Kuwait Energy

EL-12-211107

28

The producing reservoir in all the existing wells except Diaa-1 is the Middle Cretaceous

(Cenomanian) Upper and Lower Bahariya Formation (Figure 1.2), comprising sandstones

interbedded with siltstones and carbonates. The sandstone units are considerably thicker

in the Lower Bahariya than the Upper Bahariya, where the individual units are potentially

isolated. Diaa-1 produces from sandstone in the Lower Cretaceous Kharita Formation.

Production forecasts have been made by decline curve analysis for the existing wells in

ERQ, using analogy to estimate the decline rate for those wells with short or no

production history. This is complemented by a volumetric approach, which was used to

constrain the decline curve forecasts and to estimate the potential for additional wells.

Six new wells are planned: Al Zahraa-4 and Shahd SE-9 in 2014, a side-track of Rana-2

(which missed its original target), Shebl-2 and (in the 3P case only) Al Zahraa-5 and

Shebl SE-10 in 2015.

The development plan for ERQ calls for wells to be produced first from the Lower

Bahariya, and later to be recompleted and fractured for production from the Upper

Bahariya. There is little production to date from the Upper Bahariya Formation in ERQ.

Only Shahd-1 has produced at a significant rate (up to 530 bopd), while hydraulic fracture

treatments in Ghard-2 and Rana SE-2 in 2010 resulted in production rates of 40 bopd or

less.

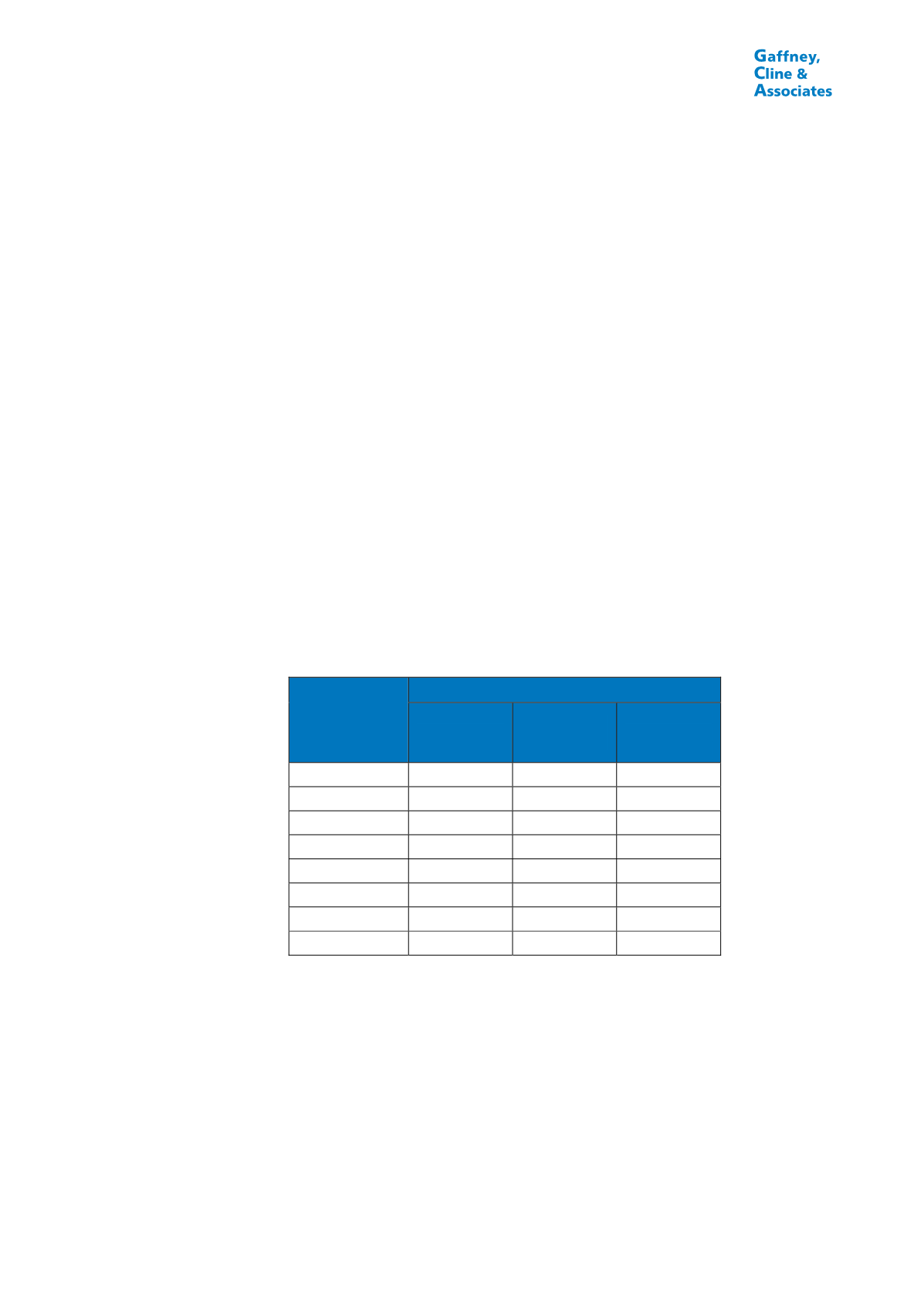

Table 1.3 shows the breakdown by field of the Reserves attributed to ERQ.

TABLE 1.3

FIELD LEVEL BREAKDOWN OF RESERVES, ERQ, EGYPT,

AS AT 31

st

MAY, 2014

Field

Gross Field Oil Reserves (MBbl)

Proved

Proved +

Probable

Proved +

Probable +

Possible

Al Zahraa

893

1,484

3,182

Shahd SE

8,211

13,014

19,927

Shahd

136

263

393

Ghard

123

414

726

Rana

178

295

429

Diaa

107

184

236

Shebl

31

169

392

Total

9,679

15,824

25,285

Notes:

1.

The Reserves shown here are included in the Reserves shown in Table 0.2.

2.

Totals may not exactly equal the sum of the individual entries due to rounding.

Future cost estimates have been provided by KE. Key elements are as follows:

US$3.5 MM per well for each new well;

US$2.3 MM for the side-track of Rana-2;

US$0.24 MM to recomplete a well in the Upper Bahariya, including hydraulic

fracturing (other work-over costs are included in OPEX); and