99

98

KUWAIT ENERGY plc

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

For the year ended 31 December 2014

39

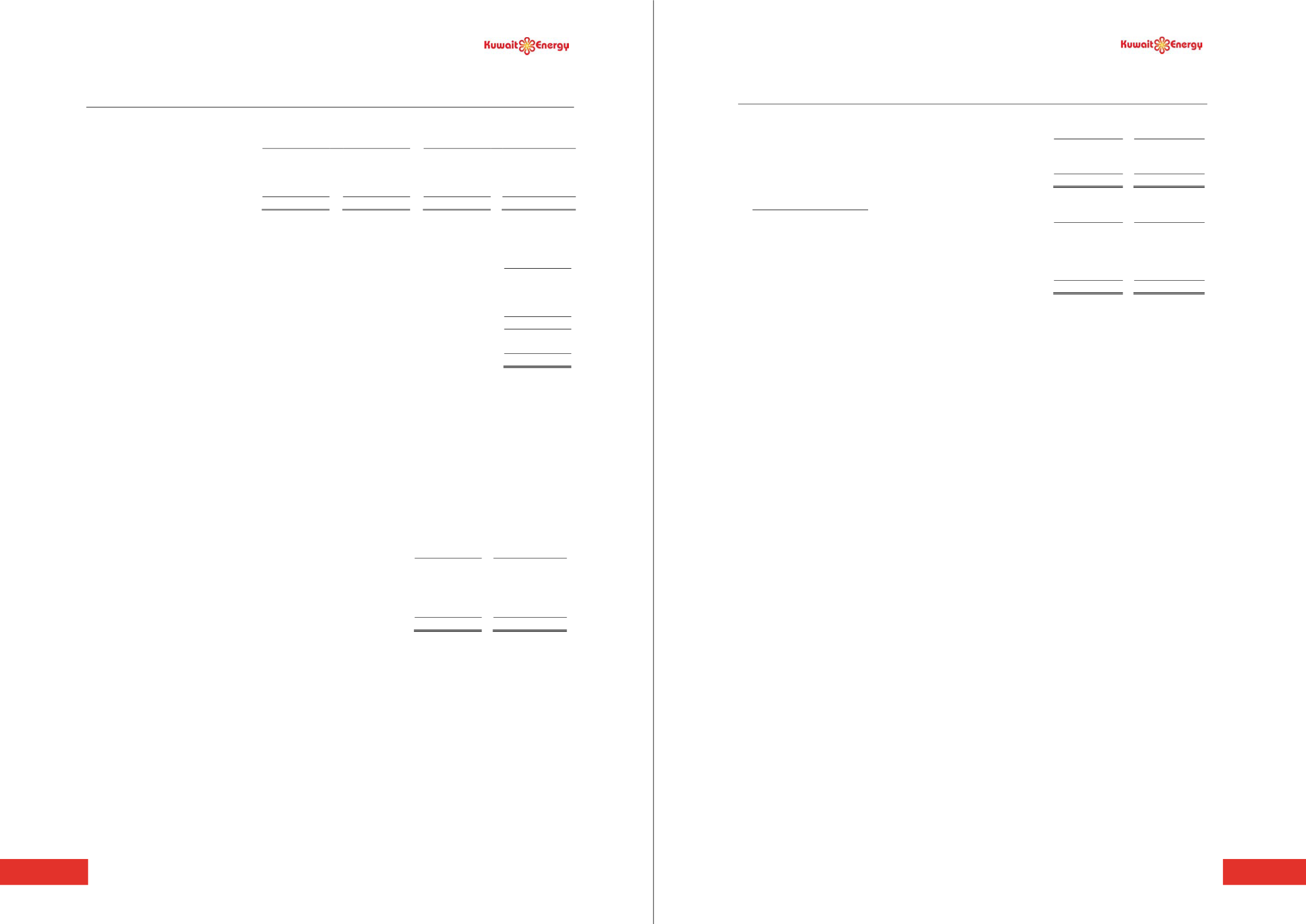

23.

BORROWINGS

2014

2013

USD 000’s

USD 000’s

USD 000’s

USD 000’s

Non-current

Current

Non-current

Current

Senior guaranteed notes (a)

242,459

-

-

-

Long-term loans (b)

-

-

88,867

75,649

242,459

-

88,867

75,649

(a)

Senior guaranteed notes

The details of Senior guaranteed notes are as follows:

2014

USD 000’s

Par value payable on maturity

250,000

Initial transaction fees

(8,201)

Fees amortised and included in finance cost during 2014

660

Non-current portion of Senior guaranteed notes

242,459

Interest accrued and payable within 12 months (included in trade and other payables)

9,896

Carrying value as at 31 December 2014

252,355

During 2014, the Group issued USD 250 million aggregate principal amount of 9.5% Senior guaranteed notes due

2019 (the “Notes”). Interest on the Notes will be paid semi

-annually in arrears on 4 February and 4 August,

commencing on 4 February 2015. The Notes have been admitted by the Irish Stock Exchange for listing and trading

on the Global Exchange Market. The proceeds received from the Notes was net of amounts used to repay the

outstanding balances under the Reserve Based Facilities and the Arab Bank Facility (see below). The remaining

proceeds, after fees, are being

used to fund capital expenditure of the Group, particularly in respect of the Group’s

assets in Iraq and for general corporate purposes.

The Notes are callable in whole, or, in part, at the option of the Group prior to maturity (subject to certain conditions

being satisfied).

(b) Long-term loans

The details of the loans are as follows:

2014

2013

USD 000’s

USD 000’s

USD 165 million facility from Deutsche Bank Syndicate that bears a floating

interest rate of LIBOR plus 5% per annum.

-

104,516

USD 60 million facility from Arab Bank that bears an interest rate of LIBOR

plus 5% per annum.

-

60,000

-

164,516

The reserve based facility from the Deutsche Bank Syndicate of USD 165 million was secured by pledges on the

assets of the subsidiary Kuwait Energy Egypt Ltd. The facility from Arab Bank was secured by assigning the rights,

title, benefits and interest in the shares of JHOC Limited to the bank as security. Further, receipts under the crude oil

sales agreement with Exxon Worldwide Trading Company were assigned to the bank as security.

The amounts outstanding under the Reserve Based Facilities from the Deutsche Bank Syndicate and the Arab Bank

Facility were repaid in full on 4 August 2014 from the proceeds of the Notes (see above).

Initial transaction costs were capitalised as other non-current assets and amortised using effective the effective interest

rate applicable. The balance outstanding at 31 December 2013 of USD 6,455 thousand, has been charged in full to the

income statement as a finance cost in 2014 on the settlement of the loans and closure of the facilities.

KUWAIT ENERGY plc

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

For the year ended 31 December 2014

40

24.

CONVERTIBLE LOANS

2014

2013

USD 000’s

USD 000

’s

Non-current portion

111,740

105,807

Current portion

6,089

6,744

117,829

112,551

Movement in convertible loan

31.12.2014

31.12.2013

USD 000’s

USD 000’s

As at 1 January

112,551

87,244

Amount drawdown

-

17,000

Change in fair value

13,747

15,683

Payment of coupon interest

(8,469)

(7,376)

As at end of the year

117,829

112,551

During 2012, the Group entered into unsecured financing arrangements with Abraaj Capital and Qatar First Bank for

USD 150 million each (total value of USD 300 million). Under the arrangements, the group has drawn down an

amount of USD 100 million, of which USD 83 million was drawn down in 2012 and USD 17 million was drawn

down in 2013. Of the USD 200 million remaining undrawn on the loans USD 50 million has expired and the residual

USD 150 million is subject to certain additional conditions precedent. The loans are repayable in three equal

instalments payable at every six month interval starting from 66

th

month from the first draw down date.

A variety of conversion options exist: if the Group undertakes a public offering of shares raising at least $150 million

of equity (a “Qualifying IPO”), there is mandatory conversion; if no such offering has occurred in the 3

6 month year

following the first draw down of each loan, the Company has the option for early repayment together with prepayment

premium; alternatively the loans may run to term.

The loans carry a coupon interest of 10.5%/ 8% and if the options are not exercised, the outstanding loans, without

additional interest, are repaid in cash as per the repayment schedule.

Should a conversion option be exercised, the outstanding loans, the coupon interest and an additional interest uplift

will be converted into the equity shares of the Company. The additional interest uplift is 8% if conversion is within

36 months of the first draw down and 12% if conversion is after this time (total effective interest rate of 12.5% /

11.4% respectively).

If the conversion options are exercised, the outstanding loans, together with the additional interest uplift outlined

above, are convertible into shares of the Company based on the fair value of the shares on the conversion date. These

embedded options are in the nature of embedded derivatives which have been determined not to be closely related to

the loan arrangements. The group has opted to recognise the convertible loans as financial liabilities at fair value

through the income statement

based on the Company’s best estimate at

the balance sheet date of the relative

likelihood of the occurrence of each conversion or prepayment option.

The change in fair value since the prior year arises as a result of changes in the forecasted cash flows. Of this amount

USD 3,816 thousand (2013: USD 3,612 thousand) has been capitalised to qualifying assets in the year, see note 14,

resulting in a net charge to the income statement of USD 9,931 thousand (2013: USD 12,071 thousand).

The convertible loans are classified as Level 3 in the fair value hierarchy in all the years presented. Level 3 fair value

measurements are those derived from inputs that are not based on observable market data (unobservable inputs). The

group uses a discounted cash flow technique to determine the fair value of the loans. The significant inputs considered

in the valuation are likelihood and timing of an equity offering and the discount rate. The discount rate used was in

the range of 15-16%. Changing the likelihood and timing assumptions in the fair value measurement could have a

maximum impact of increasing the liability by USD 6,319 thousand or reducing the liability by USD 13,026

thousand.