107

106

KUWAIT ENERGY plc

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

For the year ended 31 December 2014

47

30.

FINANCIAL INSTRUMENTS (CONTINUED)

Credit risk management (continued)

During the year ended 31 December 2014, 79% of total revenue (2013:74%) was derived from the sales to the

Group’s largest counterparty, EGPC and 18% of total revenue (2013: 21%) was derived from sales to Exxon Mobil.

Further details of the Group’s receivables with

EGPC and Exxon Mobil are provided in note 4 (“Debtor

recoverability”) and note 1

9. The Group defines counterparties as having similar characteristics if they are related

entities.

Credit risk on liquid funds and derivative financial instruments is limited because the counterparties are banks with

high credit ratings assigned by international credit rating agencies.

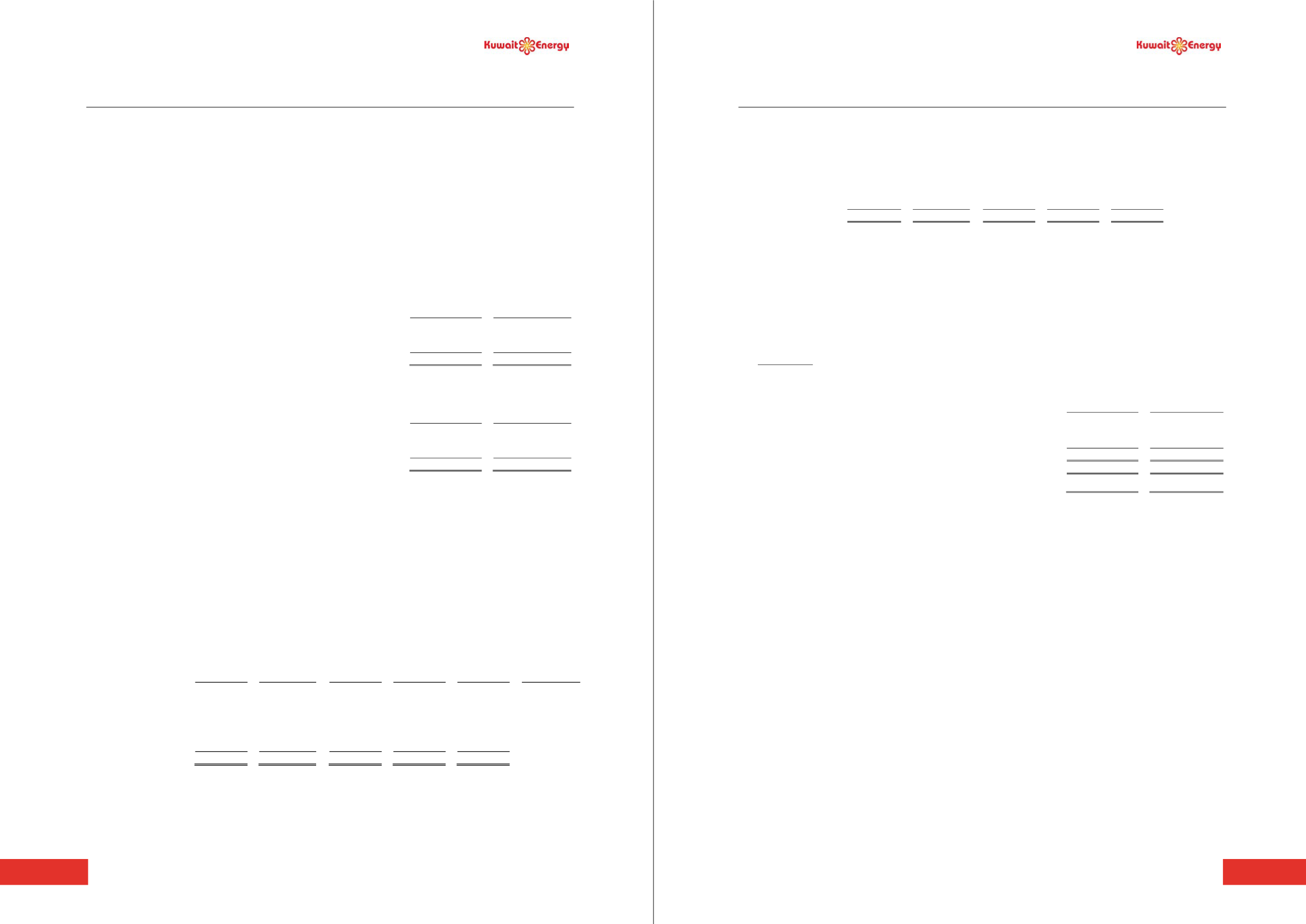

Exposure to credit risk

The carrying amount of financial assets represents the maximum credit exposure. The maximum exposure to credit

risk at the reporting date was:

2014

(Restated)

2013

USD 000’s

USD 000’s

Trade and other receivables

108,319

150,395

Cash and cash equivalents

215,992

127,594

324,311

277,989

The maximum exposure to credit risk for trade receivables at the reporting date by geographic region was:

2014

(Restated)

2013

USD 000’s

USD 000’s

Egypt

66,249

115,824

Yemen

7,355

8,961

73,604

124,785

Liquidity risk management

Liquidity risk is the risk that

the Group will not be able to meet its financial obligations as they fall due. The Group’s

approach to managing liquidity is to ensure, as far as possible, that it will always have sufficient liquidity to meet its

liabilities when due, under both normal and stressed conditions, without incurring unacceptable losses or risking

damage to the Group’s reputation.

Ultimate responsibility for liquidity risk management rests with the management, which has built an appropriate

liquidity risk management framework f

or the management of the Group’s short, medium and

s funding and liquidity

management requirements. The Group manages liquidity risk by maintaining adequate reserves and banking

facilities, by continuously monitoring forecast and actual cash flows and matching the maturity profiles of financial

assets and liabilities.

The following tables detail the Group’s remaining contractual maturity for its financial liabilities

(including interest).

The tables have been drawn up based on the undiscounted cash flows of financial liabilities.

Financial liabilities

Less than

1 year

Between

1 and 3

years

Between

3 and 5

years

More than

5 years

Total

Weighted

average

effective

interest rate

USD 000’s

USD 000’s

USD 000’s

USD 000’s

USD 000’s

%

At 31 December 2014

Borrowings

23,750

47,500

297,500

-

368,750 10.6%

Convertible loans

9,250

35,500

89,585

-

134,335

12.0%

Trade and other

payables

128,449

-

-

-

128,449

161,449

83,000

387,085

-

631,534

KUWAIT ENERGY plc

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

For the year ended 31 December 2014

48

30.

FINANCIAL INSTRUMENTS (CONTINUED)

Liquidity risk management (continued)

At 31 December 2013

Borrowings

84,436

93,447

-

-

177,883

6.62%

Convertible loans

8,000

16,000

96,796

17,169

137,965

16%

Trade and other

payables (restated)

89,001

-

-

-

89,001

-

181,437

109,447

96,796

17,169

404,849

The group has access to financial facilities as described in notes 23 and 24. The group expects to meet its other

obligations from operating cash flows.

Capital risk management

The Group manages its capital to ensure that it will be able to continue as a going concern while maximising the

return to the shareholders through the optimisation of debt and equity balance. The Group’s overall strategy remains

unchanged during 2014.

The capital structure of the Group consists of equity comprising issued share capital (note 21), share premium, other

reserves (note 22) and retained deficit.

Gearing ratio

The gearing ratio at year end was as follows:

2014

(Restated)

2013

USD 000’s

USD 000’s

Total debt (i)

360,288

277,067

Less: Cash and cash equivalents

(215,992)

(127,594)

Net debt

144,296

149,473

Equity attributable to owners of the Company

407,742

370,210

Net debt to equity ratio (%)

35.4

40.4

(i) Debt is defined as borrowings as detailed in note 23 and convertible loans as detailed in note 24.