101

100

KUWAIT ENERGY plc

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

For the year ended 31 December 2014

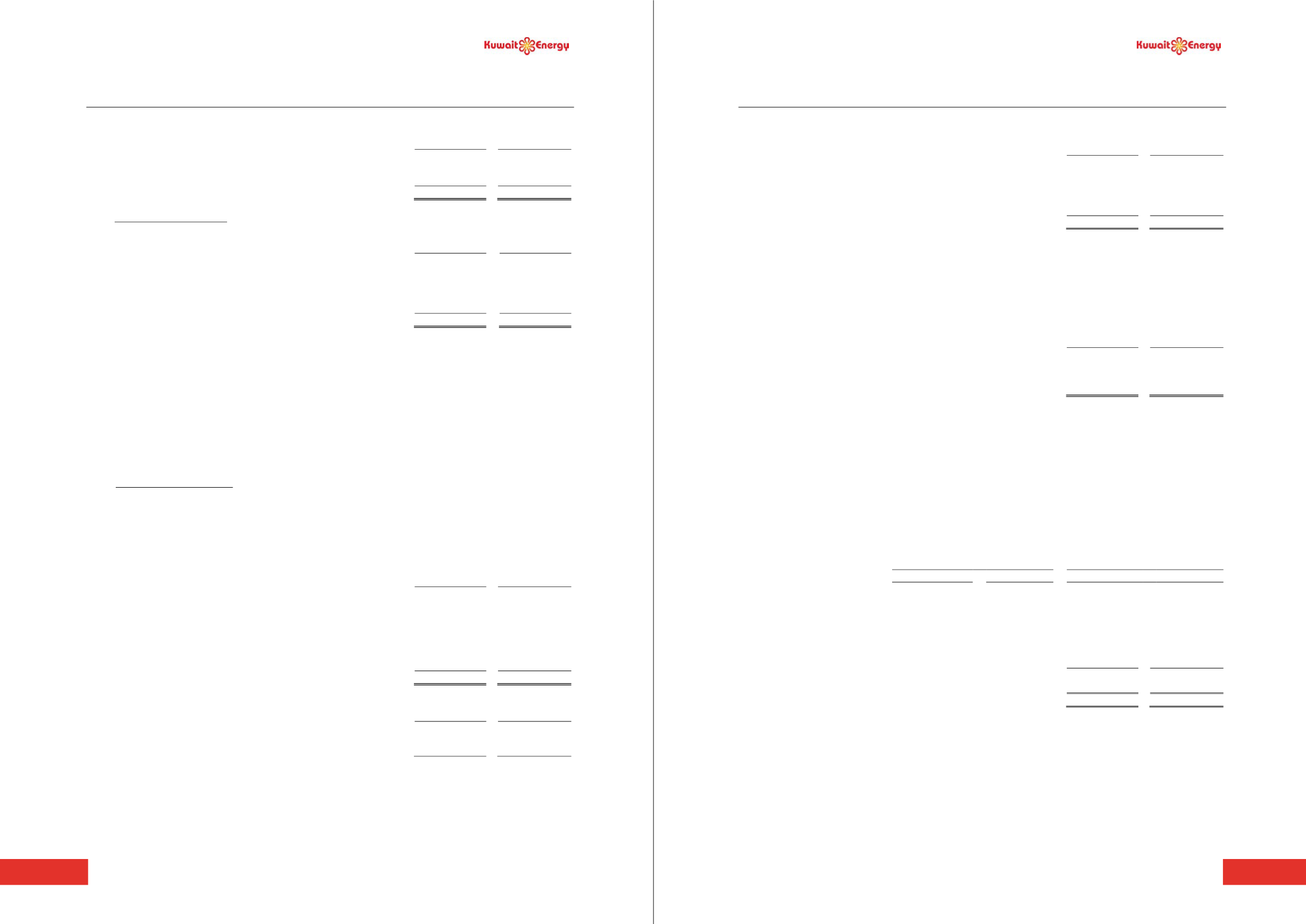

41

25.

LONG-TERM PROVISIONS

2014

2013

USD 000’s

USD 000’s

Decommissioning provision

12,433

3,013

Retirement benefit obligation

3,264

3,243

15,697

6,256

a)

Decommissioning provision

The movement in the decommissioning provision over the year is as follows:

2014

2013

USD 000’s

USD 000’s

As at 1 January

3,013

1,989

Unwinding of discount

104

158

New provisions and changes in estimate

9,316

1,002

Reclassified as held for sale

-

(136)

As at end of the year

12,433

3,013

The provision for decommissioning

relates to two of the Group’s fields and

is based on the net present value of the

Group’s share of the expenditure which may be incurred at the end of the producing life of each field (currently

estimated as being 2016 and 2023 for the two fields respectively) in the removal and decommissioning of the facilities

currently in place. Assumptions, based on the current economic environment, have been made which management

believe are a reasonable basis upon which to base the provision. These estimates are reviewed regularly to take into

account any material changes to the assumptions. However, actual decommissioning costs will ultimately depend

upon future market prices for the necessary decommissioning works required which will reflect market conditions at

the relevant time. Furthermore, the timing of decommissioning is likely to depend on when the fields cease to produce

at economically viable rates. This in turn will depend upon future oil and gas prices, which are inherently uncertain.

The significant increase during 2014 was primarily due to the receipt of an updated third party estimate in respect of

one of the fields. The Group uses a discount rate of 5% in arriving at the future value of decommissioning provisions.

b) Retirement benefit obligation

The group has a post-employment defined benefit obligation towards its non-Kuwaiti employees which is an End-of-

Service (ESB) plan governed by Kuwait Labor Law. The entitlement to these benefits is conditional upon the tenure

of employee service, completion of a minimum service year, salary drawn etc. The Group also has a defined benefit

obligation in respect of the Block 5 in Yemen. These are unfunded plans where the group meets the benefit payment

obligation as it falls due.

The movement in these defined benefit obligations over the year is as follows:

2014

2013

USD 000’s

USD 000’s

As at 1 January

3,243

1,482

Current service cost

1,066

2,150

Interest expense

-

113

Re-measurements:

Experience gains

(812)

(137)

Benefits paid

(233)

(365)

As at end of the year

3,264

3,243

The significant actuarial assumptions were as follows:

2014

2013

Discount rate

5%

5%

Inflation

4%

4%

Salary growth rate

6%

6%

KUWAIT ENERGY plc

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

For the year ended 31 December 2014

42

26.

TRADE AND OTHER PAYABLES

(Restated)

2014

2013

USD 000’s

USD 000’s

Trade Payables

86,911

70,729

Accruals and joint venture partners payables

31,150

14,516

Accrued interest payable

10,388

3,756

Salaries and bonus payables

5,204

3,000

133,653

92,001

Trade creditors and accruals principally comprise amounts outstanding for trade purchases and on-going costs. The

average credit year taken for trade purchases is 30 days. No interest is charged on the overdue trade payables. The

Group has financial risk management policies in place to ensure that all payables are paid within the pre-agreed credit

terms.

The directors consider that the carrying amount of trade payables approximates their fair value

.

27.

DERIVATIVE FINANCIAL INSTRUMENTS

2014

2013

USD 000’s

USD 000’s

Financial liabilities carried at fair value through profit or loss

Held for trading derivatives not designated in hedge accounting

relationships (interest rate cap - see below)

-

162

The Group’s deriv

ative financial instruments are all classified as Level 2 in all years. Level 2 fair value measurements

are those derived from inputs other than quoted prices that are observable for the asset or liability either directly (i.e.

as prices) or indirectly (i.e. derived from prices). The reduction in the fair value amounting to USD nil for the year

ended 31 December 2014 (2013: USD 322 thousand) was recognised in the consolidated income statement.

Derivatives used for hedging purposes but which do not meet the qualifying criteria for hedge accounting are

classified as ‘Held for trading derivatives’.

Interest rate cap is an agreement to cap the interest rate on facilities at 2% when the LIBOR is more than 2% and

equal to or less than 5%. This agreement matured on 30 June 2014.

The notional amounts of interest rate cap together with the fair value is summarised as follows:

Held for trading Derivatives

Notional principal value

Fair value (Negative)/ Positive

2014

2013

2014

2013

USD 000’s

USD 000’s

U

SD 000’s

USD 000’s

-Interest rate cap

-

50,000

-

(162)

28.

CONTINGENT LIABILITIES AND CAPITAL COMMITMENTS

2014

2013

USD 000’s

USD 000’s

a)

Contingent liabilities - letters of guarantee

500

1,628

b)

Capital commitments (other than covered by letters of guarantee)

58,531

116,400

Capital commitment includes committed exploration drilling and seismic expenditures as specified in the licence.