KUWAIT ENERGY plc GROUP

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

For the year ended 31 December 2012

F-116

30.

FINANCIAL INSTRUMENTS (CONTINUED)

Liquidity risk management (continued)

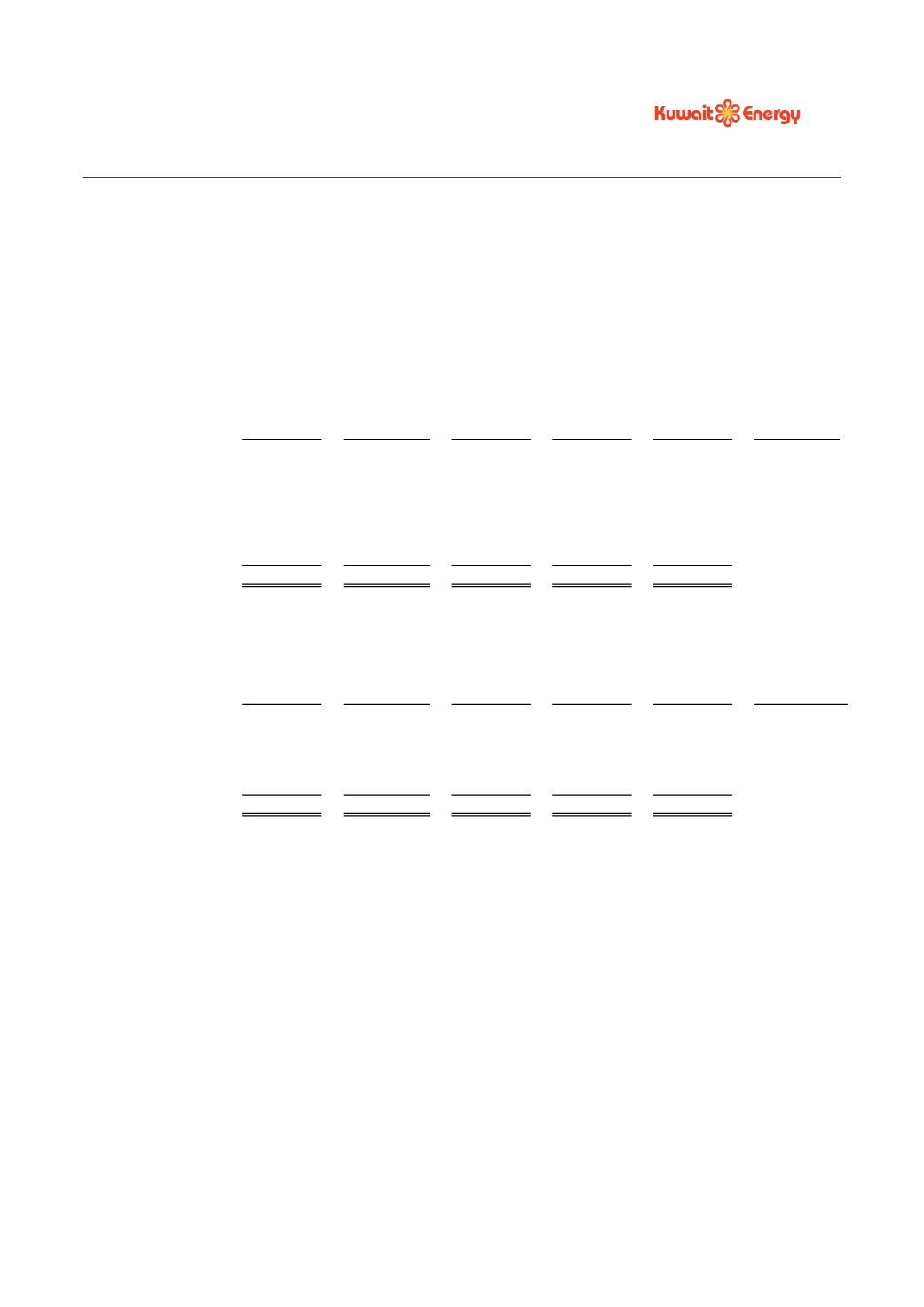

The following tables detail the Group’s remaining contractual maturity for its financial liabilities. The tables have

been drawn up based on the undiscounted cash flows of financial liabilities.

At 31 December 2012

Financial

liabilities

Less than

1 year

Between

1 and 3

years

Between

3 and 5

years

More

than 5

years

Total

Weighted

average

effective

interest

rate

USD

000’s

USD

000’s

USD

000’s

USD

000’s

USD

000’s

%

Long-term loans

3,306

6,654

66,600

-

76,560

6.62%

Convertible

loans

7,359

16,000

16,000

89,967

129,325

16%

Trade and other

payables

44,401

-

-

-

44,401

-

55,066

22,654

82,600

89,967

250,286

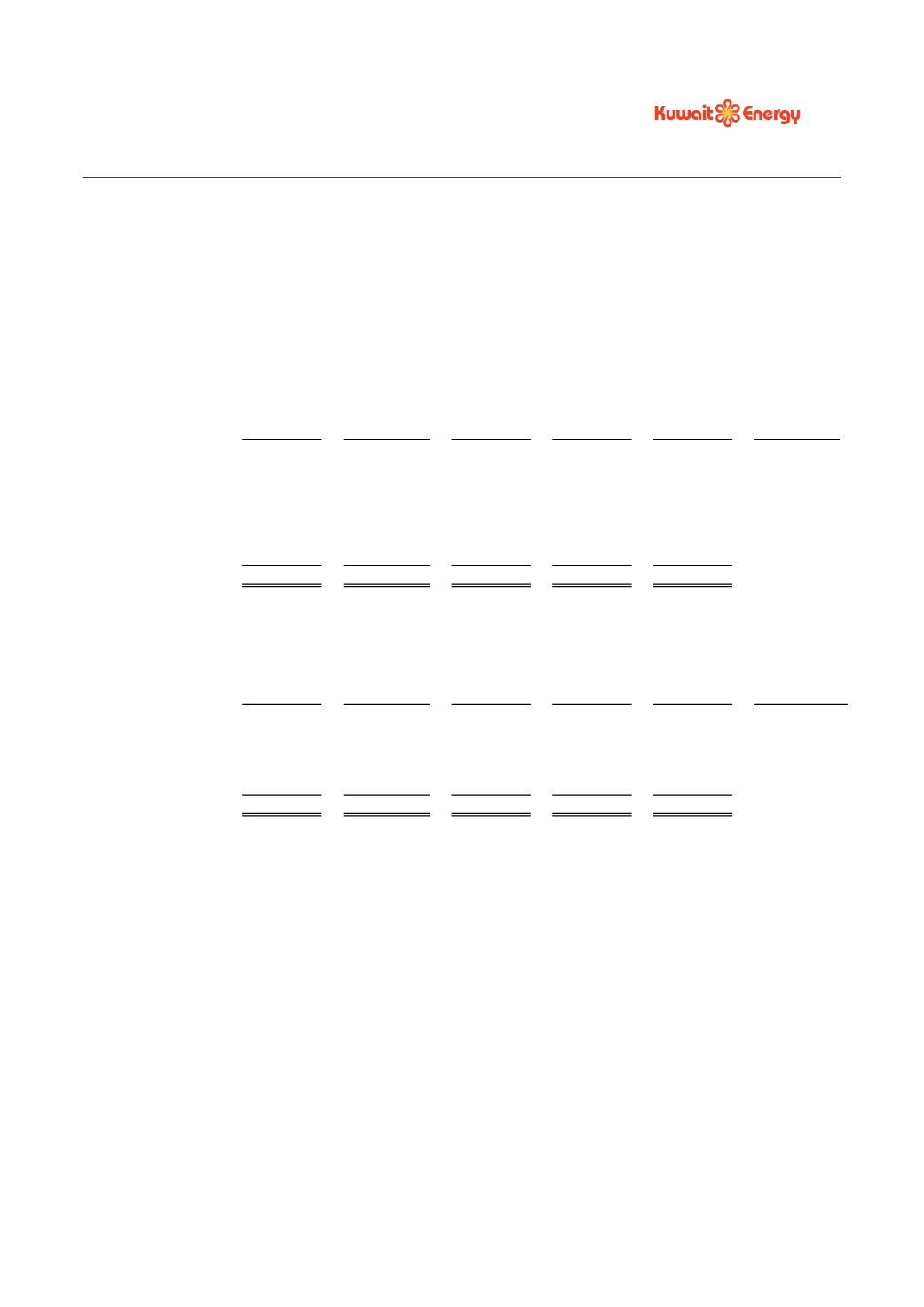

At 31 December 2011

Financial

liabilities

Less than

1 year

Between

1 and 3

years

Between

3 and 5

years

More

than 5

years

Total

Weighted

average

effective

interest rate

USD

000’s

USD

000’s

USD

000’s

USD

000’s

USD

000’s

%

Long-term loans

8,000

40,667

7,721

-

56,388

10.11%

Trade and other

payables

52,964

-

-

-

52,964

-

60,964

40,667

7,721

-

109,352

The group has access to financial facilities as described in notes 20 and 21, of which USD 95 million is unused at

the balance sheet date (2011 : USD 5 Million). The group expects to meet its other obligations from operating

cash flows.