criteria for recognition, the

basis of measurement and the basis on which income and expenses are recognised, in respect of each class of

financial asset and financial liability are disclosed in note 3 to these consolidated financial statements.

Categories of financial instruments

2012

2011

USD 000’s

USD 000’s

Financial assets

Loans and receivables

- Trade and other receivables

208,102

176,055

Cash and bank balances

48,384

40,477

Financial liabilities

At amortised cost

- Trade and other payables

44,401

52,964

- Long-term loans

60,000

45,000

- Current portion of long term loans

-

8,000

At fair value through profit and loss account (FVTPL)

-Designated as FVTPL - convertible loans

83,213

-

-Derivative financial instruments

484

750

Fair value of financial instruments

(a)

Cash, Bank, trade and other receivables balances approximates the carrying value due to short-term

nature of these instruments.

(b)

Fair value of loans from banks approximates carrying value which is recognised at amortised cost.

(c)

Financial assets and liabilities that are measured subsequent to initial recognition at fair value are

derivatives (note 24) and convertible loans (note 21).

There have been no transfers between categories during the period.