KUWAIT ENERGY PLC

NOTES TO THE CONDENSED SET OF FINANCIAL STATEMENTS

Three months ended 31 March 2016

9

3.

SEGMENT INFORMATION (CONTINUED)

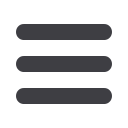

Egypt

Iraq

Yemen

Others

Total

(Audited)

USD 000’s USD 000’s USD 000’s USD 000’s USD 000’s

31 December 2015

Segment revenues

146,774

-

8,868

-

155,642

Segment operating (loss)/profit

(5,498)

8,533

(34,338)

(9,715)

(41,018)

Share of results of Joint Venture

-

-

-

445

445

Fair value loss on convertible loans

(9,261)

Other income

1,231

Foreign exchange loss

(1,851)

Finance costs

(9,654)

Loss before tax

(60,108)

Taxation charges

(2,259)

Loss for the year

(62,367)

Segment assets

288,959

401,718

86,198

83,547

860,422

E&E assets

11,792

-

20,871

-

32,663

PP&E

202,805

371,467

45,764

1,535

621,571

Segment liabilities

48,210

52,878

22,828

381,585

505,501

Other information

Exploration expenditure written off

2,590

-

11,628

-

14,218

Impairment of oil and gas assets

35,810

24,656

8,544

-

69,010

Additions to E&E

8,037

-

2,705

-

10,742

Additions to PP&E

59,532

163,113

(410)

30

222,265

Depreciation, Depletion and

Amortisation

62,869

-

5,213

1,065

69,147

4.

LOSS PER SHARE

The calculation of basic loss per share is based on the loss for the period after taxation attributable to owners of the

Company of USD 10.4 million (31 March 2015: USD 12.4 million, 31 December 2015: USD 62.2 million) and a

weighted average number of shares, net of treasury shares, of 326.5 million (31 March 2015: 326.3 million, 31 December

2015: 326.1 million).

There was no difference between basic and diluted loss per share for any of the periods shown. The only potential dilutive

instruments were the outstanding Employee Incentive Scheme (EIS) share awards, which have no material dilution

impact on earnings per share, together with shares to be issued on conversion of convertible loan which are not included

in the calculation for either period as the number of shares that could be exercised is dependent on certain future events.

5.

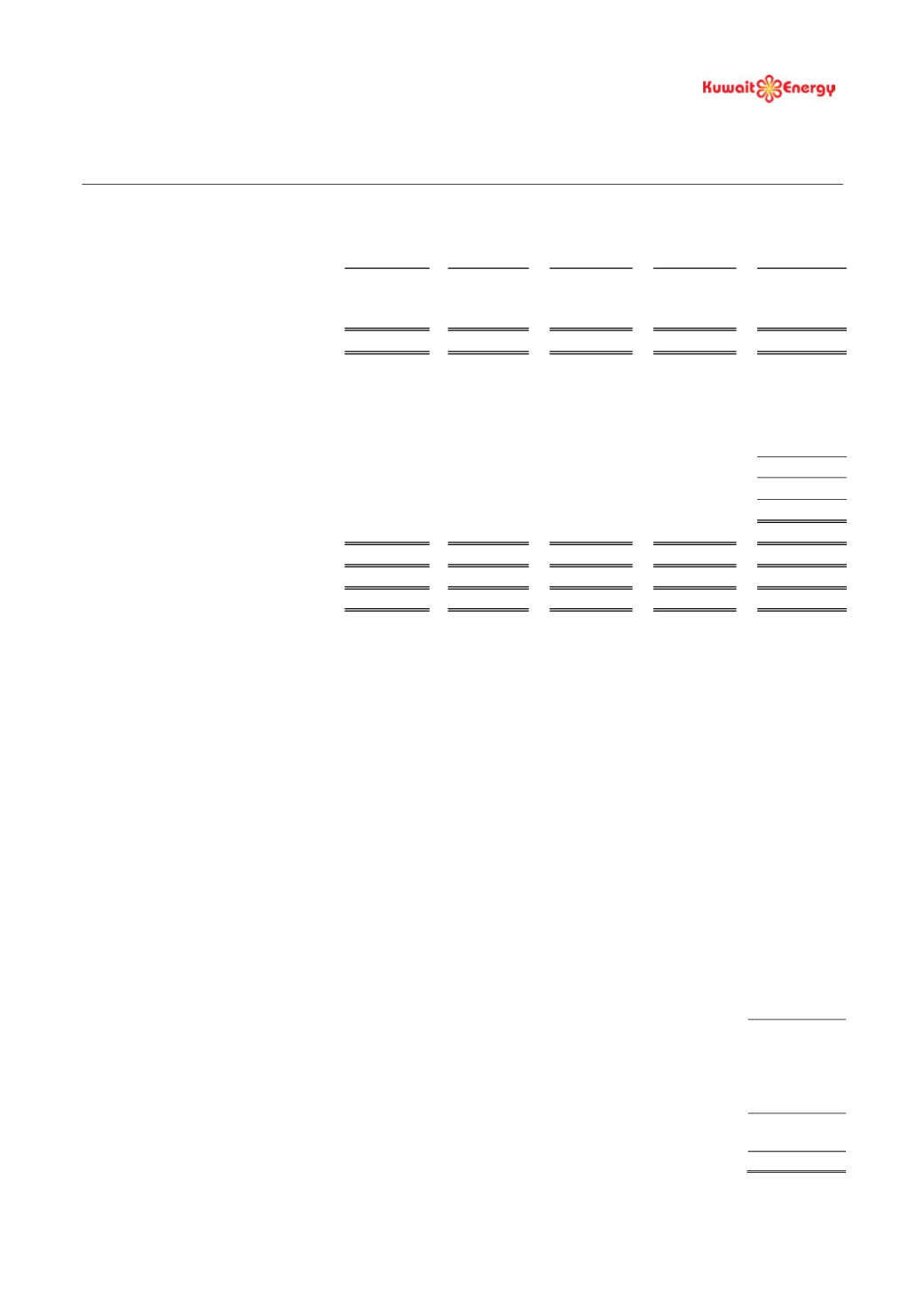

INTANGIBLE EXPLORATION AND EVALUATION (‘E&E’) ASSETS

E&E assets

USD 000’s

As at 1 January 2015 (Audited)

46,488

Additions

10,742

Exploration expenditure written off

(14,218)

Transfer to Property, plant and equipment

(10,349)

As at 31 December 2015 (Audited)

32,663

Additions

456

As at 31 March 2016 (Unaudited)

33,119

As at 31 March 2016, exploration costs of USD 33.1 million (31 December 2015: USD 32.7 million) were capitalised

pending further evaluation of whether or not the related oil and gas properties are commercially viable.