KUWAIT ENERGY plc GROUP

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

For the year ended 31 December 2012

F-97

5.

SEGMENTAL INFORMATION (CONTINUED)

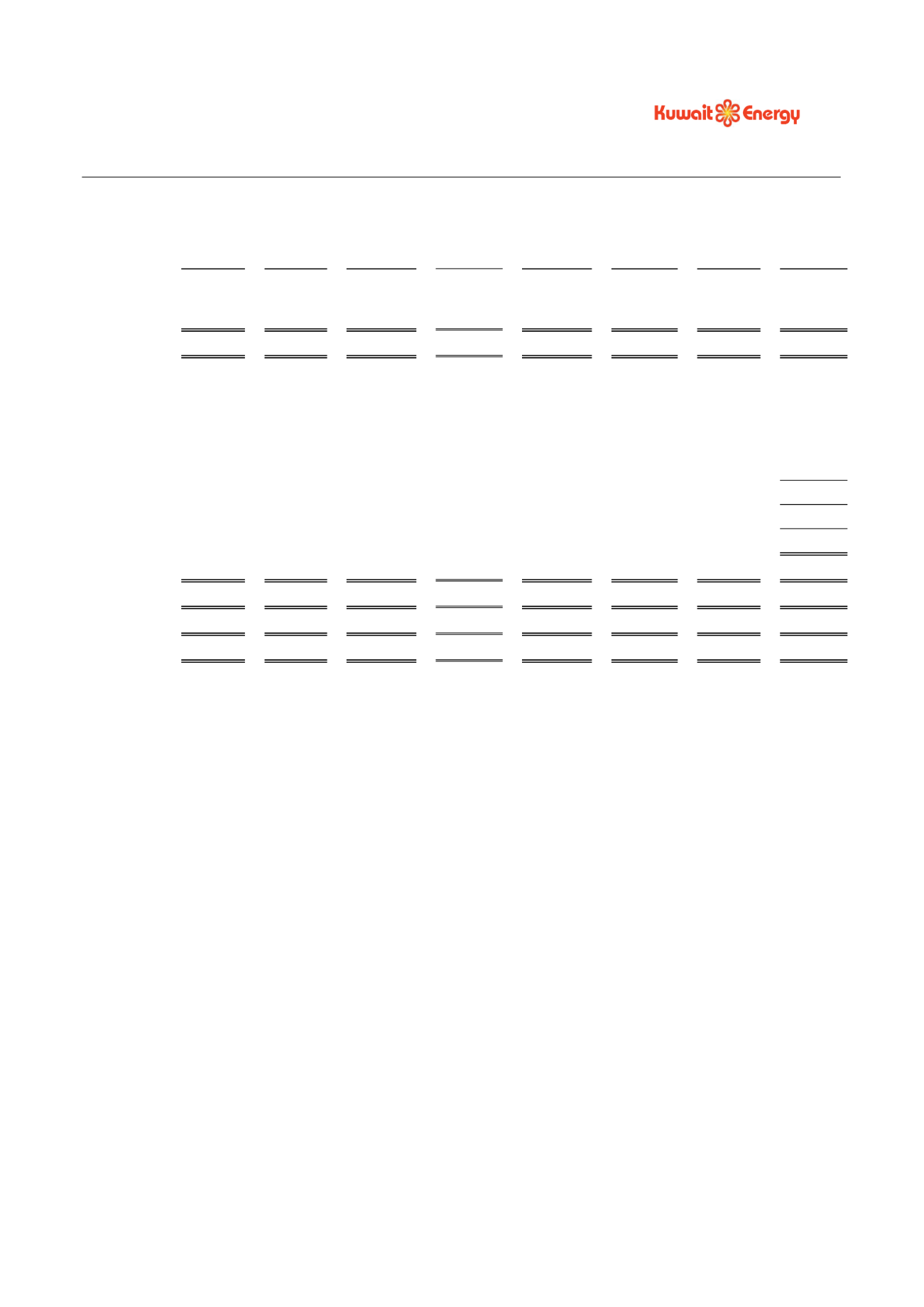

Egypt

Yemen

Iraq

Oman

Ukraine

Russia

Others

Total

USD 000’s

USD 000’s

USD 000’s

USD 000’s

USD 000’s

USD 000’s

USD 000’s

USD 000’s

31 December 2012

Segment revenues

168,241

14,735

-

20,607

8,031

13,653

-

225,267

Segment results

94,039

(21)

-

3,480

1,858

(35,753)

(14,557)

49,046

Gain on held for

trading derivative

266

Fair value loss on

convertible loans

(213)

Other income

3,375

Foreign exchange

gain

151

Finance costs (net)

(5,708)

Profit before tax

46,917

Taxation

(1,953)

Profit for the year

44,964

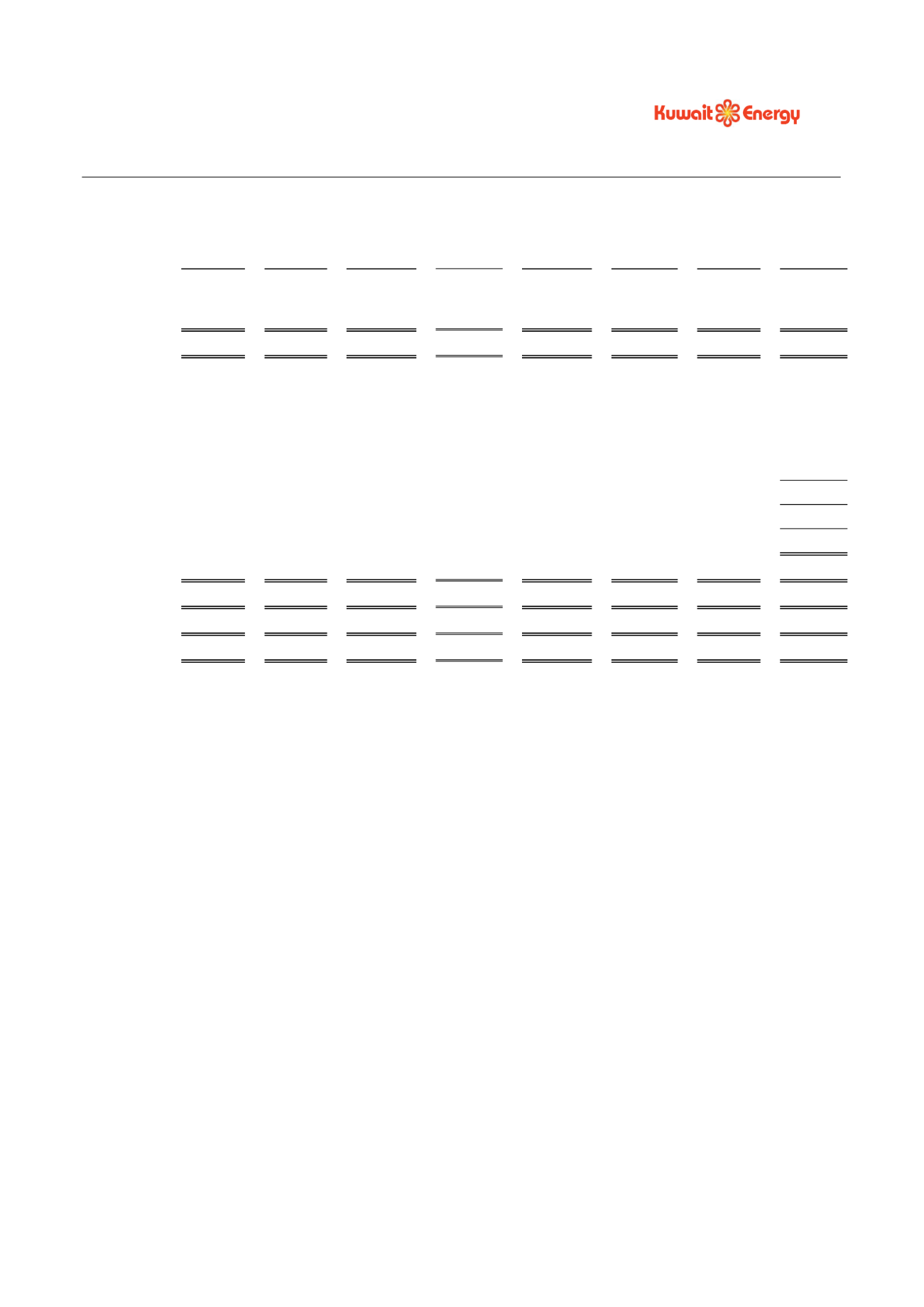

Segment assets

506,699

55,935

24,015

14,161

180,367

122,212

94,637

998,026

E&E assets

100,797

41,195

-

-

7,500

11,026

22,450

182,968

PP&E

190,776

4,007

23,696

6,359

153,377

101,278

1,245

480,738

Segment liabilities

30,800

5,138

2,701

5,106

21,606

8,673

167,059

241,083

Other information

Impairment loss /

(reversal)

-

-

-

(540)

(4,830)

30,862

-

25,492

E&E written off

-

3,680

-

-

-

-

-

3,680

Additions to E&E

24,381

9,351

-

-

-

372

3,343

37,447

Additions to PP&E

14,145

2,778

19,212

12,973

8,987

21,397

2,878

82,370