KUWAIT ENERGY plc GROUP

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

For the year ended 31 December 2012

F-100

10.

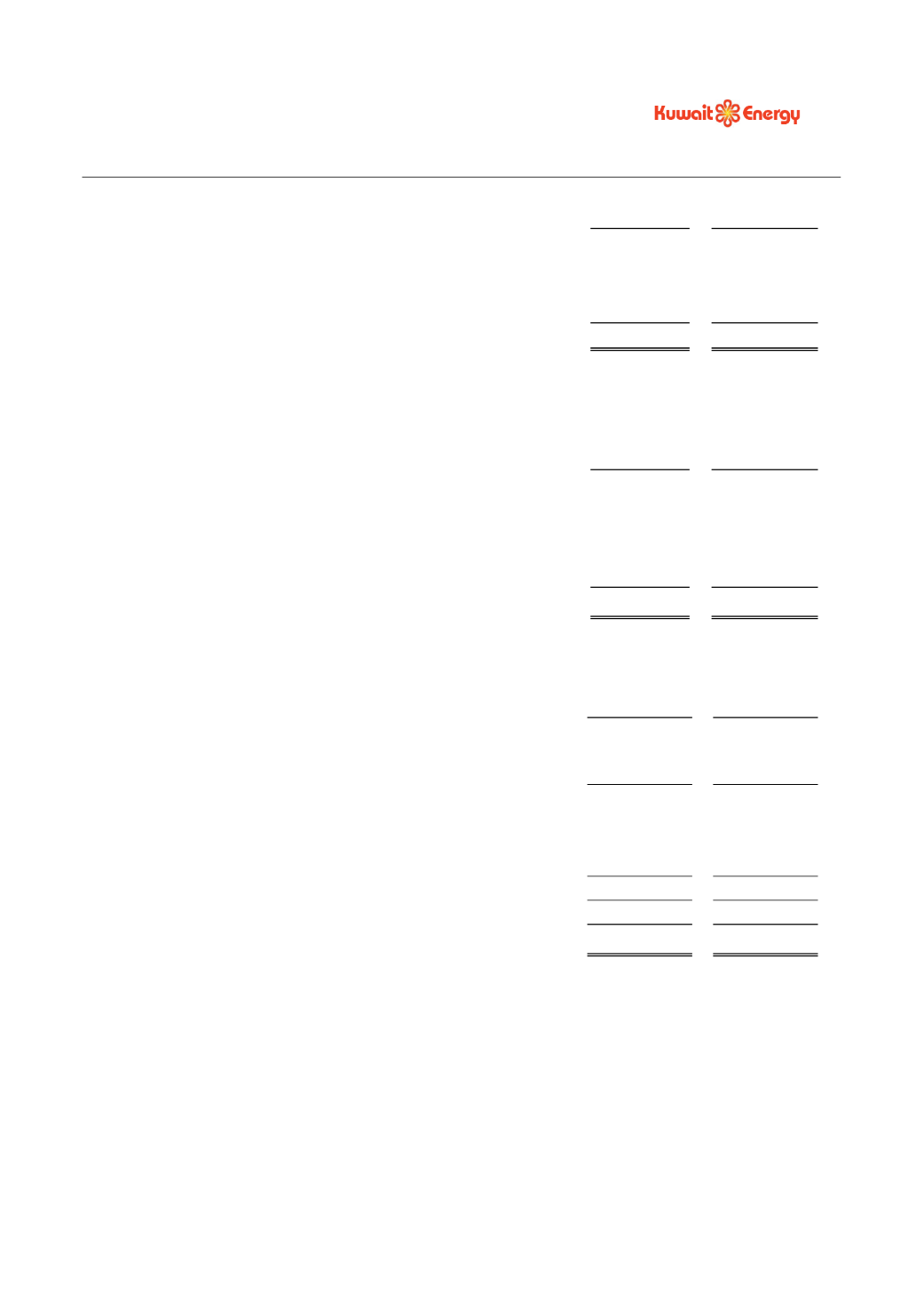

OTHER INCOME

2012

2011

USD 000’s

USD 000’s

Interest income

138

197

Reversal of account payable

2,675

-

Others

562

603

3,375

800

During the year the group reversed an amount owed to one of its creditors in Russia amounting to USD 2,675

thousand following a court decision on the disputed balance in favour of the group.

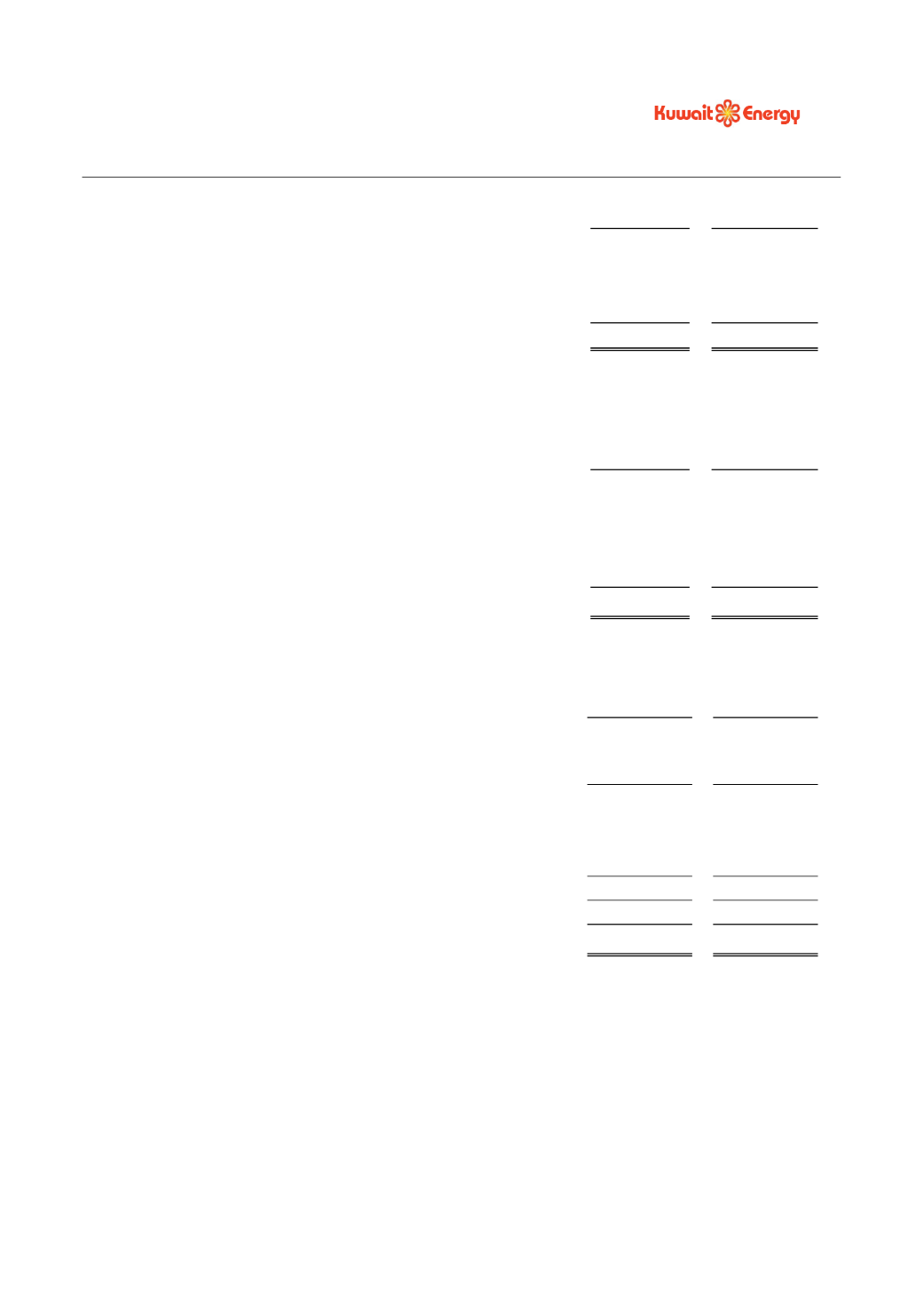

11.

FINANCE COSTS (NET)

2012

2011

USD 000’s

USD 000’s

Realised hedge loss (see note 24)

-

7,101

Unwinding of decommissioning provision

158

107

Borrowing costs on bank overdrafts and loans

10,456

5,681

Less: amount capitalised in cost of qualifying assets

(4,906)

(5,140)

5,708

7,749

12.

TAXATION

INCOME TAX EXPENSE

2012

2011

Tax on profit on ordinary activities

USD 000’s

USD 000’s

Current tax:

Corporation tax

8,713

8,957

Total current tax

8,713

8,957

Deferred tax:

Origination and reversal of temporary differences

(6,760)

912

Total deferred tax

(6,760)

912

Tax on profit on ordinary activities

1,953

9,869

Corporation tax in the Company’s country of domicile is calculated at 0% (2011: 0%) on assessable profits,

this rate being the applicable statutory tax rate for international businesses that are tax resident in Jersey.

Taxation for other jurisdictions is calculated at the rates prevailing in the respective jurisdictions.