KUWAIT ENERGY PLC

NOTES TO THE CONDENSED SET OF FINANCIAL STATEMENTS

Three months ended 31 March 2016

8

3.

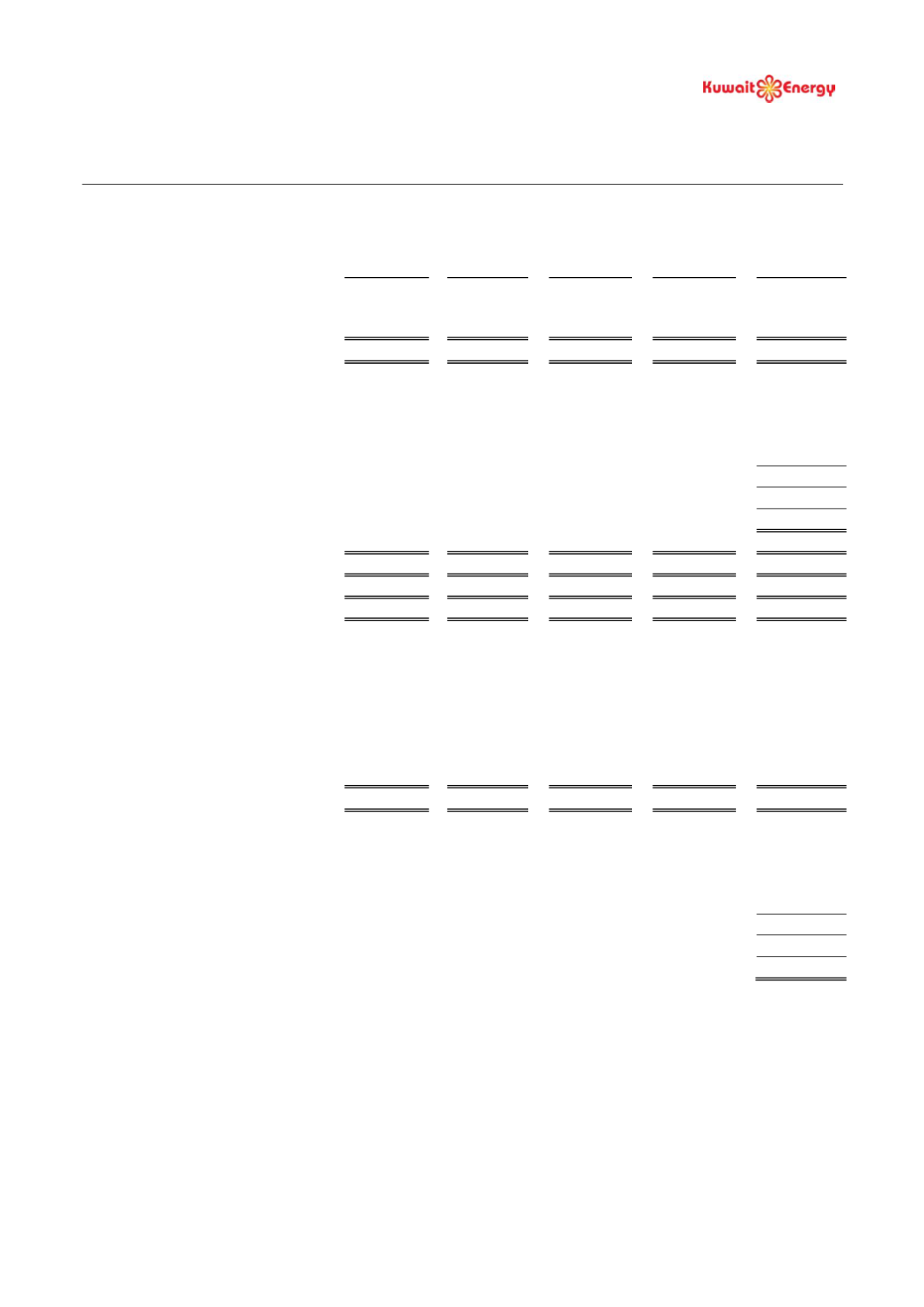

SEGMENT INFORMATION (CONTINUED)

Egypt

Iraq

Yemen

Others

Total

(Unaudited)

USD 000’s USD 000’s USD 000’s USD 000’s USD 000’s

31 March 2016

Segment revenues

24,080

8,315

-

-

32,395

Segment operating (loss)/profit

(3,103)

1,935

(1,531)

(1,404)

(4,103)

Share of results of Joint Venture

-

-

-

480

480

Fair value loss on convertible loans

(3,565)

Other income

410

Foreign exchange loss

(63)

Finance costs

(2,667)

Loss before tax

(9,508)

Taxation charges

(910)

Loss for the year

(10,418)

Segment assets

267,113

422,371

85,885

57,952

833,321

E&E assets

12,248

-

20,871

-

33,119

PP&E

191,638

398,737

45,765

1,535

637,675

Segment liabilities

45,083

43,116

21,841

378,778

488,818

Other information

Additions to E&E

456

-

-

-

456

Additions to PP&E

2,776

31,820

-

-

34,596

Depreciation, Depletion and

Amortisation

13,942

4,550

-

-

18,492

31 March 2015

Segment revenues

35,013

-

9,909

-

44,922

Segment operating profit/(loss)

6,130

-

(5,995)

(3,497)

(3,362)

Share of results of Joint Venture

-

-

-

500

500

Fair value loss on convertible loans

(3,600)

Other income

448

Foreign exchange loss

(316)

Finance costs

(4,539)

Loss before tax

(10,869)

Taxation charges

(1,500)

Loss for the year

(12,369)